Question: Estelle Inc. has a 15-year bond with a face value of $1,000 and an interest rate of 7%. The coupon is paid semiannually. Bonds

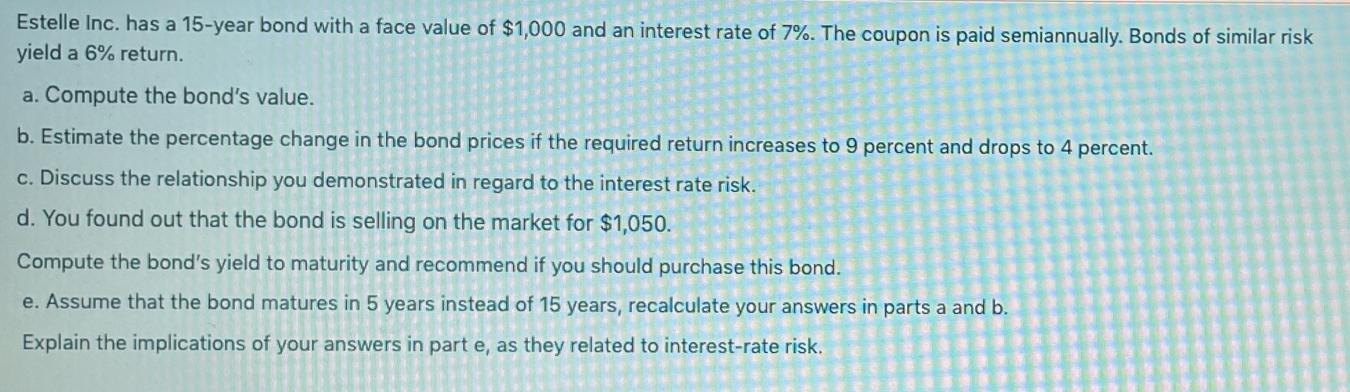

Estelle Inc. has a 15-year bond with a face value of $1,000 and an interest rate of 7%. The coupon is paid semiannually. Bonds of similar risk yield a 6% return. a. Compute the bond's value. b. Estimate the percentage change in the bond prices if the required return increases to 9 percent and drops to 4 percent. c. Discuss the relationship you demonstrated in regard to the interest rate risk. d. You found out that the bond is selling on the market for $1,050. Compute the bond's yield to maturity and recommend if you should purchase this bond. e. Assume that the bond matures in 5 years instead of 15 years, recalculate your answers in parts a and b. Explain the implications of your answers in part e, as they related to interest-rate risk.

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

a To compute the bonds value we need to calculate the present value of its future cash flows which include the periodic coupon payments and the final face value payment The bond pays a coupon semiannu... View full answer

Get step-by-step solutions from verified subject matter experts