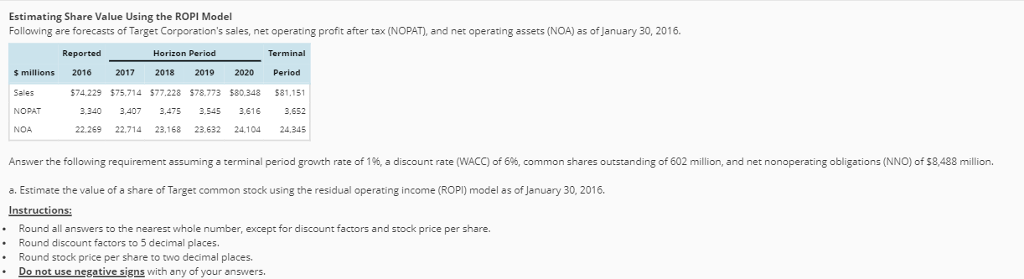

Question: Estimating Share Value Using the ROPI Model Estimating Share Value Using the ROPI Model Following are forecasts of Target Corporation's sales, net operating profit after

Estimating Share Value Using the ROPI Model

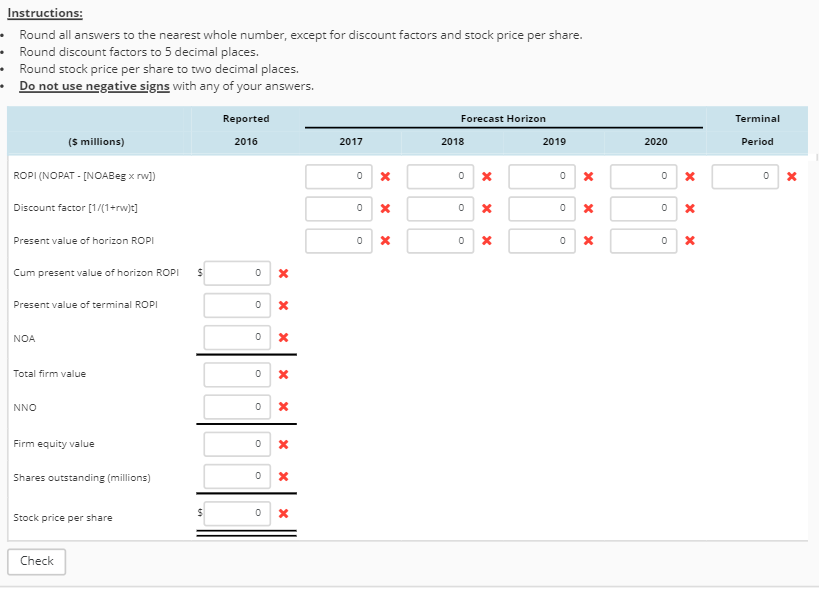

Estimating Share Value Using the ROPI Model Following are forecasts of Target Corporation's sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of January 30, 2016 Horizon Period Terminal s millions 2016 2017 2018 2019 2020 Period Sales $74 229 $75.714 $77.228 $78.773 $80.348 581.1 NOPAT0 3.340 3,407 ,475 3.545 3616 3.652 NOA 2269 22.4 23.168 23.632 24104 24345 24.345 Answer the a. Estimate the value of a share of Target common stock using the residual operating income (ROPI) model as of January 30, 2016 .Round all answers to the nearest whole number, except for discount factors and stock price per share. oll ng requirement assuming a terminal period growth rate of %, a discount rate w A of 6 o, common shares outstanding ofe 2 milion, a ne no operating ool N of 8 m ations on. Round discount factors to 5 decimal places. Round stock price per share to two decimal places. Do not use negative signs with any of your answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts