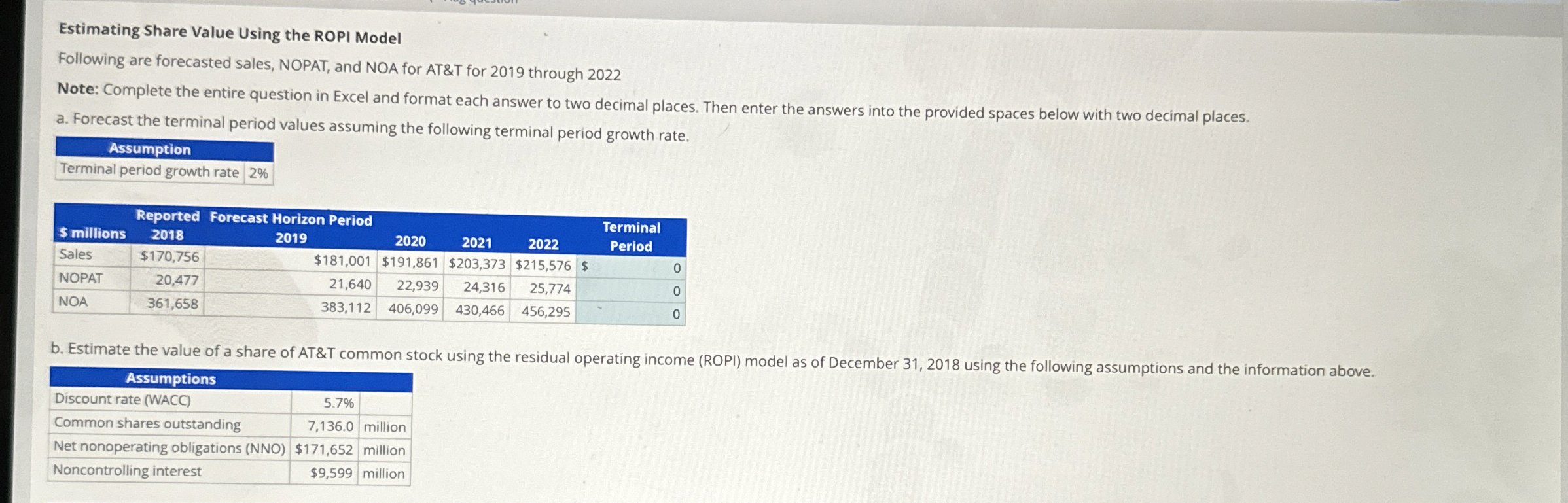

Question: Estimating Share Value Using the ROPI Model Following are forecasted sales, NOPAT, and NOA for AT&T for 2 0 1 9 through 2 0 2

Estimating Share Value Using the ROPI Model

Following are forecasted sales, NOPAT, and NOA for AT&T for through

Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places.

a Forecast the terminal period values assuming the following terminal period growth rate.

tableSmillionstableReportedtableForecast Horizon PeriodtableTerminalPeriodSales$$$$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock