Question: (Analyzing operating return on assets) The D. A. Winston Corporation earned an operating profit margin of 10.5 percent based on sales of $11.2 million and

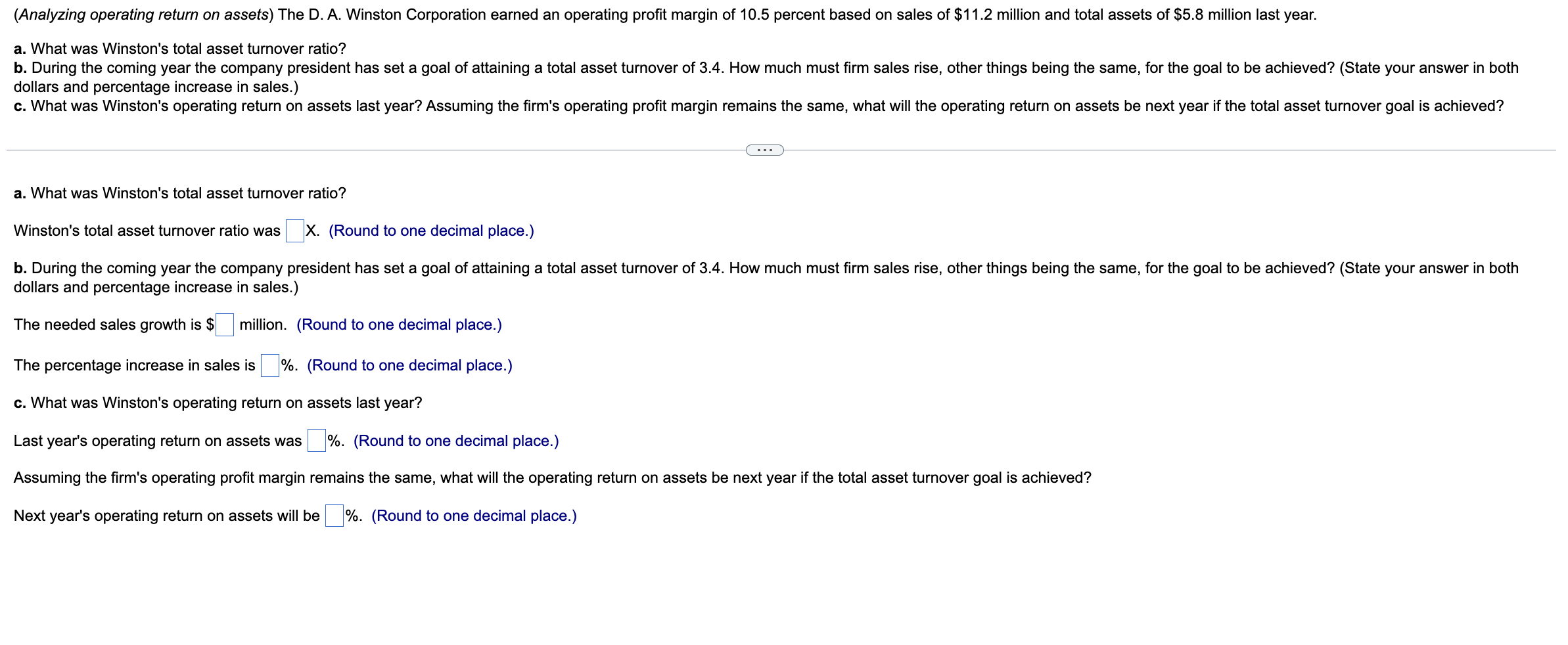

(Analyzing operating return on assets) The D. A. Winston Corporation earned an operating profit margin of 10.5 percent based on sales of $11.2 million and total assets of $5.8 million last year. a. What was Winston's total asset turnover ratio? dollars and percentage increase in sales.) a. What was Winston's total asset turnover ratio? Winston's total asset turnover ratio was c. (Round to one decimal place.) dollars and percentage increase in sales.) The needed sales growth is $ million. (Round to one decimal place.) The percentage increase in sales is %. (Round to one decimal place.) c. What was Winston's operating return on assets last year? Last year's operating return on assets was %. (Round to one decimal place.) Assuming the firm's operating profit margin remains the same, what will the operating return on assets be next year if the total asset turnover goal is achieved? Next year's operating return on assets will be o. (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts