Question: Equity has (a) a call option to buy the value of the firm (b) for the strike price of the principal and interest on

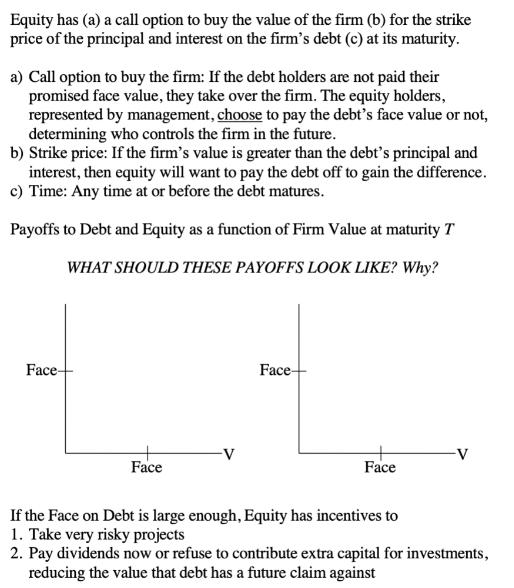

Equity has (a) a call option to buy the value of the firm (b) for the strike price of the principal and interest on the firm's debt (c) at its maturity. a) Call option to buy the firm: If the debt holders are not paid their promised face value, they take over the firm. The equity holders, represented by management, choose to pay the debt's face value or not, determining who controls the firm in the future. b) Strike price: If the firm's value is greater than the debt's principal and interest, then equity will want to pay the debt off to gain the difference. c) Time: Any time at or before the debt matures. Payoffs to Debt and Equity as a function of Firm Value at maturity T WHAT SHOULD THESE PAYOFFS LOOK LIKE? Why? Face- Face Face- Face If the Face on Debt is large enough, Equity has incentives to 1. Take very risky projects 2. Pay dividends now or refuse to contribute extra capital for investments, reducing the value that debt has a future claim against

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

The payoffs to debt and equity as a function of the firm value at maturity T can vary depending on the specific agreements and structures in place How... View full answer

Get step-by-step solutions from verified subject matter experts