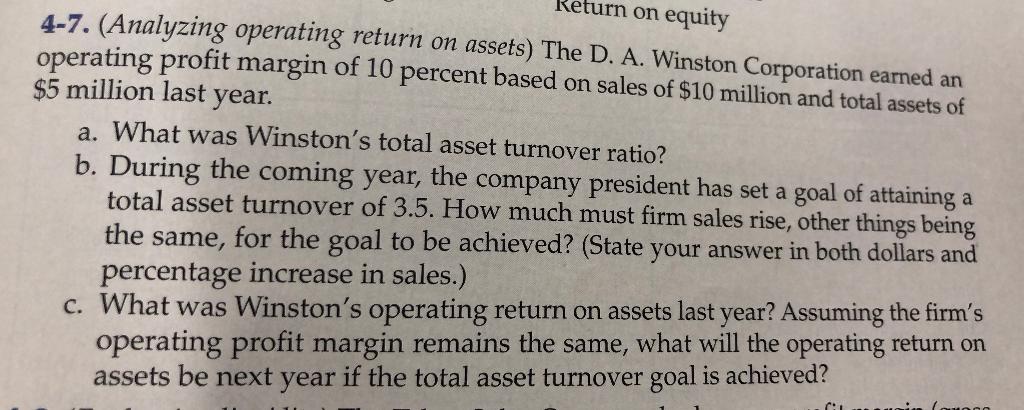

Question: eturn on equity 4-7. (Analyzing operating return on assets) The D. A. Winston Corporation earned an operating profit margin of 10 percent based on sales

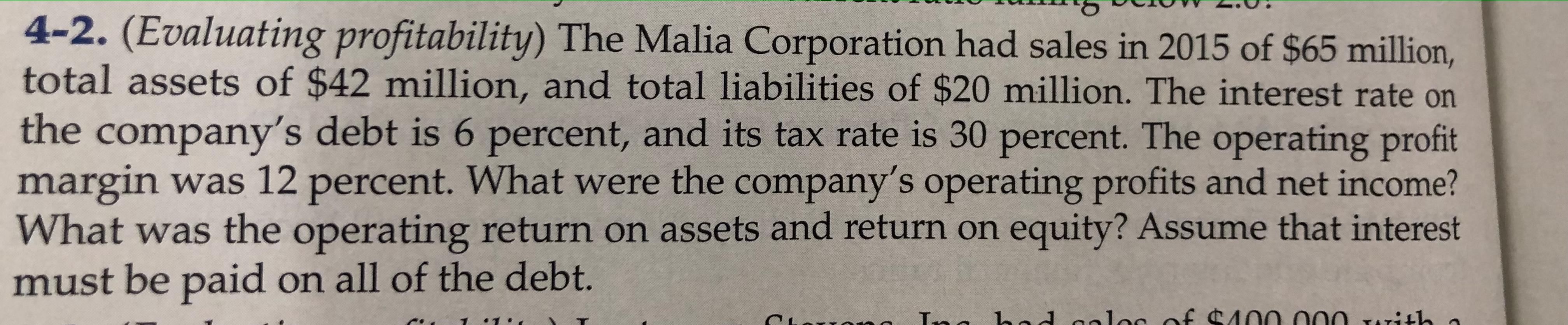

eturn on equity 4-7. (Analyzing operating return on assets) The D. A. Winston Corporation earned an operating profit margin of 10 percent based on sales of $10 million and total assets of $5 million last year. a. What was Winston's total asset turnover ratio? b. During the coming year, the company president has set a goal of attaining a total asset turnover of 3.5. How much must firm sales rise, other things being the same, for the goal to be achieved? (State your answer in both dollars and percentage increase in sales.) c. What was Winston's operating return on assets last year? Assuming the firm's operating profit margin remains the same, what will the operating return on assets be next year if the total asset turnover goal is achieved? 4-2. (Evaluating profitability) The Malia Corporation had sales in 2015 of $65 million, total assets of $42 million, and total liabilities of $20 million. The interest rate on the company's debt is 6 percent, and its tax rate is 30 percent. The operating profit margin was 12 percent. What were the company's operating profits and net income? What was the operating return on assets and return on equity? Assume that interest must be paid on all of the debt. 1 T1 lor of 100 on with a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts