Question: Question 4 1 pts You are evaluating a project which will cost $5,000 and has an expected future cash flow of $500 per year, forever,

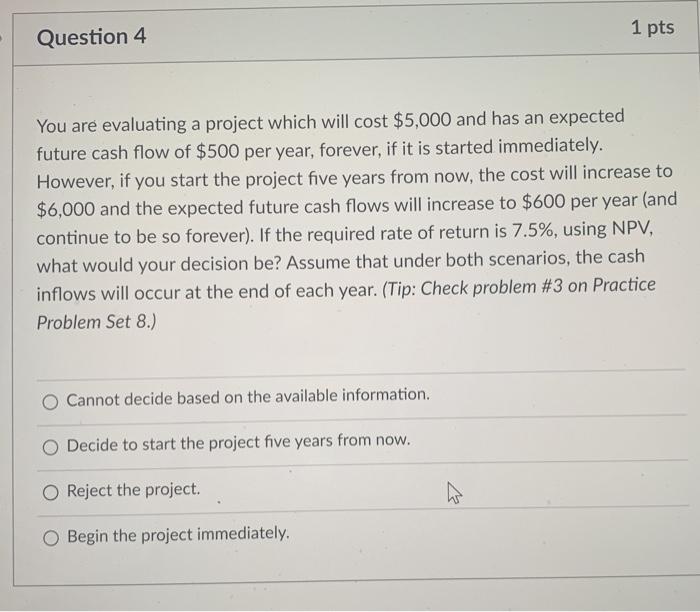

Question 4 1 pts You are evaluating a project which will cost $5,000 and has an expected future cash flow of $500 per year, forever, if it is started immediately. However, if you start the project five years from now, the cost will increase to $6,000 and the expected future cash flows will increase to $600 per year (and continue to be so forever). If the required rate of return is 7.5%, using NPV, what would your decision be? Assume that under both scenarios, the cash inflows will occur at the end of each year. (Tip: Check problem #3 on Practice Problem Set 8.) Cannot decide based on the available information. O Decide to start the project five years from now. Reject the project. O Begin the project immediately

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts