Question: estion Completion Status: Moving to another question will save this response. Question 1 of estion 1 5 points Save Jerry and his wife just purchased

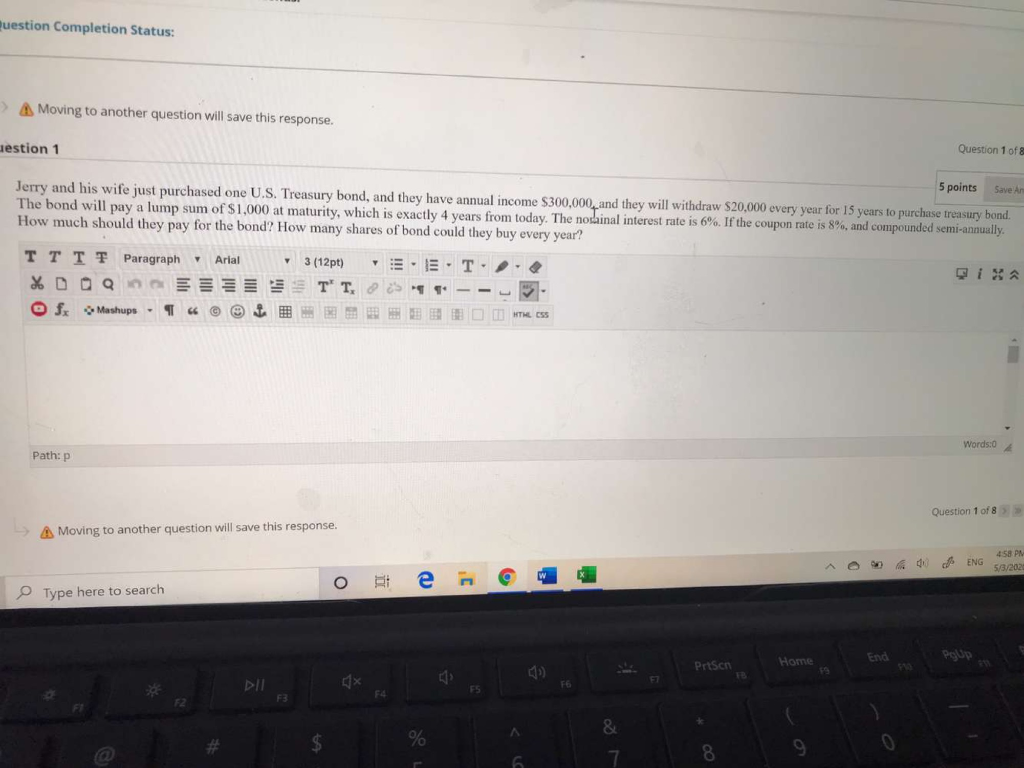

estion Completion Status: Moving to another question will save this response. Question 1 of estion 1 5 points Save Jerry and his wife just purchased one U.S. Treasury bond, and they have annual income $300,000, and they will withdraw $20,000 overy year for 15 years to purchase treasury bond. The bond will pay a lump sum of $1,000 at maturity, which is exactly 4 years from today. The nosainal interest rate is 6%. If the coupon rate is 8%, and compounded semi-annually. How much should they pay for the bond? How many shares of bond could they buy every year? T T TT Paragraph Arial %DOQO fx Mashups - 16 @ @L 3(12pt) . E T... T TO259 ---- E EBE wees Words Path:p Question 1 of 8 Moving to another question will save this response. 458 400 AENG 53/20 Type here to search End Home Prison

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts