Question: really appreciate your help Start with the cash flows from operating activities first. Then work on the cash flows from investing activities and the cash

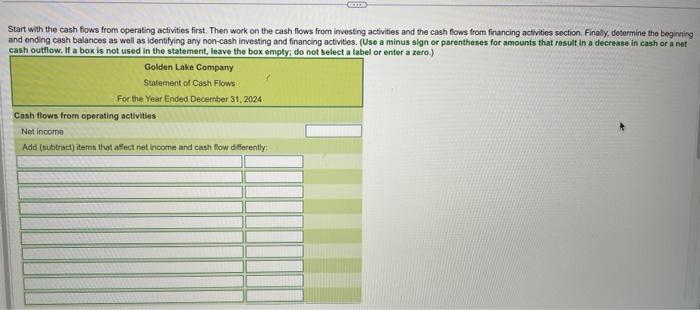

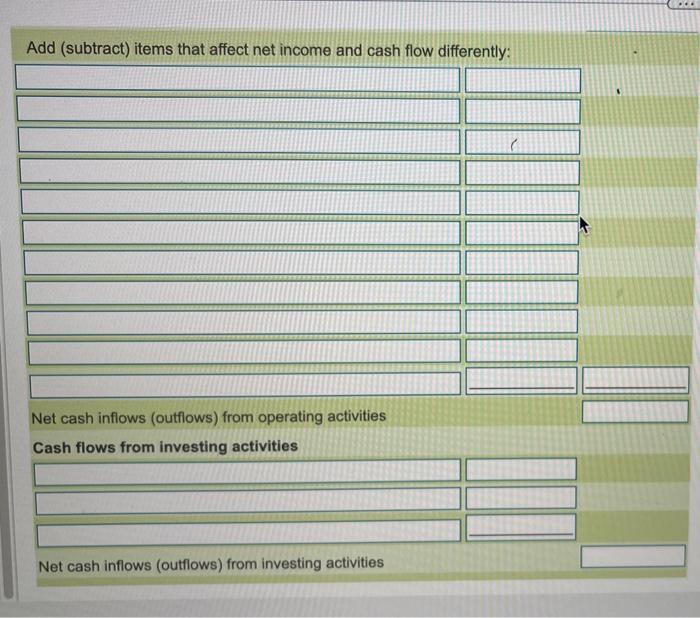

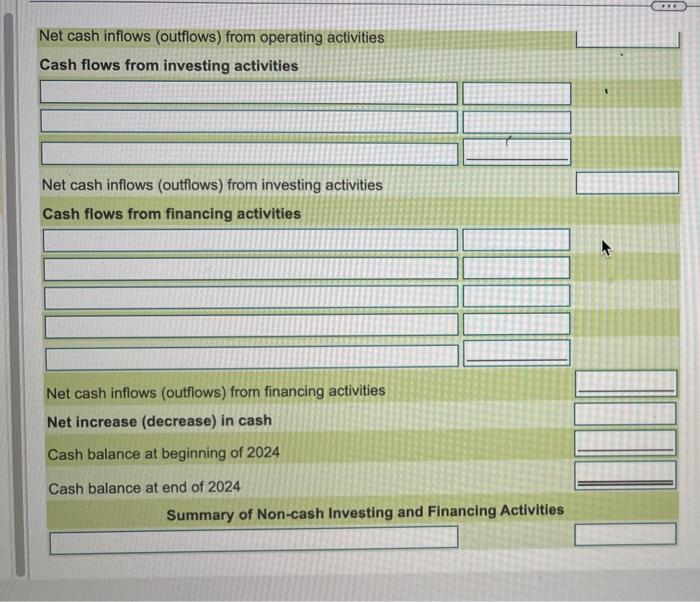

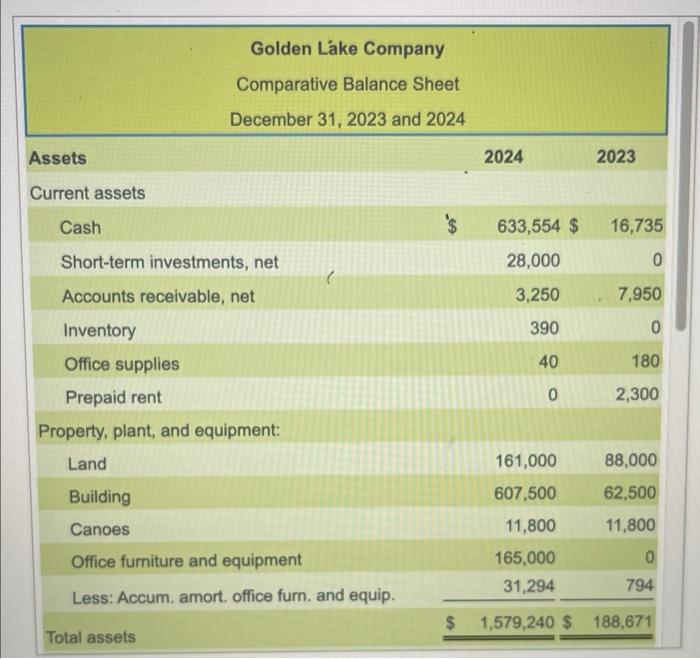

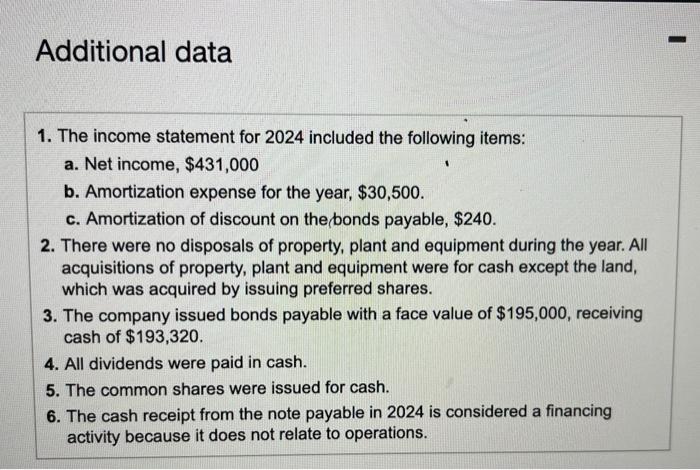

Start with the cash flows from operating activities first. Then work on the cash flows from investing activities and the cash flows from financing activitios section. Finally, determine the begining and ending cash balances as well as identilying any non-cash investing and financing activites. (Use a minus sign or parentheses for amounts that result in a decrease in cash or a net cash outflow, If a box is not used in the statement, leave the box empty; do not select a label or enter a zero.) Add (subtract) items that affect net income and cash flow differently: Net cash inflows (outflows) from operating activities Cash flows from investing activities Net cash inflows (outflows) from investing activities Net cash inflows (outflows) from operating activities Cash flows from investing activities Net cash inflows (outflows) from investing activities Cash flows from financing activities Net cash inflows (outflows) from financing activities Net increase (decrease) in cash Cash balance at beginning of 2024 Cash balance at end of 2024 Summary of Non-cash Investing and Financing Activities Golden Lke Company Comparative Balance Sheet December 31, 2023 and 2024 Assets 20242023 Current assets Cash Short-term investments, net Accounts receivable, net Inventory Office supplies Prepaid rent Property, plant, and equipment: \begin{tabular}{lrrr} \hline Land & 161,000 & 88,000 \\ \hline Building & 607,500 & 62,500 \\ \hline Canoes & 11,800 & 11,800 \\ \hline Office furniture and equipment & 165,000 & 0 \\ \hline Less: Accum. amort. office furn. and equip. & 31,294 & 794 \\ \hline Total assets & 1,579,240 & 188,671 \\ \hline \end{tabular} 1. The income statement for 2024 included the following items: a. Net income, $431,000 b. Amortization expense for the year, $30,500. c. Amortization of discount on the,bonds payable, $240. 2. There were no disposals of property, plant and equipment during the year. All acquisitions of property, plant and equipment were for cash except the land, which was acquired by issuing preferred shares. 3. The company issued bonds payable with a face value of $195,000, receiving cash of $193,320. 4. All dividends were paid in cash. 5. The common shares were issued for cash. 6. The cash receipt from the note payable in 2024 is considered a financing activity because it does not relate to operations. Start with the cash flows from operating activities first. Then work on the cash flows from investing activities and the cash flows from financing activitios section. Finally, determine the begining and ending cash balances as well as identilying any non-cash investing and financing activites. (Use a minus sign or parentheses for amounts that result in a decrease in cash or a net cash outflow, If a box is not used in the statement, leave the box empty; do not select a label or enter a zero.) Add (subtract) items that affect net income and cash flow differently: Net cash inflows (outflows) from operating activities Cash flows from investing activities Net cash inflows (outflows) from investing activities Net cash inflows (outflows) from operating activities Cash flows from investing activities Net cash inflows (outflows) from investing activities Cash flows from financing activities Net cash inflows (outflows) from financing activities Net increase (decrease) in cash Cash balance at beginning of 2024 Cash balance at end of 2024 Summary of Non-cash Investing and Financing Activities Golden Lke Company Comparative Balance Sheet December 31, 2023 and 2024 Assets 20242023 Current assets Cash Short-term investments, net Accounts receivable, net Inventory Office supplies Prepaid rent Property, plant, and equipment: \begin{tabular}{lrrr} \hline Land & 161,000 & 88,000 \\ \hline Building & 607,500 & 62,500 \\ \hline Canoes & 11,800 & 11,800 \\ \hline Office furniture and equipment & 165,000 & 0 \\ \hline Less: Accum. amort. office furn. and equip. & 31,294 & 794 \\ \hline Total assets & 1,579,240 & 188,671 \\ \hline \end{tabular} 1. The income statement for 2024 included the following items: a. Net income, $431,000 b. Amortization expense for the year, $30,500. c. Amortization of discount on the,bonds payable, $240. 2. There were no disposals of property, plant and equipment during the year. All acquisitions of property, plant and equipment were for cash except the land, which was acquired by issuing preferred shares. 3. The company issued bonds payable with a face value of $195,000, receiving cash of $193,320. 4. All dividends were paid in cash. 5. The common shares were issued for cash. 6. The cash receipt from the note payable in 2024 is considered a financing activity because it does not relate to operations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts