Question: estate rax Answer the following problems: 1. Mr. Cee a married decedent died November, 2018. He left his wife, whom he married after August, 1988

estate rax

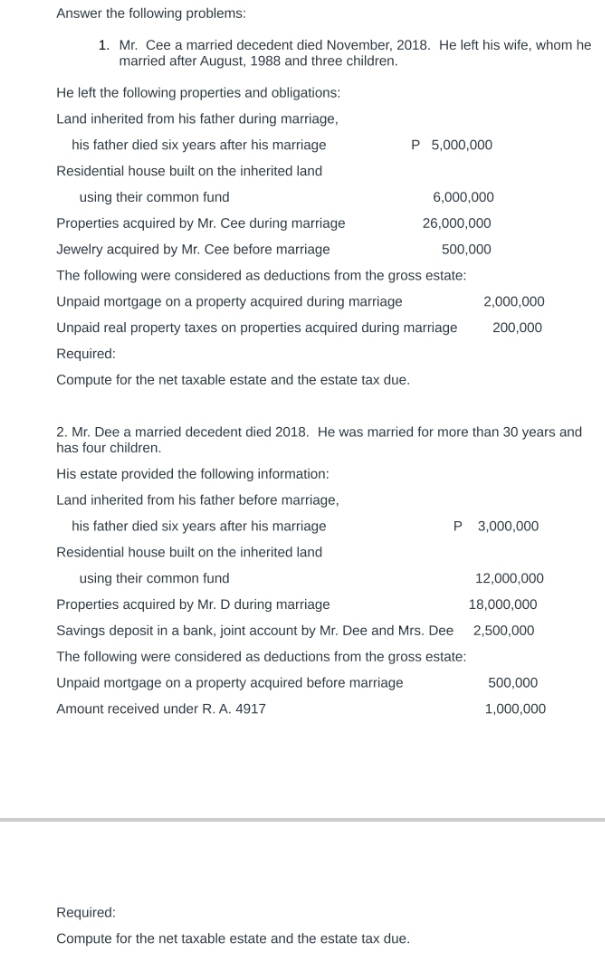

Answer the following problems: 1. Mr. Cee a married decedent died November, 2018. He left his wife, whom he married after August, 1988 and three children. He left the following properties and obligations: Land inherited from his father during marriage, his father died six years after his marriage P 5,000,000 Residential house built on the inherited land using their common fund 6,000,000 Properties acquired by Mr. Cee during marriage 26,000,000 Jewelry acquired by Mr. Cee before marriage 500,000 The following were considered as deductions from the gross estate: Unpaid mortgage on a property acquired during marriage 2,000,000 Unpaid real property taxes on properties acquired during marriage 200,000 Required: Compute for the net taxable estate and the estate tax due. 2. Mr. Dee a married decedent died 2018. He was married for more than 30 years and has four children. His estate provided the following information: Land inherited from his father before marriage, his father died six years after his marriage P 3,000,000 Residential house built on the inherited land using their common fund 12,000,000 Properties acquired by Mr. D during marriage 18,000,000 Savings deposit in a bank, joint account by Mr. Dee and Mrs. Dee 2,500,000 The following were considered as deductions from the gross estate: Unpaid mortgage on a property acquired before marriage 500,000 Amount received under R. A. 4917 1,000,000 Required: Compute for the net taxable estate and the estate tax due

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts