Question: Eun - Jung has a profitable import business she has built over several years of Eun - Jung is looking at an Individuat 4 0

EunJung has a profitable import business she has built over several years of EunJung is looking at an Individuat k Complete the following workshe

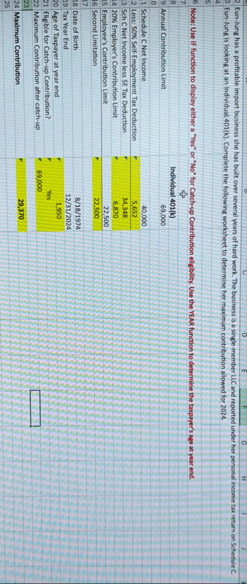

Note: Use IF function to display either a "Yes" or No for Catchup Contribu

tablefsIndividual kAnnual Contribution Limit,,Schedule C Net Income,,Less: SelfEmployment Tax Deduction,,Sch C Net Income less SE Tax Deduction,, Employer's Contribution Limit,,Employees Contribution Limit,,Second Limitation,Date of Birth,,Tax Year End,,Age of Taxpayer at year end,Eligible for Catchup Contribution?,,Maximum Contribution after catchupMaximum Contribution,

Eunlung has a profitable import business she has buit over several years of hard work. The bosiness is a singlemember LiC and reported under her personal income tax return on Schedule C funlung is looking at an individual k Complete the following workheet to determine her maximum contribution allowed for

Note: Use IF function to display either a "Yes" or No for Catchup Contribution elgiblity, Use the YEAR function to determine the taxpayer's age at year end.

tableIndividual kAnnual Contribution Limit,,Schedule C Net Income,,s: SOO SelfEmployment Tax Deduction,Sch C Net Income less SE Tax Deduction, Employer's Contribution Limit,Employee's Contribution Limit,,Second Limitation,FDate of Birth,,Tax Year End,,Age of Taxpayer at year end,Fligible for Catchup Contribution?,VesMaximum Contribution after catchupMaximum Contribution,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock