Question: please help me fix my answer Estimating Share Value Using the ROPI Model Following are forecasts of Home Depot's sales, net operating profit after tax

please help me fix my answer

please help me fix my answer

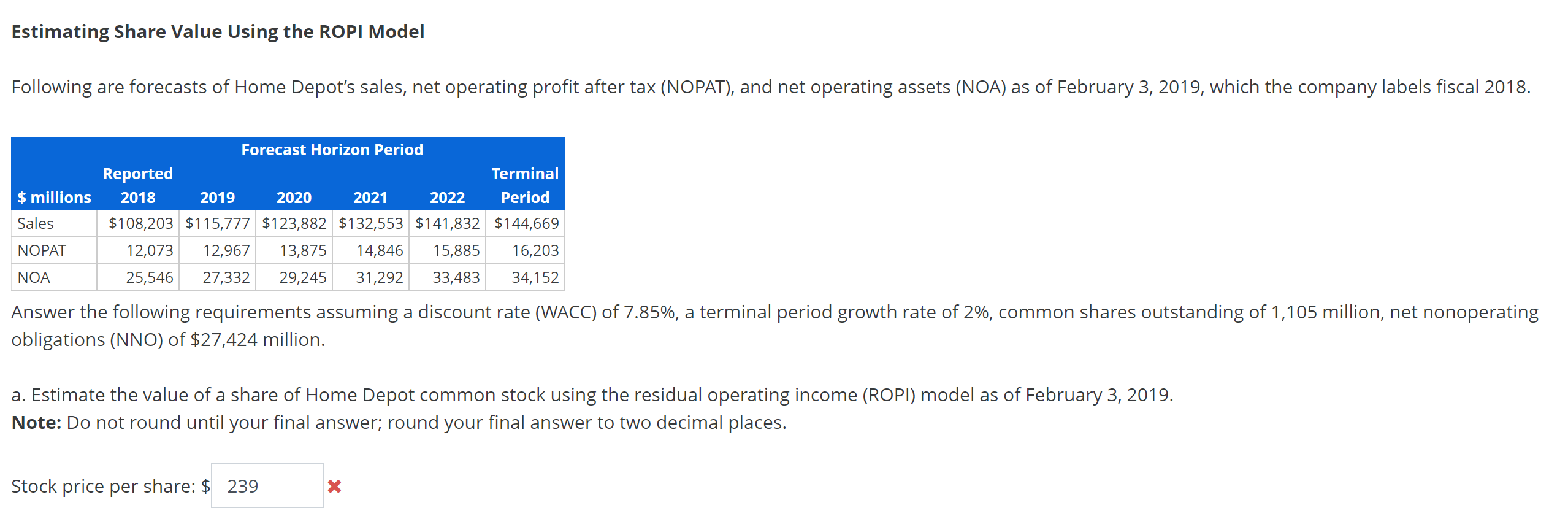

Estimating Share Value Using the ROPI Model Following are forecasts of Home Depot's sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of February 3, 2019, which the company labels fiscal 2018. $ millions Forecast Horizon Period Reported Terminal 2018 2019 2020 2021 2022 Period $108,203 $115,777 $123,882 $132,553 $141,832 $144,669 12,073 12,967 13,875 14,846 15,885 16,203 25,546 27,332 29,245 31,292 33,483 34,152 Sales NOPAT NOA Answer the following requirements assuming a discount rate (WACC) of 7.85%, a terminal period growth rate of 2%, common shares outstanding of 1,105 million, net nonoperating obligations (NNO) of $27,424 million. a. Estimate the value of a share of Home Depot common stock using the residual operating income (ROPI) model as of February 3, 2019. Note: Do not round until your final answer; round your final answer to two decimal places. Stock price per share: $ 239 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts