Question: estion 10 1 points Save Answer Suppose a stock will have a return of -9% during a recession, and a return of 18% with normal

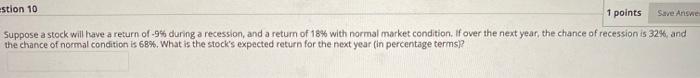

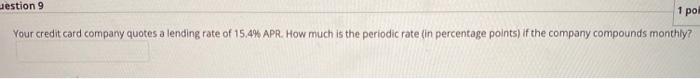

estion 10 1 points Save Answer Suppose a stock will have a return of -9% during a recession, and a return of 18% with normal market condition. If over the next year, the chance of recession is 32% and the chance of normal condition is 68%, What is the stock's expected return for the next year (in percentage terms? uestion 9 1 pol Your credit card company quotes a lending rate of 15.4% APR. How much is the periodic rate (in percentage points) if the company compounds monthly? Question 8 1 points Save Suppose you purchased a stock a year ago. Today, you receive a dividend of $16 and you sell the stock for $99. If your return was 11%, at what price did you buy the stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts