Question: Evaluating cash flows with the NPV method The net present value (NPV) rule is considered one of the most common and preferred criteria that generally

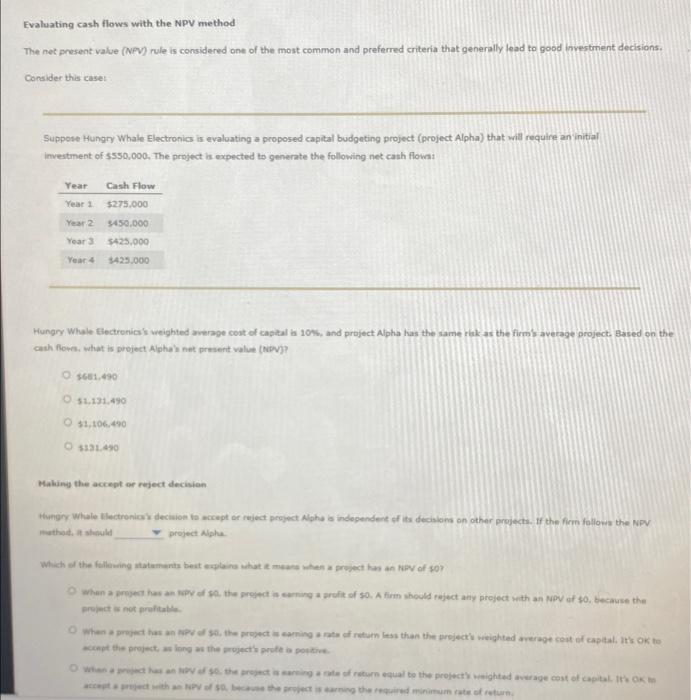

Evaluating cash flows with the NPV method The net present value (NPV) rule is considered one of the most common and preferred criteria that generally lead to good investment decisions. Consider this case Suppose Hungry Whale Electronics is evaluating a proposed capital budgeting project (project Alpha) that will require an initial investment of $550.000. The project is expected to generate the following net cash flowns Year Year Cash Flow $275.000 3450,000 Year 2 Years $425,000 Year 3425.000 Hungry Whale Electronics's weighted average cost of capital ia 10%, and project Alpha has the same risks the firm average project. Based on the cash flows what is project Alpha's not present value (NO) $651.490 51.131.490 $1,106.490 3131.490 Making the accept or reject decision Hungry Whaletlectronica's decision to accept or reject project Alpha is independent of its decisions on other projects. If the fem follows the NPV the should project Alpha Which of the following statements besteht me when a project has an NPV of 507 when a projects and so the project is coming a profit of $0. A fim should reject any project with an NDV of so because the et notre when project has the project is caring return less than the project's weighted werage cost of capital. It OK It's cept the projects long as the project's put a po so there is no return equal to the project wighted average cost of capital OK

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts