Question: Evaluate changes in the hotel /bed n breakfast industrys general environment (e.g., PESTEL analysis) to identify trends that represent both opportunities and challenges. What trends

- Evaluate changes in the hotel /bed n breakfast industrys general environment (e.g., PESTEL analysis) to identify trends that represent both opportunities and challenges. What trends are the most important for for Airbnbs future?

Airbnbs future?

Airbnbs future?

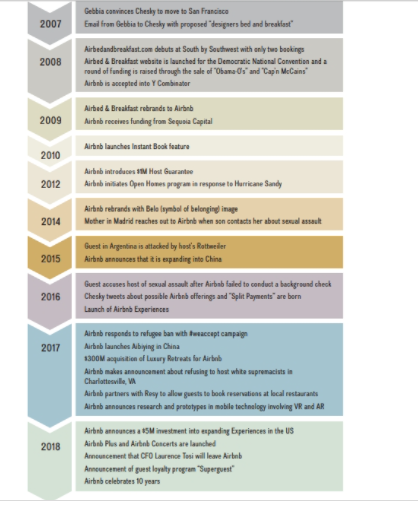

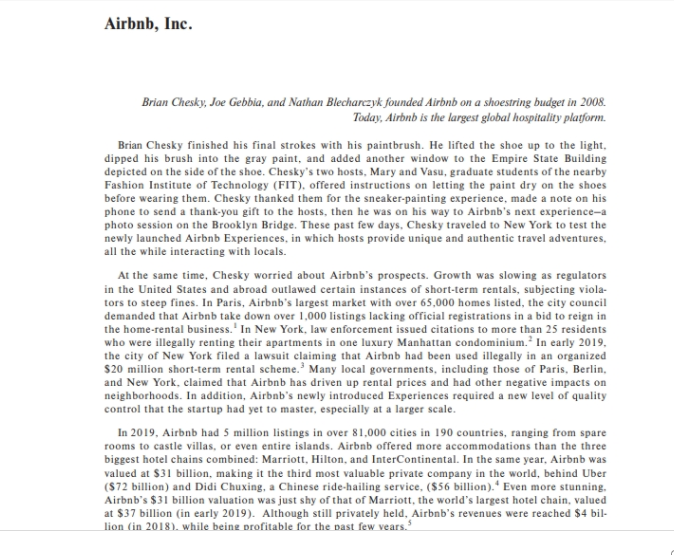

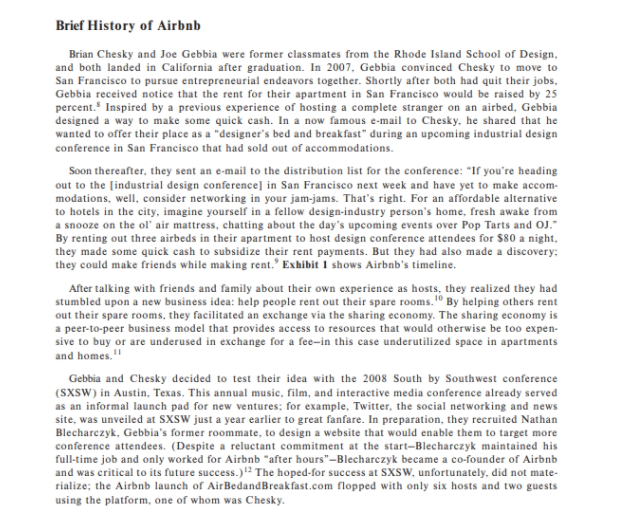

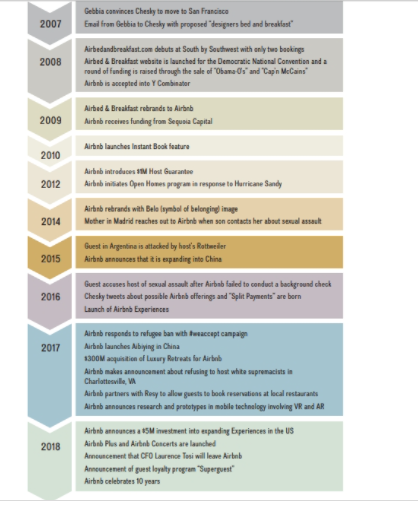

Airbnb, Inc. Brian Chesky, Joe Gebbia, and Nathan Blecharczyk founded Airbnb on a shoestring budget in 2008. Today, Airbnb is the largest global hospitality platform. Brian Chesky finished his final strokes with his paintbrush. He lifted the shoe up to the light, dipped his brush into the gray paint, and added another window to the Empire State Building depicted on the side of the shoe. Chesky's two hosts, Mary and Vasu, graduate students of the nearby Fashion Institute of Technology (FIT), offered instructions on letting the paint dry on the shoes before wearing them. Chesky thanked them for the sneaker-painting experience, made a note on his phone to send a thank-you gift to the hosts, then he was on his way to Airbnb's next experience-a photo session on the Brooklyn Bridge. These past few days, Chesky traveled to New York to test the newly launched Airbnb Experiences, in which hosts provide unique and authentic travel adventures, all the while interacting with locals. At the same time, Chesky worried about Airbnb's prospects. Growth was slowing as regulators in the United States and abroad outlawed certain instances of short-term rentals, subjecting viola- tors to steep fines. In Paris, Airbnb's largest market with over 65,000 homes listed, the city council demanded that Airbnb take down over 1,000 listings lacking official registrations in a bid to reign in the home-rental business. In New York, law enforcement issued citations to more than 25 residents who were illegally renting their apartments in one luxury Manhattan condominium. In early 2019, the city of New York filed a lawsuit claiming that Airbnb had been used illegally in an organized $20 million short-term rental scheme. Many local governments, including those of Paris, Berlin, and New York, claimed that Airbnb has driven up rental prices and had other negative impacts on neighborhoods. In addition, Airbnb's newly introduced Experiences required a new level of quality control that the startup had yet to master, especially at a larger scale. In 2019, Airbnb had 5 million listings in over 81,000 cities in 190 countries, ranging from spare rooms to castle villas, or even entire islands. Airbnb offered more accommodations than the three biggest hotel chains combined: Marriott, Hilton, and InterContinental. In the same year, Airbnb was valued at $31 billion, making it the third most valuable private company in the world, behind Uber ($72 billion) and Didi Chuxing, a Chinese ride-hailing service, ($56 billion). Even more stunning, Airbnb's $31 billion valuation was just shy of that of Marriott, the world's largest hotel chain, valued at $37 billion in early 2019). Although still privately held, Airbnb's revenues were reached $4 bil- lion (in 2018), while beine profitable for the past few wears." Brief History of Airbnb Brian Chesky and Joe Gebbia were former classmates from the Rhode Island School of Design, and both landed in California after graduation. In 2007, Gebbia convinced Chesky to move to San Francisco to pursue entrepreneurial endeavors together. Shortly after both had quit their jobs, Gebbia received notice that the rent for their apartment in San Francisco would be raised by 25 percent. Inspired by a previous experience of hosting a complete stranger on an airbed, Gebbia designed a way to make some quick cash. In a now famous e-mail to Chesky, he shared that he wanted to offer their place as a "designer's bed and breakfast" during an upcoming industrial design conference in San Francisco that had sold out of accommodations Soon thereafter, they sent an e-mail to the distribution list for the conference: "If you're heading out to the [industrial design conference) in San Francisco next week and have yet to make accom- modations, well, consider networking in your jam-jams. That's right. For an affordable alternative to hotels in the city, imagine yourself in a fellow design-industry person's home, fresh awake from a snooze on the ol' air mattress, chatting about the day's upcoming events over Pop Tarts and OJ." By renting out three airbeds in their apartment to host design conference attendees for $80 a night, they made some quick cash to subsidize their rent payments. But they had also made a discovery; they could make friends while making rent. Exhibit 1 shows Airbnb's timeline. After talking with friends and family about their own experience as hosts, they realized they had stumbled upon a new business idea: help people rent out their spare rooms. By helping others rent out their spare rooms, they facilitated an exchange via the sharing economy. The sharing economy is a peer-to-peer business model that provides access to resources that would otherwise be too expen- sive to buy or are underused in exchange for a fee-in this case under utilized space in apartments and homes. Gebbia and Chesky decided to test their idea with the 2008 South by Southwest conference (SXSW) in Austin, Texas. This annual music, film, and interactive media conference already served as an informal launch pad for new ventures, for example, Twitter, the social networking and news site, was unveiled at SXSW just a year earlier to great fanfare. In preparation, they recruited Nathan Blecharczyk, Gebbia's former roommate, to design a website that would enable them to target more conference attendees. (Despite a reluctant commitment at the start-Blecharczyk maintained his full-time job and only worked for Airbnb "after hours"-Blecharczyk became a co-founder of Airbnb and was critical to its future success.)? The hoped-for success at SXSW, unfortunately, did not mate- rialize; the Airbnb launch of Air Bedand Breakfast.com flopped with only six hosts and two guests using the platform, one of whom was Chesky. Determined to turn things around, Airbnb built online payments into the booking process. The addition was partly driven by Chesky's own experience with the cumbersome and uncomfortable in-person payment process as a guest at South by Southwest. This also provided the basis for their business model to charge transaction fees by serving as a platform for hosts and guests. Based on customer feedback, Airbnb also soon shifted from event-based listings to general listings. They had reacted to the valuable lessons learned at SXSW, the exchange of money within a person's home was an awkward experience and people were interested in this type of accommodation to travel to places generally, not just to conferences Ready for a larger stage. Airbnb planned on garnering publicity in the summer of 2008 at the Democratic National Convention (DNC) in Denver, Colorado. Through media releases and blogs, Airbnb earned coverage in The New York Times and The Wall Street Journal. The lack of hotel space and increased publicity of the DNC served as the catalyst for their relaunch; approximately 100 rentals were facilitated during the event. Unfortunately, soon afterwards the listings dropped back down, hovering just above zero. To stretch the funds of Airbnb, Chesky and Gebbia leveraged their design backgrounds to create limited editions of politically themed cereals: 500 boxes of "Obama-O's: The breakfast of change." and 500 boxes of "Cap'n McCains: A maverick in every bite." They designed the presidential images onto the boxes and sent samples to the press for media coverage. CNN featured the cereal, and even at $40 a box, the custom political cereals sold out quickly, enabling Airbnb to stay afloat for a few more months. This round of post-DNC funding was necessary to offset the plunge in website traffic that followed the DNC. The other funding source at the time for Airbnb was maxed-out credit cards. Indeed, they used so many different credit cards that the founders kept them in plastic binders ordi narily used to collect baseball cards (Exhibit 2). The fledgling venture's breakthrough came in 2009 when it was accepted into a program run by Y Combinator, a start-up incubator that has spawned famous tech companies such as Dropbox, Reddit, Stripe, and Twitch.tv. In exchange for equity in the new venture, these start-up accelerators provide a small investment fund, office space. mentoring, and networking opportunities with venture capital ists looking to fund the next big thing. This funding and support allowed Airbnb to concentrate on refining their product offering. Empowered by their investors, the co-founders began to make frequent trips to New York City to learn directly from their hosts who were early adopters of their service. After seeing the inferior cell phone quality (low resolution) photographs of the rooms, Chesky rented a professional camera and took pictures himself. Later, Airbnb hired professional photographers to take pictures of the rooms being rented. Providing professional photographs of their listings was a key differentiator that enabled the startup to gain some traction. Although not a first mover in the peer-to-peer rental space, Airbnb, while at Y Combinator, was the first to crack the code that professional photos of available rentals, combined with a sleek website, made all the difference. Gebbia and Chesky used their photoshoot interactions with hosts to un and their use of the platform; they learned that the site took much longer to book a listing and interface with guests than anticipated. Even follow ing implementation of these new insights, they continuously refined Airbnb's web platform. Within one week of making changes to the user interface and adding professional photographs booking fees jumped from $200 per week over six months to $400 per week. The Airbnb founders sle lanenadaniel chat hair avietis ante obtenham hacte The alohaleellation of visitors in New York City enabled this model to quickly take off around the world. By 2010, for tunes had turned, and Airbnb had investors knocking on its doors. Sequoia Capital, a prestigious venture capital firm in Silicon Valley that had previously invested in Apple, Google, Oracle, PayPal. YouTube, and WhatsApp, approached Airbnb to invest Airbnb was taking a cut of some 10 percent on cach transaction on their platform, which now contained professional photos and allowed for a seamless experience between hosts and guests. With the global financial crisis in full swing (by 2010), timing was now much more fortuitous. People were looking for low-cost accommodations while hosts were trying to pay rent or mortgages to keep their homes. In 2017, CFO Laurence Tosi led the acquisition of Luxury Retreats for Airbnb, a high-end rental site for $300 million. Following disagreements between Chesky and Tosi over Airbnb's growth tra jectory, however, Airbnb announced in February 2018 that the CFO would leave Airbnb (Exhibit 3). The two senior executives clashed about the question of when and the preparation of Airbnb to go public (IPO)." Chesky favored a longer time to IPO. The CFO departure remained not the only high-profile executive leaving Airbnb. As of the fall of 2018, the position of Chief Marketing Officer also remained vacant. Since March 2018, Greg Greely, former head of Amazon Prime's member ship unit, has led Airbnb Home, Airbnb's core business. Airbnb Home has since announced options for hotels, luxury properties through Airbnb Plus, and a guest loyalty program called Superguest. Airbnb's Business Model To grow, traditional competitors in the hospitality industry, such as Marriott or Hilton, would need to add additional rooms to their existing stock. To add new hotel room inventory to their chains, they would need to find suitable real estate develop and build a new hotel, furnish all the rooms, and hire and train staff to run the new hotel. This often takes years, not to mention the multimillion dollar upfront investments required and the risks involved In contrast, Airbnb faces no such constraints because it does not own any real estate, nor does it manage any hotels (Exhibit 4). Just like Marriott or Hilton, however, it uses sophisticated pricing and booking systems to allow guests to find a large variety of rooms pretty much anywhere in the world to suit their needs. As a digital platform, Airbnb allows ordinary people to offer rooms directly to any consumer looking for accommodations online. In addition to helping hosts with professional photos of their properties and thus marketing, Airbnb also assists hosts in pricing their properties for varying levels of demand and time of year. Airbnb makes money by taking a cut on every rental transaction through its platform Given that Airbnb faces no real inventory constraints as a digital platform, it can grow much faster than a traditional business, such as Marriott Airbnb's inventory is only limited by its ability to sign up new users with spare rooms for rent. This unlimited potential is combined with no to low costs for adding inventory to the existing online offerings In letting people list their spare rooms on Airbnb as hosts, Chesky and Gebbia created Airbnb as a two-sided platform. With hosts providing properties on one side and guests providing demand on another, Airbnb makes money by taking a portion of rental fees as guests book the host proper ties (about three percent). Also, Airbnb eliminated the pains of person to person transactions by facilitatine the reservation and payment entirely online. Airbnb follows an asset-light approach because it does not own any (rental) properties or real estate, unlike the large physical holdings held by traditional hotel chains. To expand capacity. Airbnb is not restricted by the need to build more properties, whereas a hotel must increase its number of beds to meet increased demand. Instead, Airbnb only needs to ensure that its site remains online and available to satisfy the growing number of guests and hosts. Airbnb's number one source of future hosts are its current guests.?! Initially, staying in an Airbnb property meant experiencing a new destination in someone's home, authentically in the way a local would. By offering properties at a cheaper rate per night compared to hotels, both guests and hosts benefited: price-conscious guests found affordable accommoda tions, while hosts benefited by the extra income earned through renting a spare bedroom Guests exchanged their generic hotel rooms in tourist areas or suburbia for interactions with local hosts and the opportunity to stay in local spaces and neighborhoods. Soon, properties expanded from spare bedrooms to offerings of entire houses, villas, treehouses, and islands complete with cooking staff Through the platform, hosts and guests were able to communicate, while both parties were further empowered by the ability to leave reviews. Guests received reviews from hosts that could impact future stays in Airbnb properties, hosts could view the reviews of a potential guest to ver the guest's behavior. Likewise, guests rated and commented on the properties of hosts, allowing potential guests to gauge if they liked the host in addition to the space they might rent. HOSTS Airbnb allows hosts to list their rooms, whole apartments, or their entire property on the Airbnb platform: from simple bedrooms to manors, and even entire islands." Airbnb provides hosts with a one- million-dollar guarantee for any damages (akin to a temporary homeowner's insurance). The platform rewards and highlights high-performing hosts who consistently carn a 5-star rating from guests as Superhosts, a designation that a mere 7 percent of hosts achieve. Airbnb provides an online marketplace where hosts can list accommodations and guests can browse and book listings. Airbnb aggregates these host listings thereby prompting more users to become guests as they are attracted to the selection and availability of listings. In turn, more hosts list accommodations on Airbnb to gain access to the increasing numbers of guests booking listings. Despite the availability of several other apartment and home online rental platforms such as VRBO, Wimdu, Wunderflats, TempoFLAT, booking.com and so forth, Airbnb hosts are quite loyal or the 5 million homes listed on Airbnb, some 3.5 million (or 70 percent of all hosts) list exclusively on Airbnb, contributing a deep, as well as unique, inventory GUESTS Through verification of licenses. Airbnb screens guests before they can register on the platform. Following a booking request, hosts can accept or reject a guest based on reviews or ratings. This has prompted cases of guests accusing hosts of racial discrimination. For properties listed as "Instabook." the host relinquishes this review-based screening process. While Airbnb hosts offer guests more choices by offering different cancellation plans, fees, ame. nities, and check-in/check-out requirements, a new rewards system is also catering to guests. In 2018. Airbnb introduced the Superguest loyalty program, akin to hotel loyalty programs. Superguest rewards Airbnb guests with free nights or discounts for frequent stays. Although this program is still in development and will not be launched until it is differentiated enough the idea is to include benefits across the Airbnb community including homes, transportation, experiences, and other ser vices. The Superguest program is just one of many ways that Airbnb continually innovates to meet the needs of its consumers and invests in increasing customer loyalty. To develop Superguest, Airbnb's website is asking guests to leave suggestions for desired features. Other improvements include categorizing listings into collections catered to different traveling needs, for example family honeymoon, or work. Through the Airbnb Plus offering, guests can expect a certain level of high quality in their stays because listed homes are subjected to an in-person 100+ point quality inspec tion by Airbnb Expanding Airbnb's Features and Offerings SPLIT PAYMENTS In a December 2016 tweet, Chesky asked "If @Airbnb could launch anything in 2017, what would it be?" In response to top requests, Airbnb launched split payments in November 2017. Over 15.5 million groups took trips using Airbnb the past year ending in November 2017. with an average stay of 3.5 nights. With split payments, the trip organizer does not need to front the entire cost of the stay, only their own, and Airbnb allows 72 hours for the other guests of the group to pay their portions. AUGMENTED AND VIRTUAL REALITY In December 2017. Airbnb announced research and prototypes in mobile technology involving virtual reality and augmented reality in their concepts, guests can use virtual reality to explore any listing, and use augmented reality that recognizes surroundings to provide contextual informa tion, such as translations or thermostat instructions. The idea is to create a virtual "try before you book experience AIRBNB EXPERIENCES Airbnb is also branching out to different segments of the travel market with Experiences to become an end-to-end travel app for a global travel community by leveraging their hosts' local expertise.29 Since Experiences launched in 2017, Airbnb has offered over 4,000 experiences in 50 global loca- tions. Over 1,000 of these Experiences are in the United States. In addition to allowing Airbnb to change from a home rental marketplace to an end-to-end travel company. Experiences offers higher margins for Airbnb, 20 percent of earnings compared to the three percent from Airbnb Homes. At the same time, quality control and the ability to scale quickly remain thorny issues to make Experiences the success Airbnb needs and desires. Some instances of high-profile negative occurrences (e.... "one Airbnb Experience offer consisted of a person yelling at the guests while they collected trash on the beach ***), highlight the pressing need to ensure stronger quality control. While this is done currently in person, the question of scaling up using such labor intensive method remains unanswered. Yet, Airbnb's Experiences is growing ten times faster than Homes, albeit from a much smaller base." Notwithstanding some exceptions, Experiences rate on average much higher than Homes, with more than 90 percent of all Experiences receiving a 5-star rating. In 2018, Airbnb announced a $5 million investment into expanding Experiences locations to 200 in the United States, with intentions to develop Experiences in smaller markets domestically. In addition, Airbnb partnered with Resy to allow guests to book reservations at local restaurants, and Airbnb Experiences allows travelers to book a wide range of activities that are a part of their travel plans though Airbnb, such as truffle hunting in Tuscany or learning how to make sushi in Japan. AIRBNB PLUS In 2018, Airbnb launched a new feature called Airbnb Plus, which created a new, luxury Lier or properties differentiated with 100 plus features such as design, accessibility, and comfort. Over 2.000 of the 5 million properties have been inspected and certified as Airbnb Plus, with a total of 75.000 Airbnb Plus properties planned by the end of 2018, according to Chesky. Hosts will pay $149 for inspection to obtain the Airbnb Plus designation and would, in return, be listed more promi nently on Airbnb's site As Airbnb adds to its offerings. it is embracing a segment that was previously distinct by welcom- ing hotels and traditional bed-and-breakfasts to post on its platform. Although some hotels had already used the platform, the new entrant's leadership is now clearly aligning these offerings as part of Airbnb's strategic direction of becoming a full-service travel company. This is an enticing opportunity for hotels, given the lower commission charged by Airbnb compared to online travel agencies. With over 200,000 rooms in this category already listed, Airbnb is curating listings for its "Boutique offering intended to showcase hotel and hotel-like offerings outside of the large corpo rate hotel chains. GROWING PAINS External factors such as regulation are continuing to create major headwinds for the startup." In 2016, the city of New York strengthened legislation first passed in 2010. It is illegal in New York City to rent out entire apartments in residential blocks for less than 30 days. It remains legal if the renter is living in the apartment at the same time, so true space sharing" is still possible. Fines start at $1,000 for the first offense, rising to $7.500 for repeat offenders. This creates major problems for Airbnb because New York City is by far the largest market for the internet venture, with more than 50,000 accommodations available for rent." In 2018, the city of New York went a step further by suing residential brokerage firms (and some of their individual employees) that used Airbnb in allegedly illegal apartment rental schemes, earning an estimated $20 million." The issue for Airbnb is that about one-third of these listings are from hosts with multiple offerings in the same city. Landlords realized quickly that it is more profitable to convert some apartments into short-term rentals and to offer them via Airbnb than to sign long-term rentals with just one tenant, which often fall under some sort of rent control in New York City. Although this tactic increases the landlord's return on investment and profits, it creates all kinds of negative externali ties. Neighbors complain about noisy tourists partying all night. Some apartments get ransacked or are used for illegal activities such as drug deals and prostitution. New Yorkers expressed their frustration by scrawling on Airbnb posters: "The dumbest person in your building is passing out keys to your front door!" On a more macro level, some argue that Airbnb drives out affordable rental space in many metropolitan cities where apartments are already scarce. Other cities such as Paris. Berlin, and Barcelona face similar problems and passed laws with stiff penalties, fining offenders over $100.000 Hotel chains and resort owners have challenged Airbnb in courts and lobbied local governments, some of which passed regulations to limit or prohibit short-term rentals. Residents in New York, San Francisco, Berlin, Paris, and many other cities are also pressuring local governments to enact more aggressive rules banning short-term rentals because they argue that companies such as Airbnb contribute to a shortage of affordable housing by turning entire apartment complexes into hotels or transforming quiet family neighborhoods into all night, every night party hot spots. Airbnb is also accused of contributing to the speed of gentrification in some metropolitan cities. For proponents of affordable housing, Airbnb has come under scrutiny for raising rents, particu- larly in areas already impacted by rising rental prices." Airbnb argues that their website enables hosts to earn extra income, in turn making their housing more affordable. Research suggests that a 10 percent increase in Airbnb listings leads to a 0.39 percent increase in rents and a 0.64 percent increase in home prices." In 2015, three of the largest landlords in the country entered into discus. sions with Airbnb to allow their apartment tenants to list their rooms on the platform in return for revenue sharing. The three apartment operators own 250,000 units. While many tenants use Airbnb to rent out rooms or entire apartments, most apartment leases prohibit tenants to sublet without permission or at all. In New York City, in particular, Airbnb is blamed for gentrification and rising rent. In a report by the city comptroller's office. Airbnb was blamed for 21.6 percent of the average monthly rent increase from 2009 to 2016. Some argue that the convenience that is provided for renting apart ments to tourists has resulted in less housing available to the full-time renter's market. Despite the 50,000 apartment listings on Airbnb, making New York City its biggest market, Airbnb only accounts for one percent of the apartments in the city. Although multiple listing operators make up only 6 percent of the market, they account for 37 percent of the revenue Acceptance of housing that permits short-term rentals appears to suffer from a generational divide; among renters aged 25 to 34 only Il percent said they would not live in a complex that allowed short-term rentals compared to 32 percent of those 65 years or older. Operating in New York City continues to one Airbnb's biggest challenges While the city of San Francisco will allow registered properties to offer short-term rentals, a fine of $1,000 per day will be the consequence for unregistered properties. Airbnb will regulate by only allowing registered properties to be posted on their website. Veritas Investments, the largest apart- ment landlord of San Francisco with over 5,000 properties, will be allowing tenants to register their properties on the website in a pilot program. Their listings break from the typical Airbnb listing of new buildings owned by institutional landlords by instead offering rent-controlled housing in older buildings. The Veritas Investments pilot provides security to renters and guests alike through a $1 million insurance policy and partnership with Pillow Residential, a startup management company that arranges cleaning and serves as a point of contact for guests. 32 Moreover, in the agreement with the city of San Francisco (and elsewhere). Airbnb collects hotel taxes from each rental and transfers the money to the city. CEO Chesky claims that in 2019 Airbnb is the largest collector of hotel taxes globally." Airbnb in China In 2015, Airbnb announced it was expanding in China, making it potentially the largest market with some 800 million internet users." Airbnb also hopes to grow its number of users by targeting Chinese tourists, whose outbound bookings had risen 700 percent during 2014 making them the fast- est growing market of customers booking stays outside of their home country. Airbnb's expansion is aided by Chinese venture capitalists, China Broadband Capital and Sequoia China. Consistent with other firms wanting to operate in China. Airbnb must comply with Chinese laws. such as governance mandating that data be stored within China. Airbnb localized the product after discoverability issues due to Chinese government censorship ("the Great Firewall") banning sites such as Google, Facebook, and Twitter. Airbnb started by building a 60-person product team in Beijing and rebranded to "Aibiying" (), meaning "welcome each other with love." Airbnb also launched Trips which offered local experience suggestions and integrated Alipay, Alibaba's online payment platform into Airbnb's platform By the end of 2017. more than half of Airbnb China's bookings were paid via Alipay, and roughly 8.6 million Chinese guests used Airbnb when traveling outside of China. The number of homes offered in China on the Airbnb platform has increased from 10.000 in 2015 to over 200.000 in 2019, and some 10 million people use Airbnb in China. According to Chesky, we run our China operations completely decentralized, and are probably one of the most successful U.S. companies in China" and "Millennials will want to go to China, and Airbnb is ready for them." In line with Airbnb's projection of China being their largest origin market by 2020, Airbnb announced $2 million in investment through 2020 for innovative tourism projects in the region." Airbnb, or Aibiying, as they are known in China, has domestic competitors with more reach and listings. Xiaozhu and rival Tajia, encountered that a lack of user education on renting and staying in spare bedrooms is a cultural barrier to many Chinese, especially those who have not stayed with a local in a foreign city. Xiaozhu employs property managers to help new users understand the concept of renting out rooms in a culture where access to one's home is restricted to family, making the idea of random guests uncomfortable for many. to encompass a variety of services and amenities at different costs. Hotel rooms differ from listings on Airbnb, primarily through consistent expectations of amenities. For Airbnb listings, homes and rooms can vary, descriptions might not be accurate, there is no front desk, and owners might leave long lists of instructions. Although offerings such as Airbnb Plus may aim to bridge the gap in terms of quality expectations by ensuring a standard set of amenities, the pools and fitness studio that await guests in hotels are unlikely to make the Airbnb amenity lists that instead guarantees essentials such as highly rated hosts, coffee, fast Wi-Fi, and fully equipped kitchens." Based on revenue, the home rental market is one-fifth the size of the hotel market in the United States, but has been growing faster since 2015.90 In 2017 the rental market was estimated to be approximately $35 billion. The U.S. hotel industry grew 5 percent in 2016 to $151 billion and is expected to experience stabilized growth of approximately 4 percent over the next five years. whereas the online vacation rental market is expected to grow at 7 percent or more. 91.52 Competition TRADITIONAL HOTELS Airbnb's presence in the travel industry had impacted operations of traditional offerings. In response, hotel deals reached a record high in 2015. With Airbnb accounting for 5.4 percent of total room supply in 2016 in an industry where only five hotel operators have a share of greater than 5 percent, hotel chains turned to consolidation as a way to grow and increase their negotiating Power In 2016, the deals trend of 2015 continued as Marriott acquired Starwood Hotels & Resorts for about $13 billion, thereby creating the largest hotel company with 5.700 hotels with more than 11 million rooms in more than 110 countries. Marriott CEO Arne Sorenson had said, 'We think there are real advantages to size." Marriott estimated a synergies savings of $250 million and increased leverage when negotiating with Expedia and other online travel agents. The Marriott International Hotel chain now includes over 30 brands such as luxury hotels: Bulgari Hotels and Resorts, The Ritz-Carlton, St. Regis, and the JW Marriott, while serving the entire price segments in the market with the standard Marriott business hotels, AC Hotels by Marriott, Marriott Courtyard, Marriott Fairfield Inn, and so forth." In 2018, the size and influence of these hotel giants was evident though Marriott's $23 billion. Hilton's $9.70 billion, Hyatt's $4.68 billion. Wyndham $1.7 billion, and IHG'S $1.87 billion in revenue. Because this rate of growth is slowing, with an expected growth of only approximately four per cent through 2023, hotels are focusing on increased spending per guest Hotels are increasingly attracting guests by offering experiences. Marriott International invested in Place Pass, a tour and activity booking startup. The experiences offered compete with Airbnb's Experiences, offering the opportunity for guests to immerse themselves in local activities. Hotels are moving away from a uniform experience and instead transforming to give travelers a taste of local cuisine, artists, and cultural activities. Place Pass is featured on Marriott's mobile app. Marriott plans to use analytics on their app on customer activity to create better recommendations for PlacePass experiences, even when the user is not staying at a Marriott hotel. hotel-like amenities, such as "in-person check-in, fresh linens, luxury toiletries, high-speed Wi-Fi internet and on-demand concierge services through the Oasis properties. Members of the World of Hyatt loyalty program can redeem their points with Oasis. This effort is a part of Hyatt's "The Unbound Collection to integrate Oasis properties into their hotel and resort portfolio." The Hyatt portfolio includes more than 700 properties in more than 50 countries. InterContinental Hotels, owners of the Holiday Inn and Crowne Plaza brands, has over 744,000 rooms worldwide. At the end of 2013, InterContinental Hotels have seen positive returns since Hilton's IPO, along with Marriott, by using an asset-light franchise model with a focus on marketing and sales as well as selling real estate. S With Airbnb on the rise, InterContinental CEO Keith Barr has invested in its technology platform and made acquisitions to fill gaps in its portfolio by expand ing in market niches, such as luxury hotels. ONLINE TRAVEL AGENTS Airbnb is facing increased direct competition through online booking websites now offering non- traditional accommodations, such as apartments and vacation rentals. Booking Holdings, the owner of Priceline, decided to create a special category for alternative accommodations after obtaining the same number of listings as Airbnb. Not different from acquisition-led hotel industry growth, both Expedia and Priceline have jumped into the home rental market with acquisitions of their own thereby expanding their offering of apartments and vacation rentals. In 2015, Expedia bought HomeAway, a vacation rental site with 1.4 million bookable online listings. Those listings are slowly being made available on Expedia.com and Hotels.com. In the first quarter of 2017. Home Away saw an increase of 48 percent in online vacation rental bookings, compared to a year earlier, resulting in $2.7 billion in revenue. Priceline's Booking.com has expanded their vacation rental inventory by 50 percent to 613,000 properties, and 2.5 million listings in 2017. Challenges Safety A range of safety concerns impact the operations and reputation of Airbnb. Following the death of a family due to gas asphyxiation in a property rented through Expedia's HomeAway and VRBO rental services, there is increased public interest in the safety of rental sites." Airbnb reports on safety protections, and while 80 percent of properties do offer smoke detectors, Airbnb does not set this as a requirement Hosts must ultimately inform and decide for themselves The blurred line of responsibility between hosts, guests, and the company is also evident in con- troversies involving sexual assault. In July of 2014, when a mother of a 19-year old host reached out to Airbnb after receiving a frantic call from her son about being locked in an apartment and threat- ened into performing sexual acts, Airbnb did not jump to the rescue but instead provided the mother with contact information to the local Madrid police as the proper channel for her concerns. In July of 2016, Leslie Lapayowker accused her host of sexual assault, filing a lawsuit against Airbnb for failing to conduct a background check to reveal a previous arrest after another Airbnb guest also claimed that she was sexually assaulted by the same host in his Los Angeles studio apartment. Other factors, such as pets, pose an additional threat to guests. In April of 2015, a guest in Salta, Argentina, had an unfortunate encounter with his host's Rottweiler that left him with wounds in his arm that demanded a two-night hospital stay. On its website, Airbnb now outlines its precautions to addressing safety concerns ranging from cmploying analytics in risk scoring preparedness workshops for hosts, secure payments, profiles. secure messaging, and reviews. The platform promotes a global team on 24/7 standby in 11 different languages to support hosts and guests." REGULATION Local governments have been concerned about landlords opting to list on Airbnb instead of having traditional tenants, reducing the available long-term housing." Airbnb contested with lawmakers in New York City in a lawsuit against New York State law ending with fines in December of 2016.12 The law fines Airbnb hosts up to $7.500 for illegally renting out whole apartments for fewer than 30 days. The New York Hotel Trades Council, representing hotel workers, opposes Airbnb from chang. ing the law. Revenue from New York City Airbnb hosts amounted to $1 billion in revenue in 2016. Unlike New York City, New Orleans is a city that has a good relationship with Airbnb. Jointly working on a deal to legalize short-term rentals, Airbnb conceded to share data and register hosts in a law passed at the end of 2016." Airbnb revealed a policy tool chest, a set of guidelines that reflect a cooperative strateey Airbnb used in New Orleans Internationally, Airbnb has faced criticism over housing shortages, negative externalities (such as noise pollution due to partying in short-term rentals), and government regulation, especially in China and Europe. In Berlin, Germany, nearly 8,000 apartments returned to the traditional rental market in 2016 due to strict property laws from the Senate Department for Urban Development and Housing." "The law had fined landlords up to $125,000 for illegally renting out their property for short-term stays. Other European cities such as Amsterdam, Paris, and Barcelona have also pushed back on illegal short-term rentals. DIVERSITY AND CORPORATE SOCIAL RESPONSIBILITY Some Airbnb guests voiced concerns on being discriminated against by hosts who refuse to issue a booking due to race or other characteristics." Airbnb responded by increasing the number of list ines for which customers can instantly book a reservation, rather than requiring the approval of a host. The company further demonstrated its commitment to inclusion and clearly outlined expecta- tions, both legal and social, for hosts in different geographic areas through its "Nondiscrimination Policy: Our Commitment to Inclusion and Respect document. The policy states that hosts that fail to comply to Airbnb's policies risk suspension from the platform." In August of 2017, Airbnb refused to lodge white supremacists in Charlottesville, Virginia. In an interview with The New York Times, Chesky commented. "You're always going to have your own values, but at the root of Airbnb is this idea of acceptance, and anyone who doesn't make people feel accepted, in particular because of the country or culture they're from, what they look like what their orientations are and who they worship, are things that we can't stand for. Last year, we introduced our commu- nity commitment where we made 200 million people attest that they won't discriminate. We're generally not taking political positions except when it violates this commitment, and we felt that white nationalism definitely qualified. From Hurricane Sandy to Hurricane Harvey, Airbnb has offered listings as shelters and offered free lodging through its disaster relief program to those displaced by the disasters. Started in 2012 after Hurricane Sandy, the program has responded to over 90 disasters. Through this offering known as Open Homes, hosts can offer their free space to individuals seeking housing for various reasons including medical stays, refugee housing, and disaster relief. Airbnb supports this initiative by offer ing security to its volunteer hosts through services such as screening, property damage insurance, and 24/7 support and by serving as a platform for partnerships with nonprofits. Chesky's commitment to social responsibility and growth are reflected in the company's approach to growth by staying true to the company's vision of offering "the feeling of belonging and doing so in a way that does not compromise company ethics in exchange for fast growth. While Chesky accepts investor funds, his interest is instead in the greater responsibility to society that the com pany holds. By staying true to his stakeholders over current investors and potential shareholders, Airbnb is reluctant to pursue rapid growth that could jeopardize the unique offering the company provides or negatively impact stakeholders. Instead, he views Airbnb as special kind of community rather than just customers of the platform, or simply transaction partners. Decision Time Given its valuation of $31 billion, Airbnb is under pressure to go public. Despite the co-founders desire to stay private until the time is right," Airbnb is widely expected to go public in the second half of 2019, at the earliest. In doing so, the company seems committed to thinking in the long-term not only for investors but for all of its stakeholders, including their employees, guests, hosts, and local communities. One question that remains, is whether the founding team around Brian Chesky is up for the challenge of managing a publicly traded company In an attempt to redefine the rules, Airbnb is asking that the SEC grant its most loyal hosts the right to be shareholders. By doing so, Airbnb is essentially asking the SEC to recognize hosts as employees. This is an interesting twist given the stance of other sharing economy companies, such as Uber, that have denied responsibility of drivers being employees. Airbnb claims doing so could align hosts with the interests of the company." Finishing his Brooklyn Bridge photo session, Chesky thought about sending the photos to Joe Gebbia and Nathan Blecharczyk Chesky also thought about the slowing growth of guest bookings hindered by regulations, diversity allegations, and trouble expanding in China. What should Airbnb be doing to sustain its growth? How should Airbnb be working with local governments? How should Airbnb be responding to the efforts of Marriott, Expedia, Priceline, and others! In the meantime, the competitors add more home rental listings and guests, as well as local experiences, thereby intensifying competition 2007 2008 2009 Gebbia convinces Chesky to move to San Francisco Email from Gebbia to Chesky with proposed designers bed and breakfast Airbedandbreakfast.com debuts at South by Southwest with only tus bookings Airbed & Breakfast website is launched for the Democratic National Convention and a round of funding is raised through the sale of Obama Os' and Capin McCaini Airbnb in accepted into Y Combinator Airbed & Breakfast rebrands to Airbnb Airbnb receives funding from Sequoia Capital Airbnb launches Instant Book feature Airbnb intraducers sal Host Guarantee Airbub initiaties Open Homes program in response to Hurricane Sandy Airbnb rebrands with Belo lsymbol of belonging image Mother in Madrid reaches out to Airbnb when son contacts her about sexual assault Guest in Argentina is attacked by host's Rottweiler Airbnb announces that it is expanding into China 2010 2012 2014 2015 2016 2017 Guest accuses host of sexual assault alter Airbnb failed to conduct a background check Chesky tweets about possible Airbnb offerings and "Split Payments are born Launch of Airbnb Experiences Airbnb responds to refugee bar with accept campaign Airbnb launches Abying in China 1200M acquisition of Luxury Retreats for Airbnb Airbnb makes announcement about refusing to host white supremacists in Charlottesville, Airbnb partners with Resy to allow guests to book reservations at local restaurants Airbnb announces resarch and prototypes in mobile technology involving VR and AR Airbnb announces : 5M investment into apanding Experiences in the US Airbnb Plus and Airbnb Concerts are launched Announcement that CFO Laurence Tosi will leave hirbnb Announcement of gast loyalty program "Superpost" Airbnb celebrates 10 years 2018

Airbnbs future?

Airbnbs future?