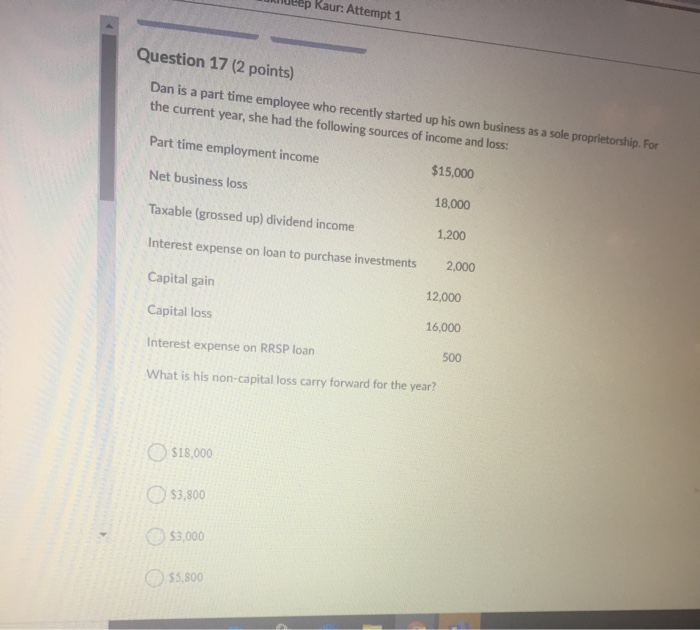

Question: ep Kaur: Attempt 1 Question 17 (2 points) Dan is a part time employee who recently started up his own business as a sole proprietorship.

ep Kaur: Attempt 1 Question 17 (2 points) Dan is a part time employee who recently started up his own business as a sole proprietorship. For the current year, she had the following sources of income and loss: Part time employment income Net business loss $15,000 Taxable (grossed up) dividend income 18,000 1,200 Interest expense on loan to purchase investments 2,000 Capital gain 12,000 Capital loss 16,000 Interest expense on RRSP loan 500 What is his non-capital loss carry forward for the year? $18,000 $3,800 $3,000 55.800

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock