Question: Evaluate the current and quick ratios as a trend analysis (year-over-year) and when compared to the industry averages. What do these numbers tell us about

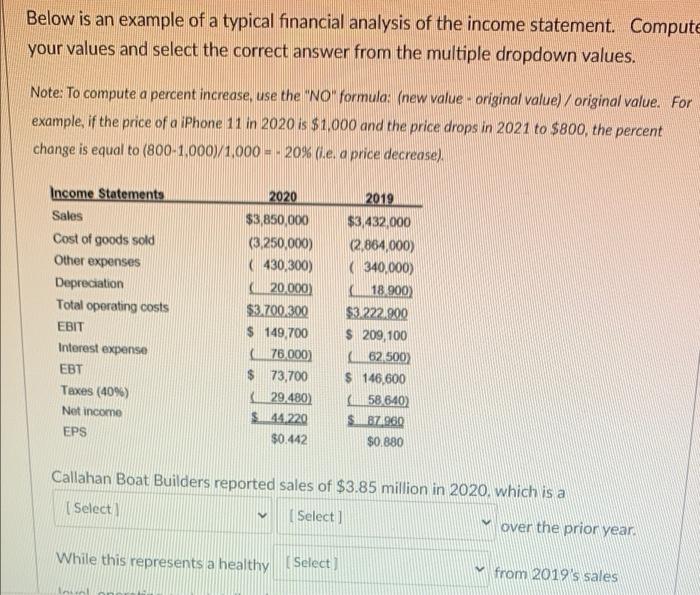

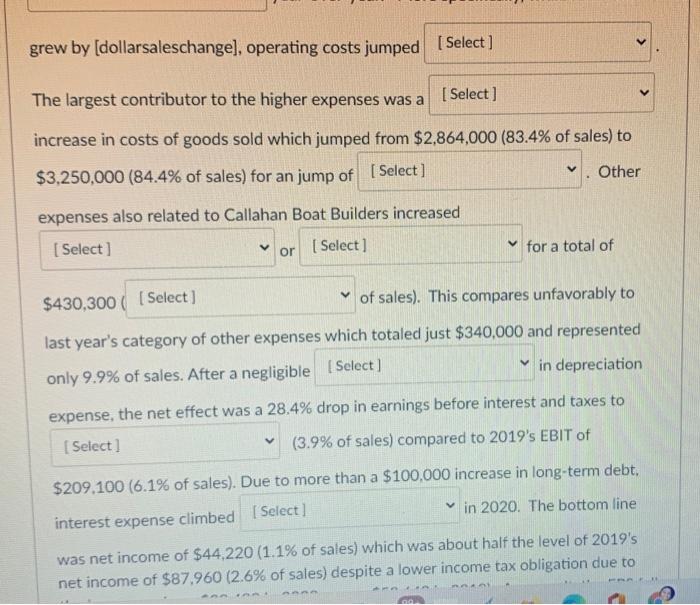

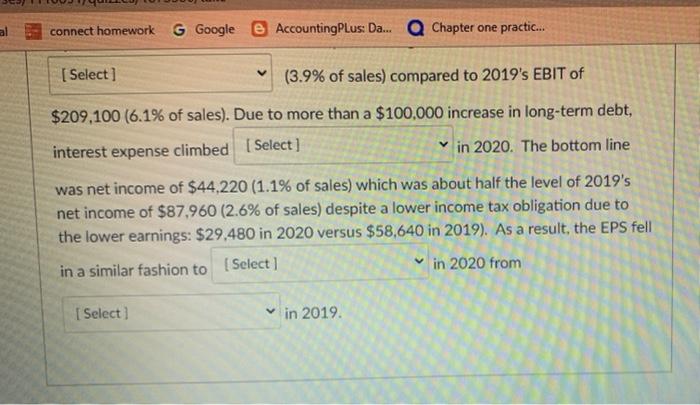

Evaluate the current and quick ratios as a trend analysis (year-over-year) and when compared to the industry averages. What do these numbers tell us about the company's liquidity position? Please use the current and prior period numbers in your analysis as well as the industry averages. Use my explanation (available after the first attempt) to GUIDE your answers fo your second (and final) attempt but use your own words. My comments serve as a general overview only and are not provided to be "your" answer. To maximize points, proofread carefully and demonstrate to the reader that you understand the material with originality. Edit View Insert Format Tools Table 12pt Paragraph B I V Ave Tv : 99 EE Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) original value. For example, if the price of a iPhone 11 in 2020 is $1.000 and the price drops in 2021 to $800, the percent change is equal to (800-1,000/1.000 - - 20% (e. a price decrease). Income Statements Sales Cost of goods sold Other expenses Depreciation Total operating costs EBIT Interest expense EBT Taxes (40%) Net income 2020 $3,850,000 (3.250,000) (430,300) ( 20.000) $3.700.300 $ 149,700 76 000) 73,700 29,480) S144.220 $0.442 2019 $3,432,000 (2.864,000) (340,000) 18 900) $3.222.900 $ 209,100 (62.500) $ 146,600 (58 640) S87960 $0.880 EPS Callahan Boat Builders reported sales of $3.85 million in 2020, which is a (Select Select] over the prior year. V While this represents a healthy Select) from 2019's sales WALA grew by (dollarsaleschange), operating costs jumped [Select] The largest contributor to the higher expenses was a [ Select) increase in costs of goods sold which jumped from $2,864,000 (83.4% of sales) to $3,250,000 (84.4% of sales) for an jump of [Select) . Other expenses also related to Callahan Boat Builders increased [Select] [ Select] V or for a total of $430,300 ( [Select) of sales). This compares unfavorably to last year's category of other expenses which totaled just $340,000 and represented only 9.9% of sales. After a negligible [ Select) in depreciation expense, the net effect was a 28.4% drop in earnings before interest and taxes to [Select) (3.9% of sales) compared to 2019's EBIT of $209,100 (6.1% of sales). Due to more than a $100,000 increase in long-term debt. interest expense climbed [Select) in 2020. The bottom line was net income of $44,220 (1.1% of sales) which was about half the level of 2019's net income of $87.960 (2.6% of sales) despite a lower income tax obligation due to connect homework G Google AccountingPlus: Da... Q Chapter one practic... [Select] (3.9% of sales) compared to 2019's EBIT of $209,100 (6.1% of sales). Due to more than a $100,000 increase in long-term debt, interest expense climbed [Select] in 2020. The bottom line was net income of $44,220 (1.1% of sales) which was about half the level of 2019's net income of $87,960 (2.6% of sales) despite a lower income tax obligation due to the lower earnings: $29.480 in 2020 versus $58,640 in 2019). As a result, the EPS fell in a similar fashion to [Select] in 2020 from [ Select in 2019. Evaluate the current and quick ratios as a trend analysis (year-over-year) and when compared to the industry averages. What do these numbers tell us about the company's liquidity position? Please use the current and prior period numbers in your analysis as well as the industry averages. Use my explanation (available after the first attempt) to GUIDE your answers fo your second (and final) attempt but use your own words. My comments serve as a general overview only and are not provided to be "your" answer. To maximize points, proofread carefully and demonstrate to the reader that you understand the material with originality. Edit View Insert Format Tools Table 12pt Paragraph B I V Ave Tv : 99 EE Below is an example of a typical financial analysis of the income statement. Compute your values and select the correct answer from the multiple dropdown values. Note: To compute a percent increase, use the "NO" formula: (new value - original value) original value. For example, if the price of a iPhone 11 in 2020 is $1.000 and the price drops in 2021 to $800, the percent change is equal to (800-1,000/1.000 - - 20% (e. a price decrease). Income Statements Sales Cost of goods sold Other expenses Depreciation Total operating costs EBIT Interest expense EBT Taxes (40%) Net income 2020 $3,850,000 (3.250,000) (430,300) ( 20.000) $3.700.300 $ 149,700 76 000) 73,700 29,480) S144.220 $0.442 2019 $3,432,000 (2.864,000) (340,000) 18 900) $3.222.900 $ 209,100 (62.500) $ 146,600 (58 640) S87960 $0.880 EPS Callahan Boat Builders reported sales of $3.85 million in 2020, which is a (Select Select] over the prior year. V While this represents a healthy Select) from 2019's sales WALA grew by (dollarsaleschange), operating costs jumped [Select] The largest contributor to the higher expenses was a [ Select) increase in costs of goods sold which jumped from $2,864,000 (83.4% of sales) to $3,250,000 (84.4% of sales) for an jump of [Select) . Other expenses also related to Callahan Boat Builders increased [Select] [ Select] V or for a total of $430,300 ( [Select) of sales). This compares unfavorably to last year's category of other expenses which totaled just $340,000 and represented only 9.9% of sales. After a negligible [ Select) in depreciation expense, the net effect was a 28.4% drop in earnings before interest and taxes to [Select) (3.9% of sales) compared to 2019's EBIT of $209,100 (6.1% of sales). Due to more than a $100,000 increase in long-term debt. interest expense climbed [Select) in 2020. The bottom line was net income of $44,220 (1.1% of sales) which was about half the level of 2019's net income of $87.960 (2.6% of sales) despite a lower income tax obligation due to connect homework G Google AccountingPlus: Da... Q Chapter one practic... [Select] (3.9% of sales) compared to 2019's EBIT of $209,100 (6.1% of sales). Due to more than a $100,000 increase in long-term debt, interest expense climbed [Select] in 2020. The bottom line was net income of $44,220 (1.1% of sales) which was about half the level of 2019's net income of $87,960 (2.6% of sales) despite a lower income tax obligation due to the lower earnings: $29.480 in 2020 versus $58,640 in 2019). As a result, the EPS fell in a similar fashion to [Select] in 2020 from [ Select in 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts