Question: Hi I need help on what is the answer to this problems? Below is the question and other concerns will be in the comment section

Hi I need help on what is the answer to this problems? Below is the question and other concerns will be in the comment section. I hope you can help me and surely I will give you full positive feedback

.

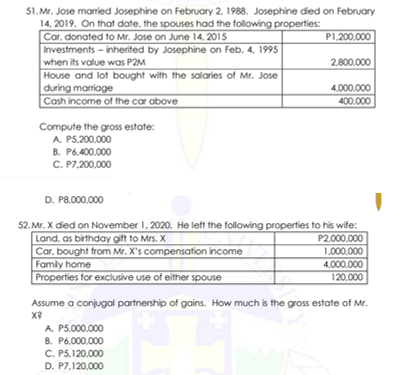

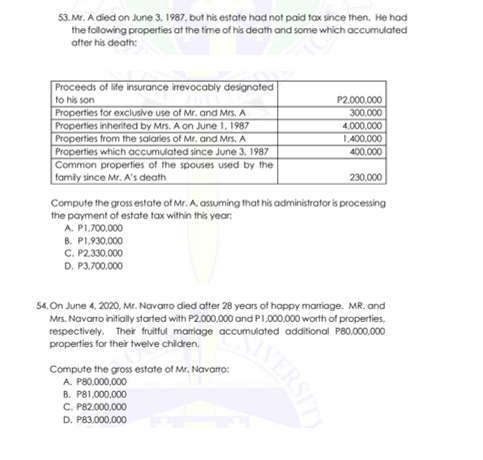

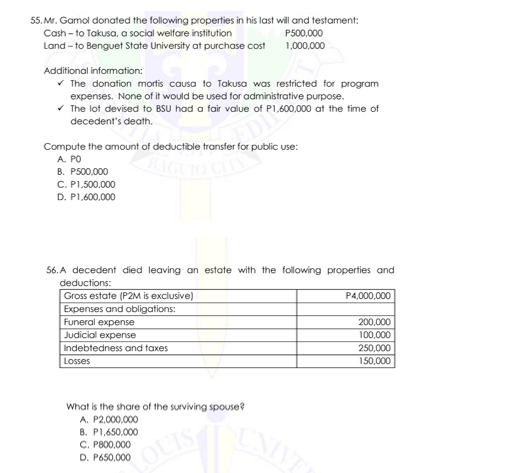

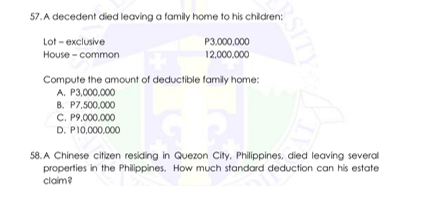

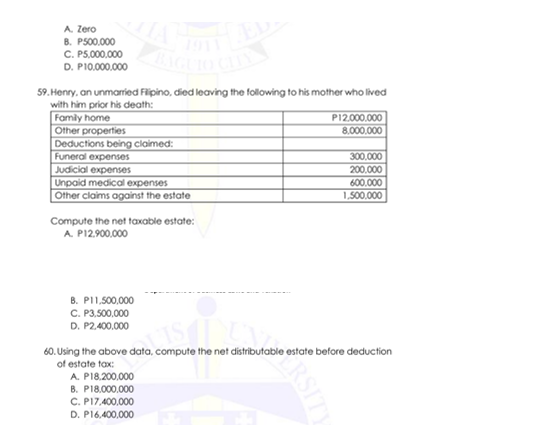

51.Mr. Jose married Josephine on February 2. 1988. Josephine died on February 14, 2019. On that date, the spouses had the following properties: Cor, donated to Mr. Jose on June 14. 2015 P1.200,000 Investments - inherited by Josephine on Feb. 4, 1995 when its value was P2M 2.800.000 House and lo! bought with the solorios of Mr. Jose during mariage 4,000.000 Cash income of the cor above 400 000 Compute the gross estate: A. P5.200.000 B. P6.400,000 C. P7.200,000 D. P8,000,000 52. Mr. X died on November 1, 2020. He left the following properties to his wife: Land, of birthday gift to Mrs. X P2.000.000 Cor, bought from Mr. X's compensation income 1,000.000 Family home 4.000.000 Properties for exclusive use of either spouse 120.000 Assume a conjugal partnership of gains. How much is the gross estate of Mr. A. P5.000,000 B. P6.000.000 C. P5.120,000 D. P7.120.00053. Mr. A died on June 3, 1987, but his estate had not paid fox since then. He hod the following properties at the time of his death and some which accumulated after his death: Proceeds of life insurance irrevocably designated to his son P2.000,000 Properties for exclusive use of Mr. and Mrs. A 300,000 Properties Inherited by Mrs. A on June 1, 1987 4,000,000 Properties from the salaries of Mr. and Mrs. A 1,400,000 Properties which accumulated since June 3, 1987 400,000 Common properties of the spouses used by the family since Mr. A's death 230.000 Compute the gross estate of Mr. A, assuming that his administrator is processing the payment of estate tax within this year: A. P1.700,000 B. P1.930,000 C. P2.330,000 D. P3.700,000 54. On June 4, 2020, Mr. Navarro died after 28 years of happy marriage. MR. and Mrs. Navarro initially started with P2.000,000 and P1,000,000 worth of properties, respectively. Their fruitful marriage accumulated additional P80.090,000 properties for their twelve children. Compute the gross estate of Mr. Navarro: A. P80.000,000 B. P81,000,000 C. P82.000,000 D. P83,000,00055. Mr. Gamol donated the following properties in his last will and testament: Cash - to Tokusa, a social welfare institution P500,000 Land - to Benguet State University at purchase cost 1,000,000 Additional information: The donation mortis causa to Takusa was restricted for program expenses. None of it would be used for administrative purpose. The lot devised to BSU had a fair value of P1,600,000 at the time of decedent's death. Compute the amount of deductible transfer for public use: A PO B. P500,000 C. P1.500,000 D. P1,800,000 56. A decedent died leaving on estate with the folowing properties and deductions: Gross estate (P2M is exclusive) P4,000,000 Expenses and obligations: Funeral expense 200,000 Judicial expense 100,000 Indebtedness and taxes 250,000 Losses 150,000 What is the share of the surviving spouse? A. P2.000,000 B. P1,650,000 C. P800,000 OUIS D. P650,00057.A decedent died leaving a family home to his children: Lot - exclusive P3,000,000 House - common 12,000.000 Compute the amount of deductible family home: A. P3,000,000 B. P7.500.000 C. P9,000,000 D. P10,000,000 58.A Chinese citzen residing in Quezon City, Philippines, died leaving several properties In the Philippines. How much standard deduction can his estate claim?A. Zero B. P500.000 C. P5.000,000 D. P10,000,000 BAG 59. Henry. on unmonied Filipino, died leaving the following to his mother who lived with him prior ha death: Family home P12.000.000 Other properties 8.000.000 Deductions being claimed: Funeral expenses 300.000 Judicial expenses 200.000 Unpaid medical expenses 600,000 Other claims against the estate 1,500,000 Compute the net taxable estate: A. P12.900,000 B. P11,500,000 C. P3,500,000 D. P2.400,000 40. Using the above data, compute the net distributable estate before deduction of estate tax: A. P18.200,000 B. P18,000,000 C. P17.400,000 D. P16,400,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts