Question: Ethiles Problem Diane Dennison is a financial analyst working for a lape chain of discount retail siores. Her company is looking at the possbiliy of

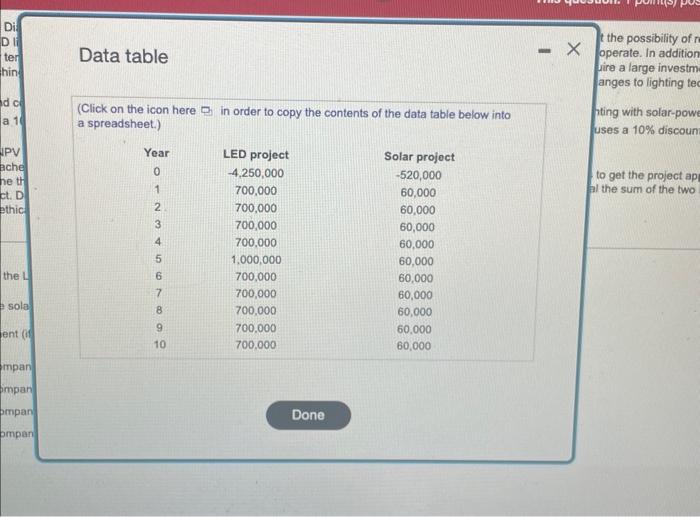

Ethiles Problem Diane Dennison is a financial analyst working for a lape chain of discount retail siores. Her company is looking at the possbiliy of replacing the existing flucrescent Ights in all of its storos with LED lights. The main advantage of making this swilch is that the LED ights are much more efficient and cont iess to operate. In addition, LED lights last much longer and wil have io be replaced after ten yeers, whereas the exising lights have to be roplaced after five years. Of course, making this change wil roquire a large investment io purchase pera LED Jghts and to pay for the lober of switching out tens of thousands of bulbs. Diane plans to use a 10-year hertzon to analyze this peoposal, fouring that ehanges to lighting fochnology wil eventually make this investrient obsolete. Dane's triend and coworker, David, hes analyzod another energy-saving investment opportanity that involves replacing eutdoor lighting wath solar-powered fituros in a fer of the comparyy's stores Dovid also used a 10 -year horisoa to conduct his analysis. Cash flow forecasts for each project are given here. The conpany uses a 10xi discount rate lo analyre captai budpetrg proposas. a. What is the NPV of each investment? Which irvestment of ether) should the company undertake? b. David approaches Diane for a tavor. David says that the solar lighting project is a pet project of his boss, and Dovid roaly wants ta get the projoct approvod to curry favor with his boss . He sugpests to Diane that they rol their wo projocts into a single proposal. The cash flows for this combined peoject would simply equal the sum of the two individual projecth. Calculate the NPV of the combined project Does it apgear lo be warth doing? Would you recommend investing in the combined projeet? c. What is the ethical issue that Dane taces? is any harm dene if she does the fovor for Dovid as he asks? The NPV of the LED preject is (Round to the neares dollar) The NPV af the solar project in 5 (Round to the nearest dolar) Which invesument if ethen) sheuld the company undertake? (flelect the best aniwer belon) A. The cempany ahoudd cheose the Solar pegect becauke is NPY is negilve. B. The company thould chooso the LED proipd because ths NPV is posihe. c. The company ahould not choose evther propect D. The compary shoudd choove both projects t the possibility of n Data table operate. In addition Iire a large investm anges to lighting te (Click on the icon here Q in order to copy the contents of the data table below into ting with solar-pow a spreadsheet.) uses a 10% discoun to get the project ap al the sum of the two

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts