Question: Ethical Decision-Making Field Manual #5: The Client Directive Case Page Case Study: The Client DIrective Transcript for Ricardo's voicemail to Daniel Hi Daniel, it's Ricardo.

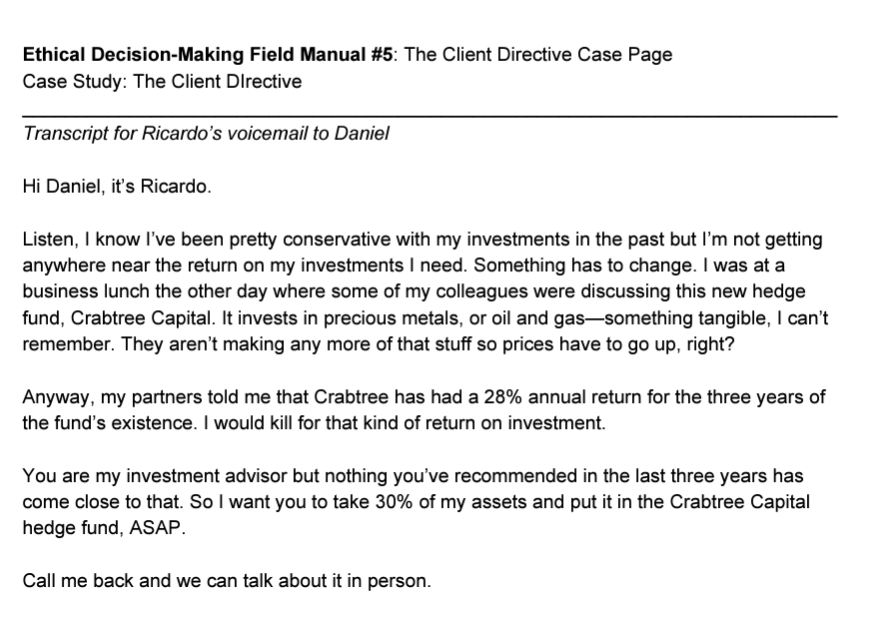

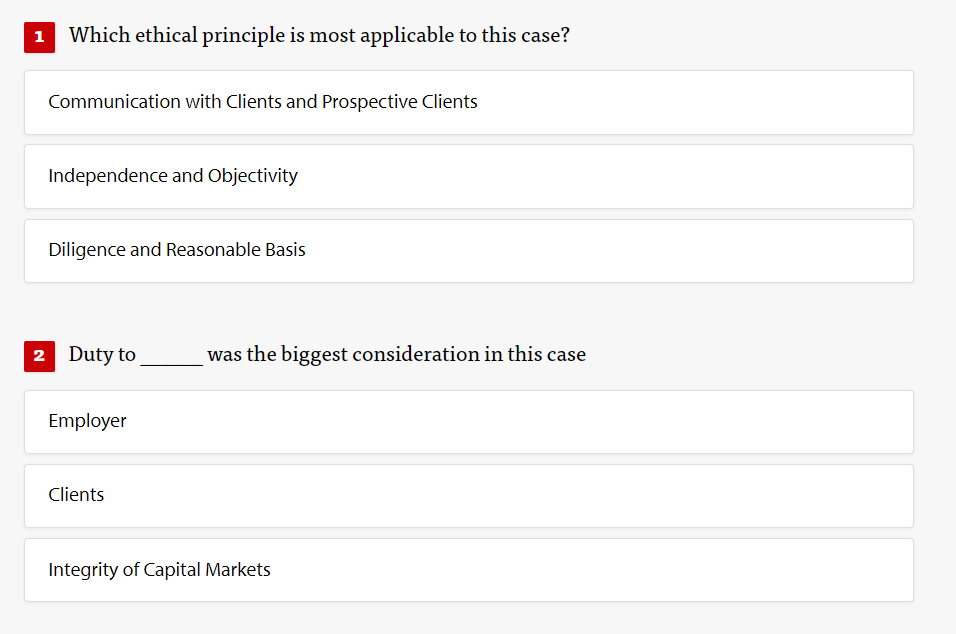

Ethical Decision-Making Field Manual \#5: The Client Directive Case Page Case Study: The Client DIrective Transcript for Ricardo's voicemail to Daniel Hi Daniel, it's Ricardo. Listen, I know l've been pretty conservative with my investments in the past but I'm not getting anywhere near the return on my investments I need. Something has to change. I was at a business lunch the other day where some of my colleagues were discussing this new hedge fund, Crabtree Capital. It invests in precious metals, or oil and gas-something tangible, I can't remember. They aren't making any more of that stuff so prices have to go up, right? Anyway, my partners told me that Crabtree has had a 28% annual return for the three years of the fund's existence. I would kill for that kind of return on investment. You are my investment advisor but nothing you've recommended in the last three years has come close to that. So I want you to take 30% of my assets and put it in the Crabtree Capital hedge fund, ASAP. Call me back and we can talk about it in person. 1 Which ethical principle is most applicable to this case? Communication with Clients and Prospective Clients Independence and Objectivity Diligence and Reasonable Basis Duty to was the biggest consideration in this case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts