Question: ER) - 0.13 E(R2) = 0.17 Flo) - 0.04 (0) - 0.05 Calculate the expected returns and expected standard deviations of a two-stock portfolio having

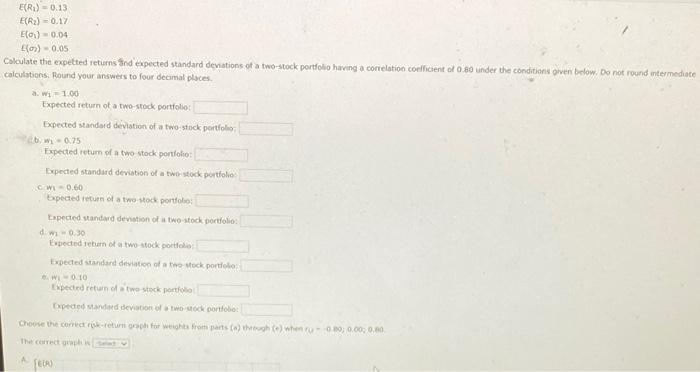

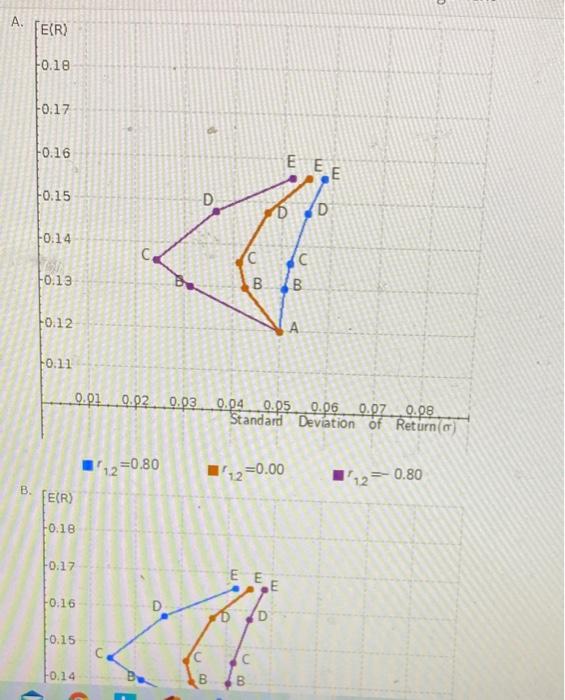

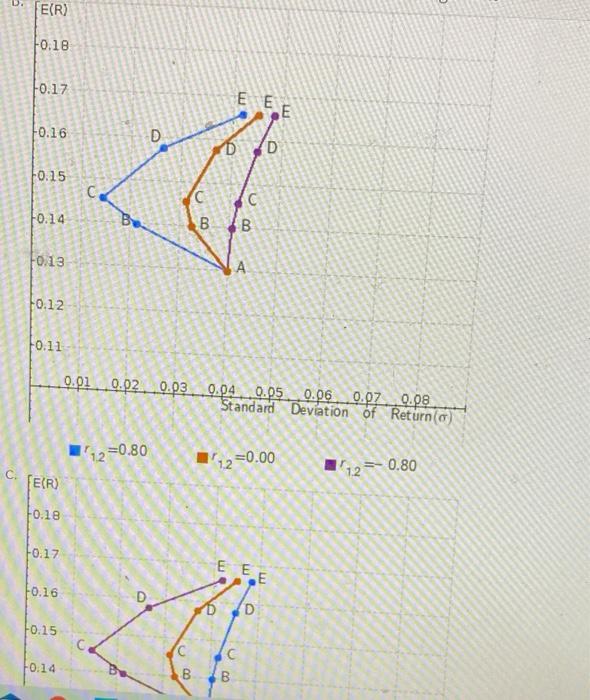

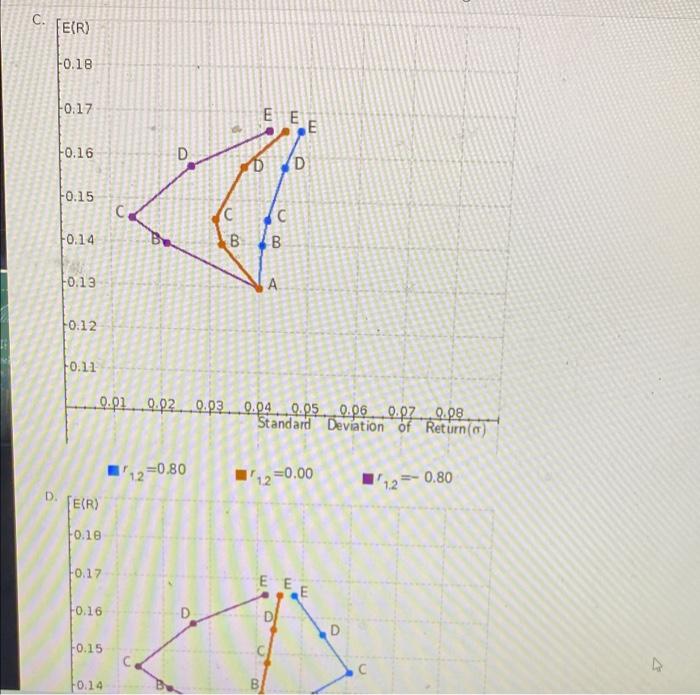

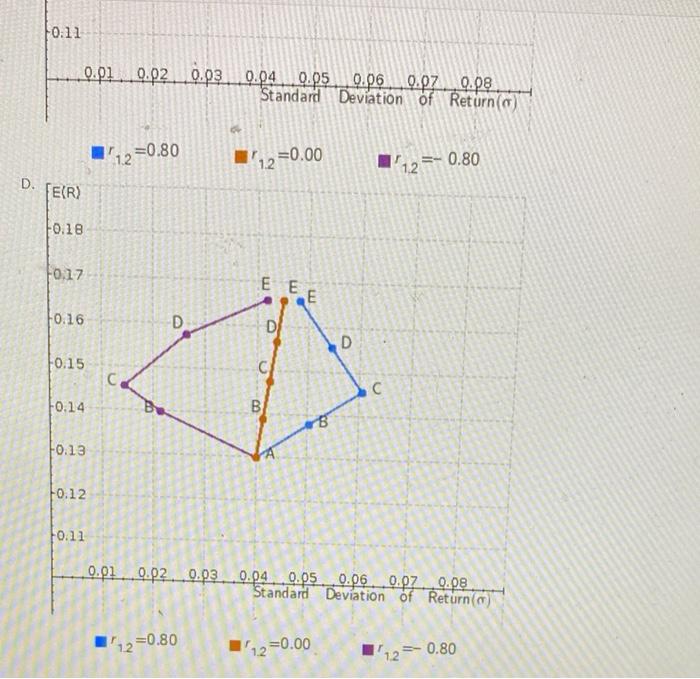

ER) - 0.13 E(R2) = 0.17 Flo) - 0.04 (0) - 0.05 Calculate the expected returns and expected standard deviations of a two-stock portfolio having a correlation coefficient of 0.80 under the conditions given below. Do not round intermediate calculations. Round your answers to four decimal places a. w 1.00 Expected return of a two-stock portfolio Expected standard deviation of a two-stock portfolio cbwi - 0.25 Expected return of a two stock portfolio Expected standard deviation of two stock portfolio CW-0.60 bpected return of a two stock portfolio Expected standard deviation of two stock portfolio dw -0.30 Expected return of a two-stock portfolio Expected standard deviation of two stock portfolio W010 Expected return of two stock portfolio pede mandard deviation of wood porto Choose the cornerskum for weights from parts() through the 0.30 0.00 0.00 The correct A TEOR A E(R) F0.18 F0.17 0.16 E EE F0.15 D D -0.14 C F0.13 . B 10.12 A F0.11 0.01 0.02. 0.03 0.04 0.05 0.06 0.07 0.08 Standard Deviation of Return 12=0.80 (22=0.00 112=0.80 B. TER) 0.18 F0.17 E +0.16 D 0 F0.15 10.14 B D B D. E(R) F0.18 +0.17 E E E -0.16 D D D 10.15 c C F0.14 . B B F0.13 10.12 10.11 0.01 0.02 0.03 0.04. 0.05 0.06 0.07 0.08 Standard deviation of Return (0) 12=0.80 112=0.00 C. 112=-0.80 TER) F0.18 10.17 E E E 10.16 o 6200 . D D F0.15 -0.14 000 B B 00 C. FER) -0.18 +0.17 E E E F0.16 D D D 0.15 (c B +0.14 B F0.13 10.12 0.11 -0.01 0.02. 0.03 0.04 0.05 0.06 0.07 _ 0.08 Standard Deviation of Return (C) 12=0.80 '12=0.00 (12=-0.80 D. ER +0.18 +0.17 E om F0.16 D D 0.15 F0.14 3 B F0:11 0.01 0.02 0.03 0.04 0.05 0.06 0.07 0.08 Standard Deviation of Return(0) 1'12=0.80 112=0,00 1'12=-0.80 D. FER) 10.18 F0.17 E E E 0.16 D D D 0.15 . . +0.14 B 8 -0.13 F0.12 F0.11 0.01 0.02. 0.03 0.04 0.05 0.06 0.07 0.08 Standard Deviation of Return (m) 112=0.80 112=0.00 I'12=0.80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts