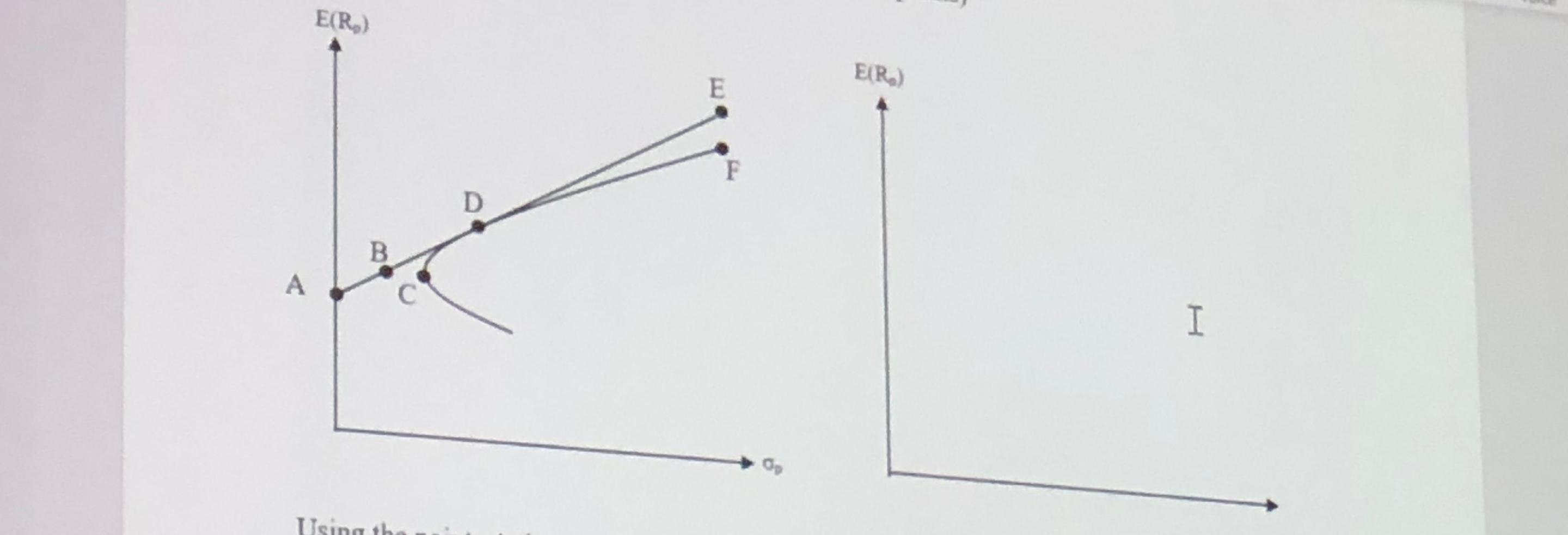

Question: E(R) ER.) E F D B A I Using th point). nisk will allocate money to e. A risk lover who borrows money for more

E(R) ER.) E F D B A I Using th point). nisk will allocate money to e. A risk lover who borrows money for more investment will allocate money to have a complete portfolio between and (1 point). f. Read the question carefully and make sure you show everything asked for. Suppose that point D is the market portfolio that generates a 12% return and that the risk-free rate is 5%. On the right side of the graph, draw the Security Market Line. Show what the horizontal and vertical axes represent. Show the intercept, the slope and the point for the market portfolio Indicates beta for the market portfolio. Note you need connect lines from the left side graph for the risk-free rate and for the market portfolio (5 points) E(R) ER.) E F D B A I Using th point). nisk will allocate money to e. A risk lover who borrows money for more investment will allocate money to have a complete portfolio between and (1 point). f. Read the question carefully and make sure you show everything asked for. Suppose that point D is the market portfolio that generates a 12% return and that the risk-free rate is 5%. On the right side of the graph, draw the Security Market Line. Show what the horizontal and vertical axes represent. Show the intercept, the slope and the point for the market portfolio Indicates beta for the market portfolio. Note you need connect lines from the left side graph for the risk-free rate and for the market portfolio (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts