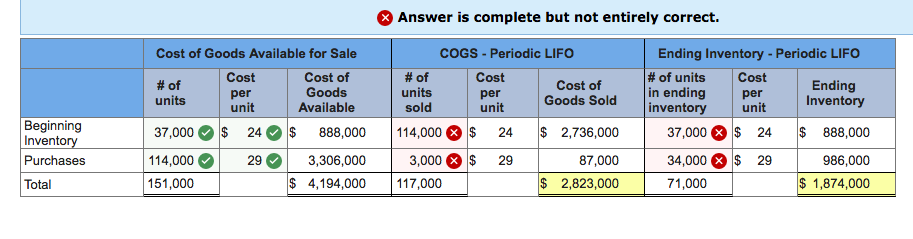

Question: Esquire Inc. uses the LIFO method to value its inventory. Inventory at January 1, 2016, was $888,000 (37,000 units at $24 each). During 2016, 114,000

| Esquire Inc. uses the LIFO method to value its inventory. Inventory at January 1, 2016, was $888,000 (37,000 units at $24 each). During 2016, 114,000 units were purchased, all at the same price of $29 per unit. 117,000 units were sold during 2016. Esquire uses a periodic inventory system. |

| Complete the below table to calculate the December 31, 2016, ending inventory and cost of goods sold. |

Answer is complete but not entirely correct Cost of Goods Available for Sale COGS Periodic LIFO Ending Inventory - Periodic LIFO Cost per unit Cost of Goods Available #of units sold Cost per unit # of units #of units Cost per unit Ending Inventory Cost of in ending Goods Sold nventory Beginning Invento Purchases 37,000 24 888,000 114,000 24 2,736,000 37,000 X 24 888,000 114,000 2 3,306,000 3,000 29 151,000 87,000 $2,823,000 34,000 x $ 29 986,000 Total $ 4,194,000 117,000 71,000 $1,874,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts