Question: Estimating Share Value Using the DCF Model Following are forecasted sales, NOPAT, and NOA for AT&T for 2019 through 2022 Note: Complete the entire question

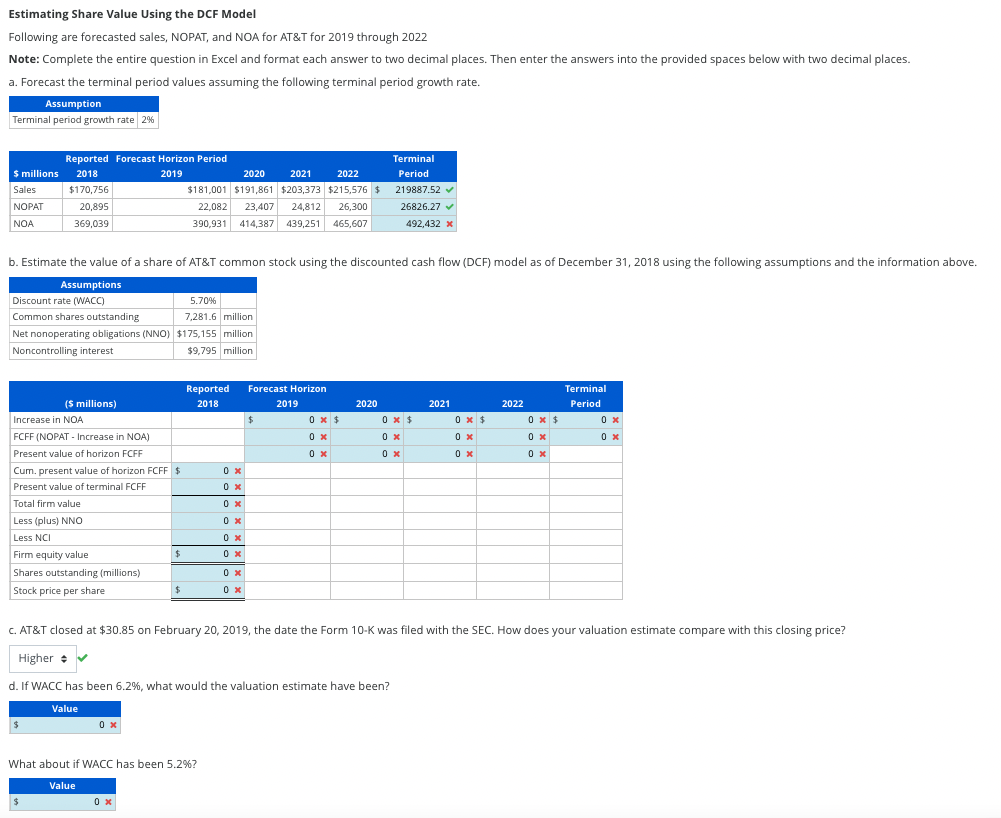

Estimating Share Value Using the DCF Model Following are forecasted sales, NOPAT, and NOA for AT\&T for 2019 through 2022 Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two destimal a. Forecast the terminal period values assuming the following terminal period growth rate. b. Estimate the value of a share of AT\&T common stock using the discounted cash flow (DCF) model as of December 31,2018 using the following assumptions and the information c. AT\&T closed at $30.85 on February 20, 2019, the date the Form 10-K was filed with the SEC. How does your valuation estimate compare with this closing price? d. If WACC has been 6.2%, what would the valuation estimate have been? What about if WACC has been 5.2% ? Estimating Share Value Using the DCF Model Following are forecasted sales, NOPAT, and NOA for AT\&T for 2019 through 2022 Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two destimal a. Forecast the terminal period values assuming the following terminal period growth rate. b. Estimate the value of a share of AT\&T common stock using the discounted cash flow (DCF) model as of December 31,2018 using the following assumptions and the information c. AT\&T closed at $30.85 on February 20, 2019, the date the Form 10-K was filed with the SEC. How does your valuation estimate compare with this closing price? d. If WACC has been 6.2%, what would the valuation estimate have been? What about if WACC has been 5.2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts