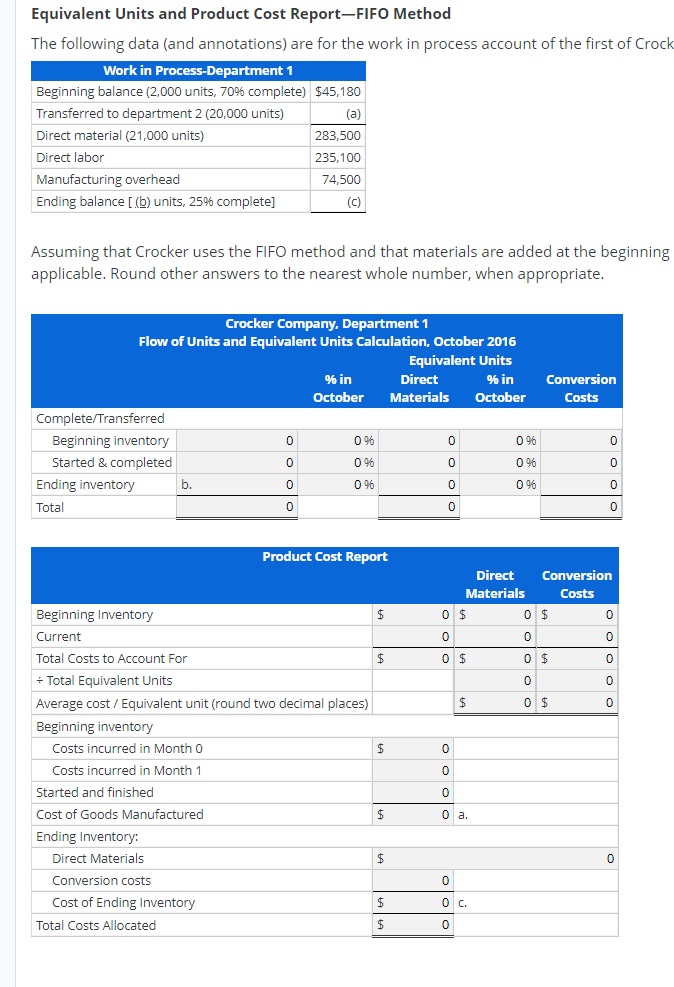

Question: Equivalent Units and Product Cost Report-FIFO Method The following data (and annotations) are for the work in process account of the first of Crock

Equivalent Units and Product Cost Report-FIFO Method The following data (and annotations) are for the work in process account of the first of Crock Work in Process-Department 1 Beginning balance (2,000 units, 70% complete) $45,180 Transferred to department 2 (20,000 units) (a) Direct material (21,000 units) 283,500 Direct labor 235,100 Manufacturing overhead 74,500 Ending balance [(b) units, 25% complete] (c) Assuming that Crocker uses the FIFO method and that materials are added at the beginning applicable. Round other answers to the nearest whole number, when appropriate. Crocker Company, Department 1 Flow of Units and Equivalent Units Calculation, October 2016 Equivalent Units % in October Direct Materials % in October Conversion Costs Complete/Transferred Beginning inventory 0 0% 0 09 0 Started & completed 0 0% 0 0% 0 Ending inventory b. 0 0% 0 0% 0 Total 0 0 0 Beginning Inventory Current Total Costs to Account For + Total Equivalent Units Product Cost Report Average cost/Equivalent unit (round two decimal places) Beginning inventory Costs incurred in Month 0 Costs incurred in Month 1 Started and finished Cost of Goods Manufactured Ending Inventory: Direct Materials Conversion costs Cost of Ending Inventory Total Costs Allocated Direct Materials Conversion Costs $ 0 $ 0 $ 0 0 0 0 $ 0 $ 0 $ 0 0 0 $ 0 $ 0 0 0 0 $ 0 a. $ 0 $ LALA $ 0 c. 0 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts