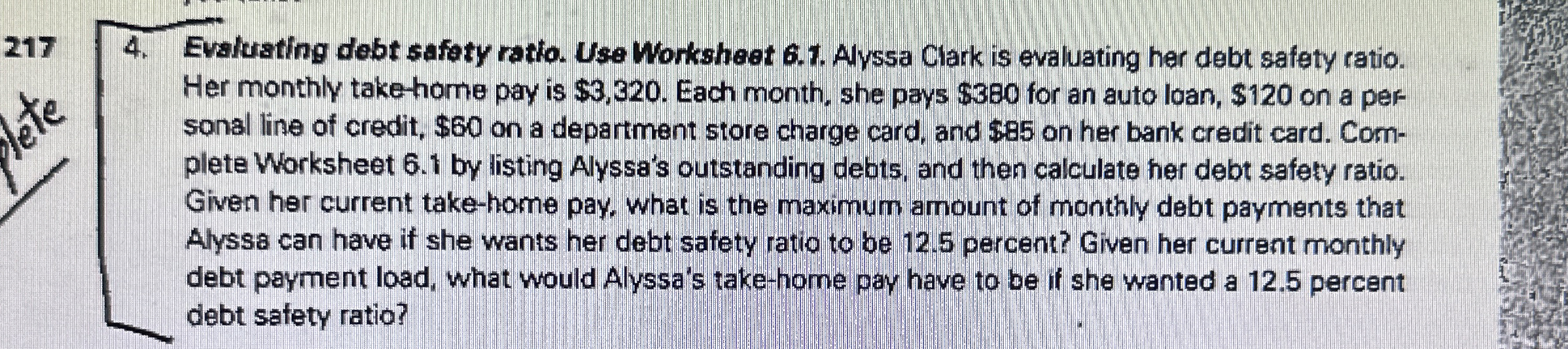

Question: Evaluating debt safety ratio. Use Worksheet 6 . 1 . Alyssa Clark is evaluating her debt safety catio. Her monthly take - home pay is

Evaluating debt safety ratio. Use Worksheet Alyssa Clark is evaluating her debt safety catio.

Her monthly takehome pay is $ Each month, she pays $ for an auto loan, $ on a per

sonal line of credit, $ on a department store charge card, and $ on her bank credit card. Com

plete Worksheet by listing Alyssa's outstanding debts, and then calculate her debt safety ratio.

Given her current takehome pay, what is the maximum amount of monthly debt payments that

Alyssa can have if she wants her debt safety ratio to be percent? Given her current monthly

debt payment load, what would Alyssa's takehome pay have to be if she wanted a percent

debt safety ratio?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock