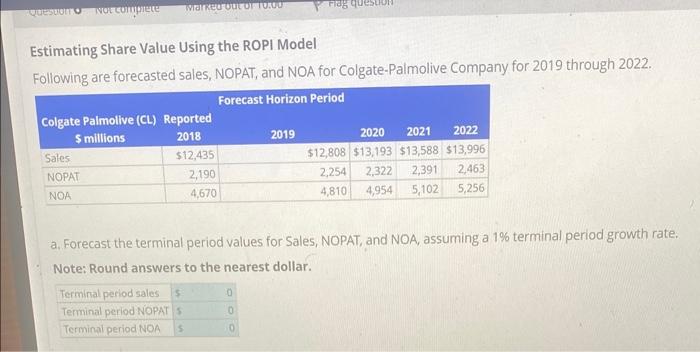

Question: Estimating Share Value Using the ROPI Model Following are forecasted sales, NOPAT, and NOA for Colgate-Palmolive Company for 2019 through 2022. a. Forecast the terminal

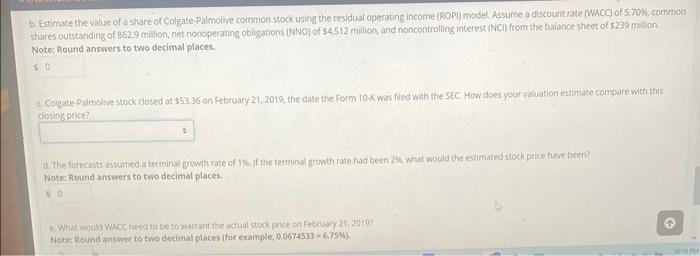

Estimating Share Value Using the ROPI Model Following are forecasted sales, NOPAT, and NOA for Colgate-Palmolive Company for 2019 through 2022. a. Forecast the terminal period values for Sales, NOPAT, and NOA, assuming a 1% terminal period growth rate, Note: Round answers to the nearest dollar. b. Estimate the value of a share of colgate.Palmolive common stock using the residual operating income (ROP) model. Assume a discount rate (wacC) of 5.7016, common stares outstanding of 862.9 million, net nonoperating obligations (NNO) of $4,512 million and noncontroling interest (NCI) from the baliance sheet of 5239 mill on. Note: Round answers to two decimal places. thocine nrice? Note: Round answers to two decimal places. (4. Whak wou'd Whec need to be 10 wactant the actual stock pelce on fobruary 21, 2019} Note: Roond answer to two decimal places (fot example, 0.0674533 = 6.75% ). d. The forecasts assumed a terminal growth rate of 1%. If the terminal growth rate had been 2%, what would the estimated stock price have been? Note: Round answers to two decimal places. e. What would WACC need to be to warrant the actual stock price on February 21, 2019? Note: Round answer to two decimal places (for example, 0.0674533 = 6.75% ). Estimating Share Value Using the ROPI Model Following are forecasted sales, NOPAT, and NOA for Colgate-Palmolive Company for 2019 through 2022. a. Forecast the terminal period values for Sales, NOPAT, and NOA, assuming a 1% terminal period growth rate, Note: Round answers to the nearest dollar. b. Estimate the value of a share of colgate.Palmolive common stock using the residual operating income (ROP) model. Assume a discount rate (wacC) of 5.7016, common stares outstanding of 862.9 million, net nonoperating obligations (NNO) of $4,512 million and noncontroling interest (NCI) from the baliance sheet of 5239 mill on. Note: Round answers to two decimal places. thocine nrice? Note: Round answers to two decimal places. (4. Whak wou'd Whec need to be 10 wactant the actual stock pelce on fobruary 21, 2019} Note: Roond answer to two decimal places (fot example, 0.0674533 = 6.75% ). d. The forecasts assumed a terminal growth rate of 1%. If the terminal growth rate had been 2%, what would the estimated stock price have been? Note: Round answers to two decimal places. e. What would WACC need to be to warrant the actual stock price on February 21, 2019? Note: Round answer to two decimal places (for example, 0.0674533 = 6.75% )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts