Question: estion 1 (30 points): Multiple choice: choose the correct answer million to shareholders. How much was paid to debtholders and debt 1. A fir m

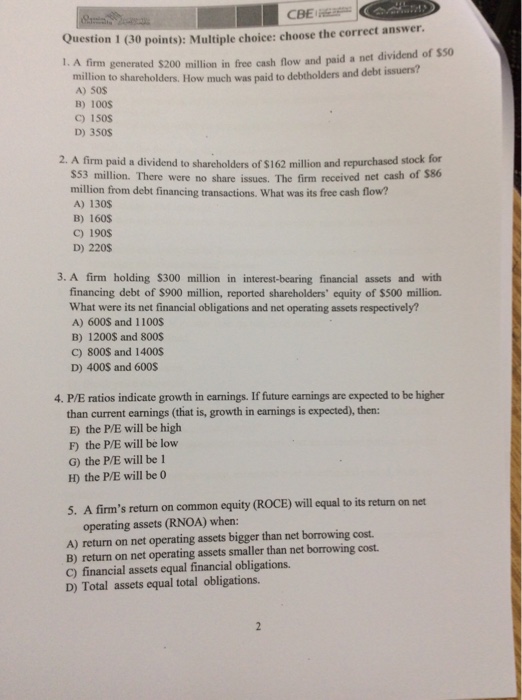

estion 1 (30 points): Multiple choice: choose the correct answer million to shareholders. How much was paid to debtholders and debt 1. A fir m generated $200 million in free cash flow and paid a net dividend of $50 A) 50S B) 100S C) 1508 D) 350S 2. A firm paid a dividend to sharcholders of $162 million and repurchased stock for $53 million. There were no share issues. The firm received net cash of $86 million from debt financing transactions. What was its free cash flow? A) 130s B) 160s C) 190s D) 220s 3. A firm holding $300 million in interest-bearing financial assets and with financing debt of $900 million, reported shareholders' equity of $500 million. What were its net financial obligations and net operating assets respectively? A) 600S and 1100S B) 1200S and 800S C) 800S and 1400S D) 400S and 600S 4. P/E ratios indicate growth in carnings. If future carnings are expected to be higher than current earnings (that is, growth in earnings is expected), then: E) the P/E will be high F) the P/E will be low G) the P/E will be 1 H) the P/E will be 0 5. A firm's return on common equity (ROCE) will equal to its return on net operating assets (RNOA) when: A) return on net operating assets bigger than net borrowing cost. B) return on net operating assets smaller than net borrowing cost. C) financial assets equal financial obligations. D) Total assets equal total obligations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts