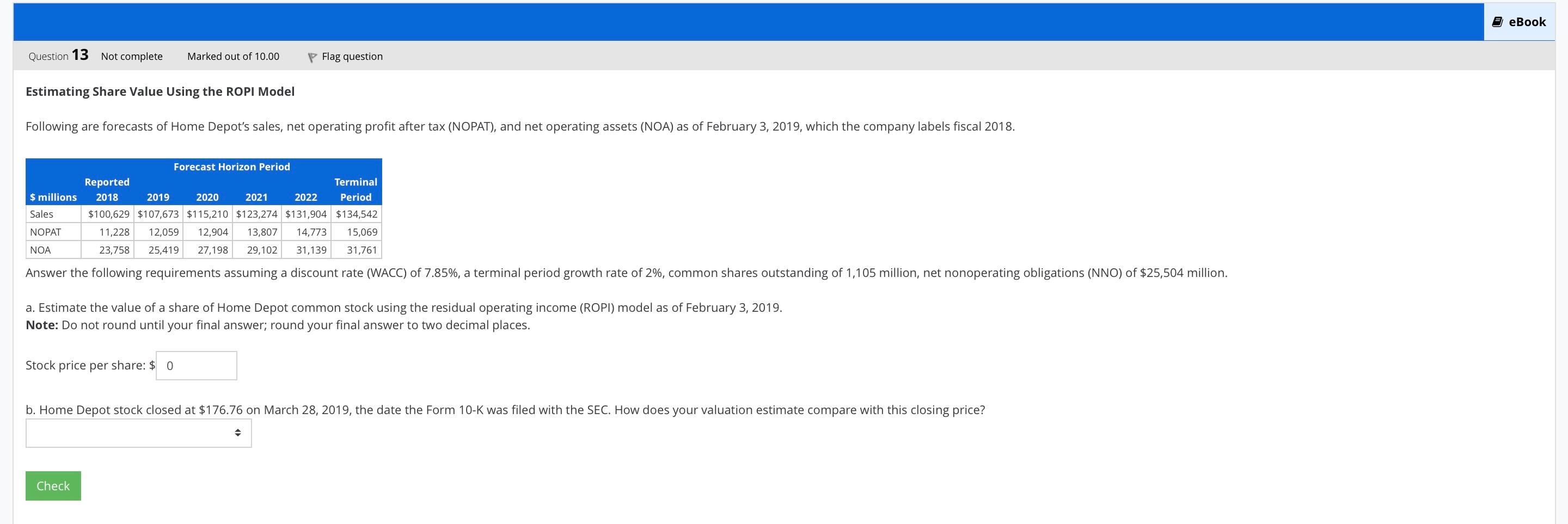

Question: Estimating Share Value Using the ROPI Model Following are forecasts of Home Depot's sales, net operating profit after tax (NOPAT), and net operating assets (NOA)

Estimating Share Value Using the ROPI Model Following are forecasts of Home Depot's sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of February 3, 2019 , which the company labels fiscal 2018. Estimating Share Value Using the ROPI Model Following are forecasts of Home Depot's sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of February 3, 2019 , which the company labels fiscal 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts