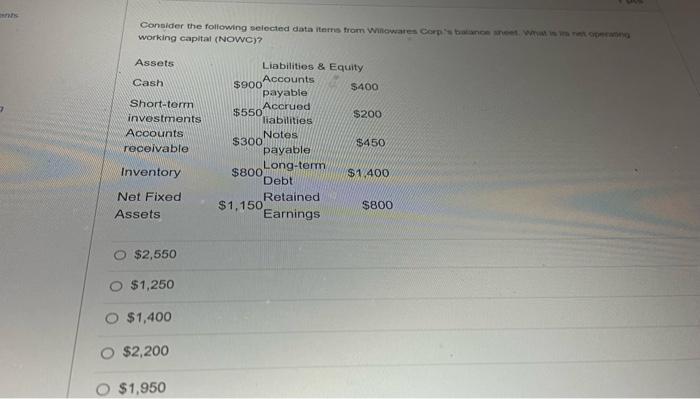

Question: ents Consider the following selected data items from Willowares Corp's balance sheet. What is in net operating working capital (NOWC)? Assets Cash Short-term investments Accounts

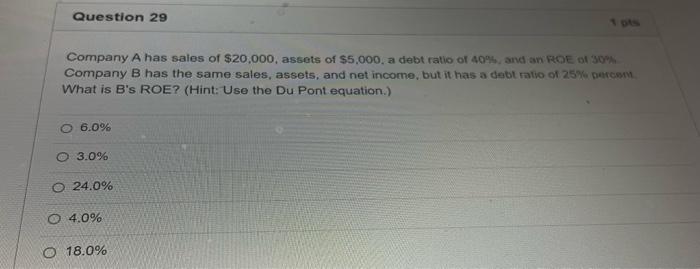

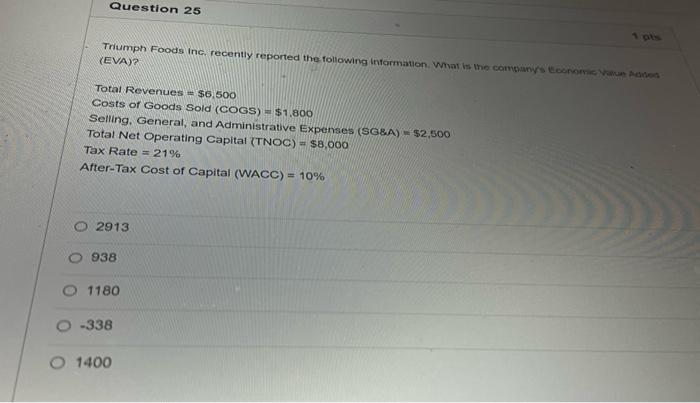

ents Consider the following selected data items from Willowares Corp's balance sheet. What is in net operating working capital (NOWC)? Assets Cash Short-term investments Accounts receivable Inventory Net Fixed Assets $2,550 $1,250 $1,400 $2,200 $1,950 $900 $550 Liabilities & Equity Accounts payable Accrued liabilities $300 $800 $1,150 Notes payable Long-term Debt Retained Earnings $400 $200 $450 $1,400 $800 Question 29 Company A has sales of $20,000, assets of $5,000, a debt ratio of 40%, and an ROE of 30% Company B has the same sales, assets, and net income, but it has a debt ratio of 25% percent What is B's ROE? (Hint: Use the Du Pont equation.) O 6.0% O 3.0% O24.0% O 4.0% 18.0% Question 25 Triumph Foods Inc. recently reported the following information. What is the company's Economic Value Added (EVA)? Total Revenues = $6,500 Costs of Goods Sold (COGS) = $1,800 Selling, General, and Administrative Expenses (SG&A) = $2,500 Total Net Operating Capital (TNOC) = $8,000 Tax Rate = 21% After-Tax Cost of Capital (WACC) = 10% 2913 938 1180 -338 1400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts