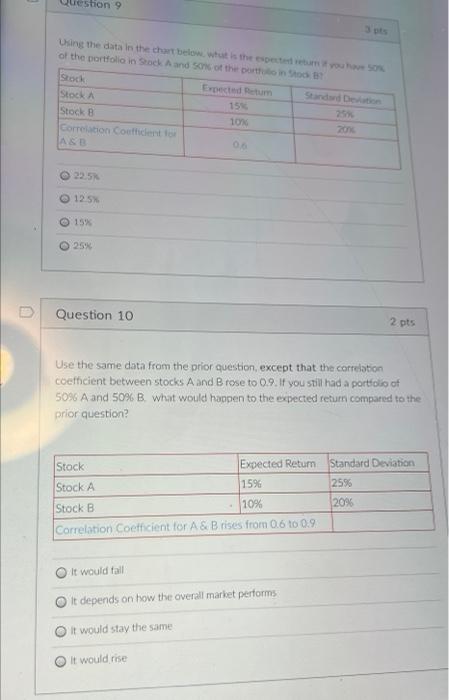

Question: estion 9 Using the data in the chart below. wat is the speed you of the portfolio in Sock and Sons of the portino Erpected

estion 9 Using the data in the chart below. wat is the speed you of the portfolio in Sock and Sons of the portino Erpected Retum Istock a 15 Stock B 101 Correlation Coefficent for ASB 22.5 125% 15% 25% U Question 10 2 pts Use the same data from the prior question, except that the correlation coefficient between stocks A and B rose to 0.9. If you still had a portfolio of 50% A and 50% B. what would happen to the expected return compared to the prior question Stock Expected Retum Standard Deviation Stock A 15% 2596 Stock B 20% Correlation coefficient for A & B rises from 0.6 to 0.9 - 10% It would tall It depends on how the overall market performs It would stay the same it would rise

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts