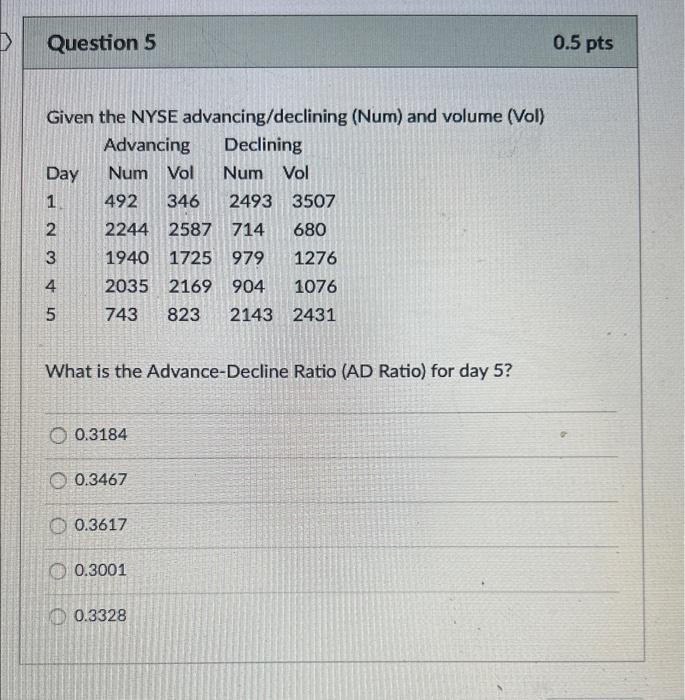

Question: EOM L9 Given the NYSE advancing/declining (Num) and volume (Vol) What is the Advance-Decline Ratio (AD Ratio) for day 5 ? 0.3184 0.3467 0.3617 0.3001

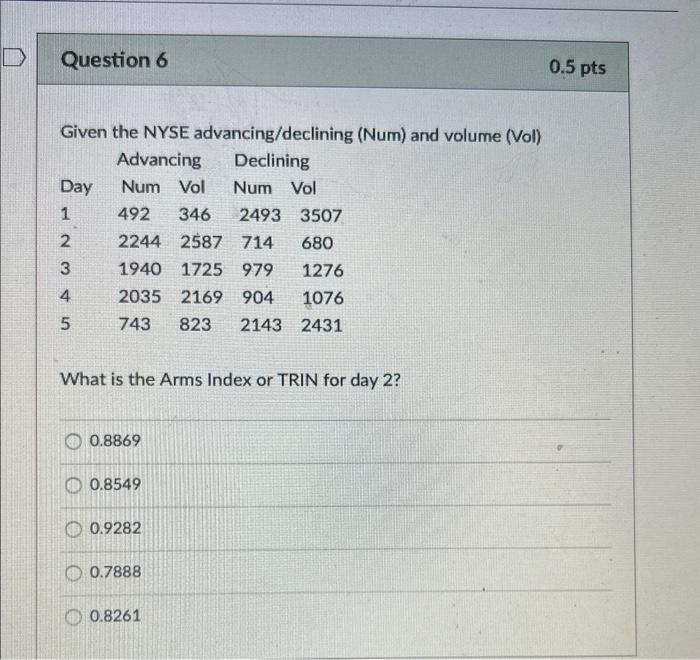

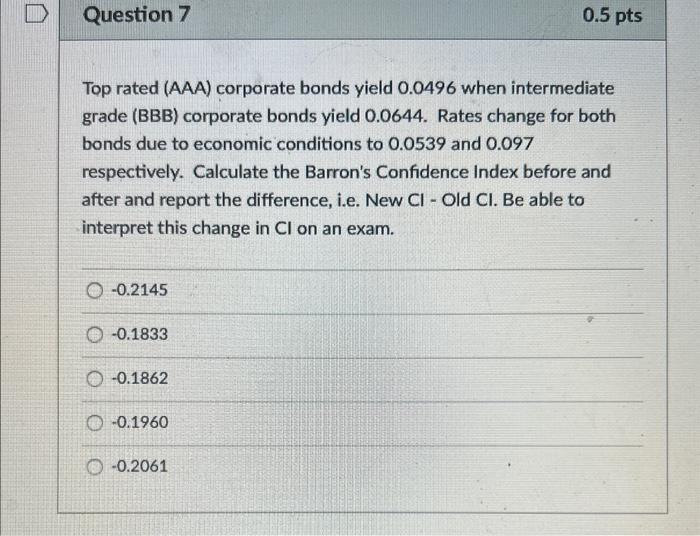

Given the NYSE advancing/declining (Num) and volume (Vol) What is the Advance-Decline Ratio (AD Ratio) for day 5 ? 0.3184 0.3467 0.3617 0.3001 0.3328 Given the NYSE advancing/declining (Num) and volume (Vol) What is the Arms Index or TRIN for day 2? 0.8869 0.8549 0.9282 0.7888 0.8261 Top rated (AAA) corporate bonds yield 0.0496 when intermediate grade (BBB) corporate bonds yield 0.0644 . Rates change for both bonds due to economic conditions to 0.0539 and 0.097 respectively. Calculate the Barron's Confidence Index before and after and report the difference, i.e. NewCl - Old Cl. Be able to interpret this change in Cl on an exam. 0.2145 0.1833 0.1862 0.1960 0.2061 Given the NYSE advancing/declining (Num) and volume (Vol) What is the Advance-Decline Ratio (AD Ratio) for day 5 ? 0.3184 0.3467 0.3617 0.3001 0.3328 Given the NYSE advancing/declining (Num) and volume (Vol) What is the Arms Index or TRIN for day 2? 0.8869 0.8549 0.9282 0.7888 0.8261 Top rated (AAA) corporate bonds yield 0.0496 when intermediate grade (BBB) corporate bonds yield 0.0644 . Rates change for both bonds due to economic conditions to 0.0539 and 0.097 respectively. Calculate the Barron's Confidence Index before and after and report the difference, i.e. NewCl - Old Cl. Be able to interpret this change in Cl on an exam. 0.2145 0.1833 0.1862 0.1960 0.2061

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts