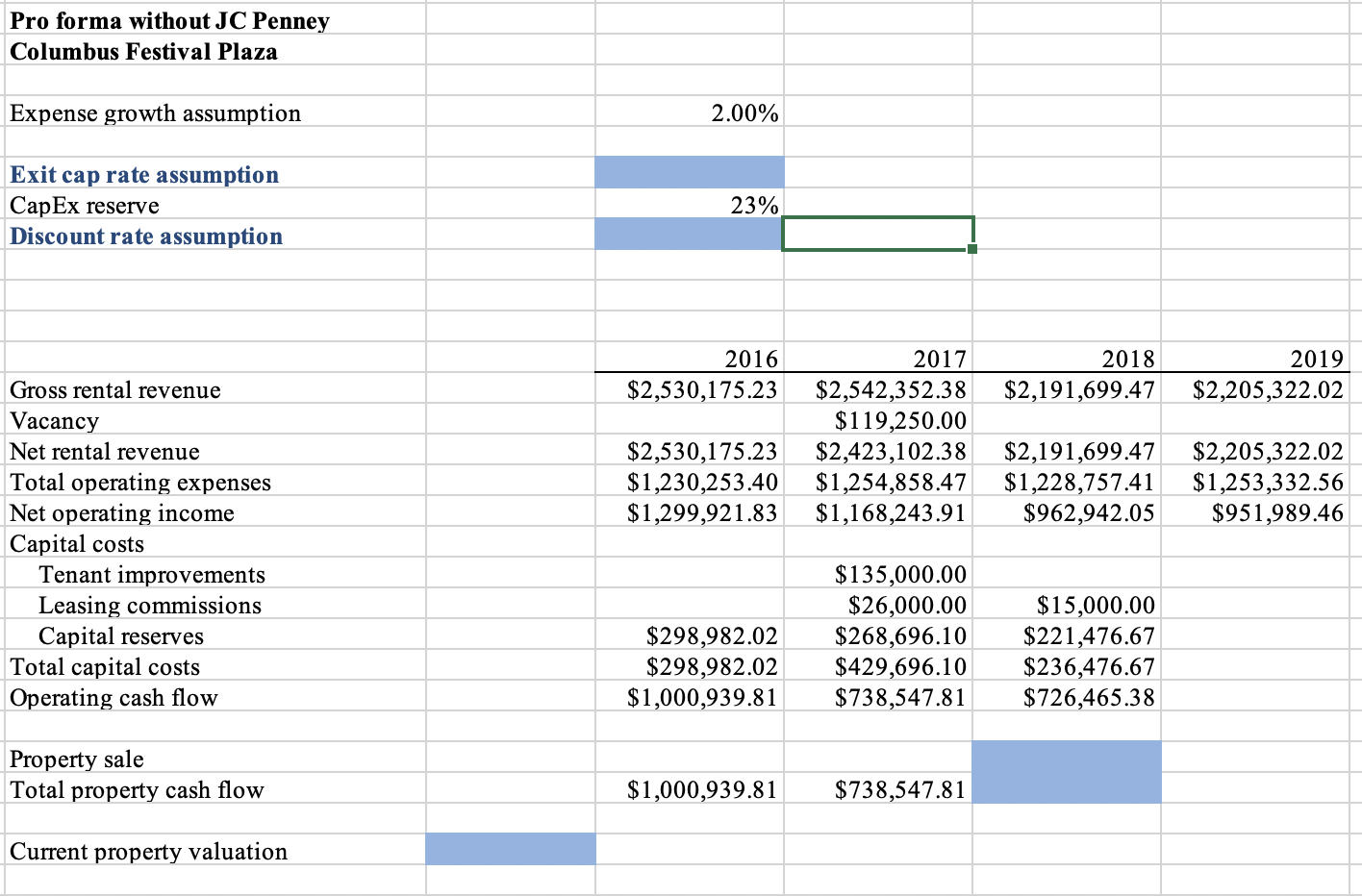

Question: Estimate each propertys current value by calculating the present discounted value of expected future cash flows given to you in Exhibit 11 (Screenshot Below). To

Estimate each propertys current value by calculating the present discounted value of expected future cash flows given to you in Exhibit 11 (Screenshot Below). To complete your valuation, you will need to make an exit cap and discount rate assumption. For Columbus Festival, assume that the exit cap rate on the property if JC Penney does not renew would be 0.50% higher than if JC Penney does renew.

Please show all calculations and work. Thank you!

Pro forma without JC Penney Columbus Festival Plaza Expense growth assumption 2.00% Exit cap rate assumption CapEx reserve Discount rate assumption 23% 2016 $2,530,175.23 2018 $2,191,699.47 2019 $2,205,322.02 $2,530,175.23 $1,230,253.40 $1,299,921.83 2017 $2,542,352.38 $119,250.00 $2,423,102.38 $1,254,858.47 $1,168,243.91 $2,191,699.47 $1,228,757.41 $962,942.05 $2,205,322.02 $1,253,332.56 $951,989.46 Gross rental revenue Vacancy Net rental revenue Total operating expenses Net operating income Capital costs Tenant improvements Leasing commissions Capital reserves Total capital costs Operating cash flow $298,982.02 $298,982.02 $1,000,939.81 $135,000.00 $26,000.00 $268,696.10 $429,696.10 $738,547.81 $15,000.00 $221,476.67 $236,476.67 $726,465.38 Property sale Total property cash flow $1,000,939.81 $738,547.81 Current property valuation Pro forma without JC Penney Columbus Festival Plaza Expense growth assumption 2.00% Exit cap rate assumption CapEx reserve Discount rate assumption 23% 2016 $2,530,175.23 2018 $2,191,699.47 2019 $2,205,322.02 $2,530,175.23 $1,230,253.40 $1,299,921.83 2017 $2,542,352.38 $119,250.00 $2,423,102.38 $1,254,858.47 $1,168,243.91 $2,191,699.47 $1,228,757.41 $962,942.05 $2,205,322.02 $1,253,332.56 $951,989.46 Gross rental revenue Vacancy Net rental revenue Total operating expenses Net operating income Capital costs Tenant improvements Leasing commissions Capital reserves Total capital costs Operating cash flow $298,982.02 $298,982.02 $1,000,939.81 $135,000.00 $26,000.00 $268,696.10 $429,696.10 $738,547.81 $15,000.00 $221,476.67 $236,476.67 $726,465.38 Property sale Total property cash flow $1,000,939.81 $738,547.81 Current property valuation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts