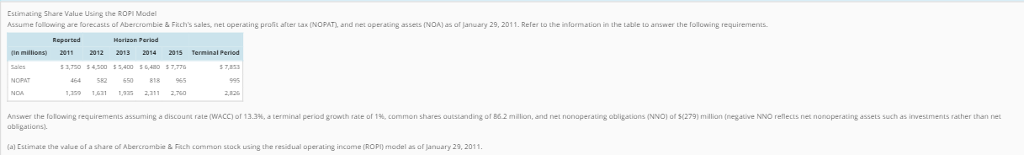

Question: Estimating Share Value Using the ROPI Model Estimating Share Value Using the ROPI Model Assume follow r are forecasts of Abercrombie & Fitch's sales, nel

Estimating Share Value Using the ROPI Model

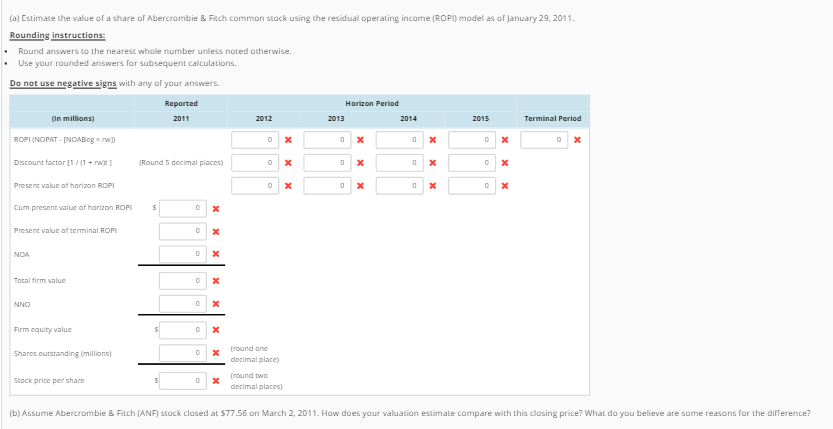

Estimating Share Value Using the ROPI Model Assume follow r are forecasts of Abercrombie & Fitch's sales, nel operating profil at ef NOPAT and net aperatir INDA) as of an ary 29, 2011 Refer to the information n the le 10 answer the rollo ir requirements assets Reparted Harizon 7erlad in millios) 2011 2012 2013 2014 2015 Terninal Peried 3,720 4,900 3,4000407,770 7,3 1,300 1621 1323 2,1 2,70 Answer the fo o n requirements assuming a d iscount rate WACC) of 13.3% a terminal period growth rat e of 1%, common s ares outstandin of B millor, and net nono era r obl NO of S 2 9 ma on ne au e NI renects net no assets such as investments rather than net ations operati a) [SLinate ht value of a share of Abercrombie & Ruch common stock using the residual operating income (ROPI) model s of January 29, 2011 . Estimating Share Value Using the ROPI Model Assume follow r are forecasts of Abercrombie & Fitch's sales, nel operating profil at ef NOPAT and net aperatir INDA) as of an ary 29, 2011 Refer to the information n the le 10 answer the rollo ir requirements assets Reparted Harizon 7erlad in millios) 2011 2012 2013 2014 2015 Terninal Peried 3,720 4,900 3,4000407,770 7,3 1,300 1621 1323 2,1 2,70 Answer the fo o n requirements assuming a d iscount rate WACC) of 13.3% a terminal period growth rat e of 1%, common s ares outstandin of B millor, and net nono era r obl NO of S 2 9 ma on ne au e NI renects net no assets such as investments rather than net ations operati a) [SLinate ht value of a share of Abercrombie & Ruch common stock using the residual operating income (ROPI) model s of January 29, 2011

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts