Question: Estimating Share Value Using the ROPI Model Following are forecasted sales, NOPAT, and NOA for Colgate-Palmolive Company for 2019 through 2022. Note: Complete the

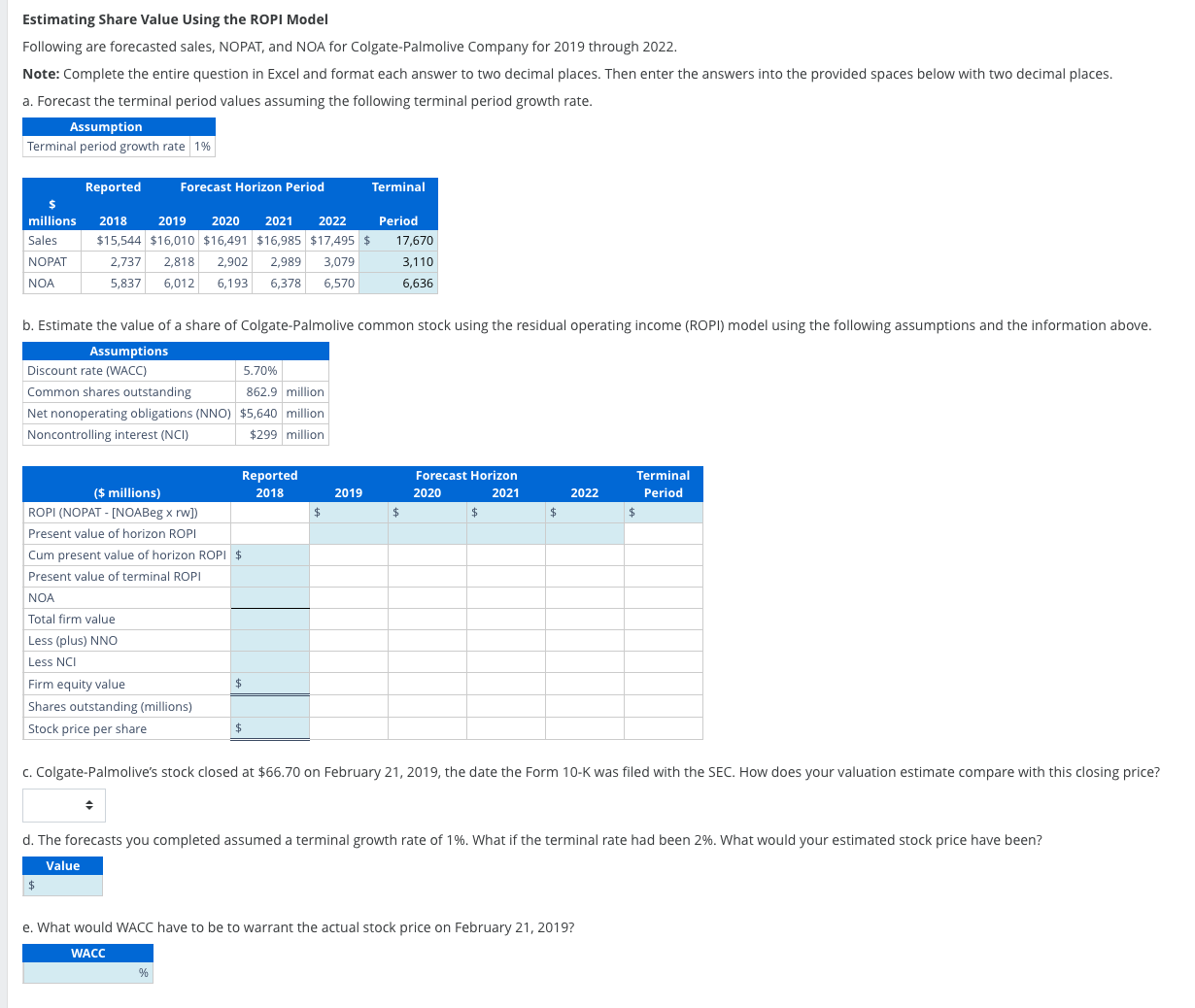

Estimating Share Value Using the ROPI Model Following are forecasted sales, NOPAT, and NOA for Colgate-Palmolive Company for 2019 through 2022. Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places. a. Forecast the terminal period values assuming the following terminal period growth rate. Assumption Terminal period growth rate 1% Reported Forecast Horizon Period Terminal millions 2018 Sales NOPAT NOA 2019 2020 2021 2022 $15,544 $16,010 $16,491 $16,985 $17,495 $ 2,737 2,818 2,902 2,989 3,079 5,837 6,012 6,193 6,378 6,570 Period 17,670 3,110 6,636 b. Estimate the value of a share of Colgate-Palmolive common stock using the residual operating income (ROPI) model using the following assumptions and the information above. Assumptions Discount rate (WACC) Common shares outstanding 5.70% 862.9 million Net nonoperating obligations (NNO) $5,640 million Noncontrolling interest (NCI) $299 million Reported ($ millions) 2018 2019 Forecast Horizon 2020 2021 2022 Terminal Period ROPI (NOPAT - [NOABeg x rw]) $ $ $ $ Present value of horizon ROPI Cum present value of horizon ROPI $ Present value of terminal ROPI NOA Total firm value Less (plus) NNO Less NCI Firm equity value $ Shares outstanding (millions) $ Stock price per share c. Colgate-Palmolive's stock closed at $66.70 on February 21, 2019, the date the Form 10-K was filed with the SEC. How does your valuation estimate compare with this closing price? d. The forecasts you completed assumed a terminal growth rate of 1%. What if the terminal rate had been 2%. What would your estimated stock price have been? Value e. What would WACC have to be to warrant the actual stock price on February 21, 2019? WACC %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts