Question: Evaluating Four Alternative Inventory Methods Based on Income and Cash Flow (AP7-2) At the end of January of the current year, the records of Donner

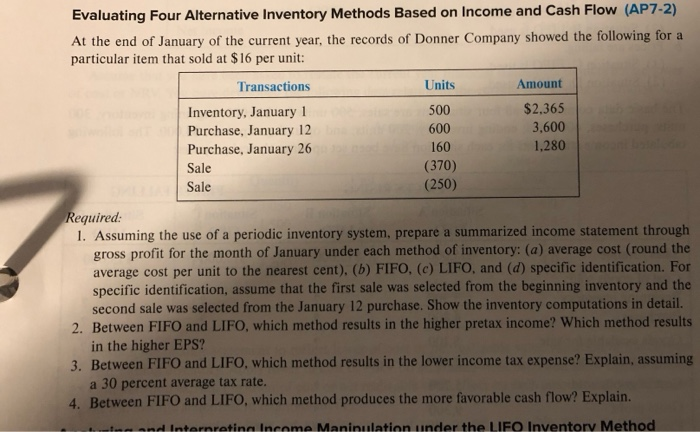

Evaluating Four Alternative Inventory Methods Based on Income and Cash Flow (AP7-2) At the end of January of the current year, the records of Donner Company showed the following for a particular item that sold at $16 per unit: Amount Units Transactions $2.365 500 Inventory, January 1 Purchase, January 12 Purchase, January 26 3,600 600 1,280 160 (370) Sale (250) Sale Required 1. Assuming the use of a periodic inventory system, prepare a summarized income statement through gross profit for the month of January under each method of inventory: (a) average cost (round the average cost per unit to the nearest cent), (b) FIFO, (c) LIFO, and (d) specific identification. For specific identification, assume that the first sale was selected from the beginning inventory and the second sale was selected from the January 12 purchase. Show the inventory computations in detail. 2. Between FIFO and LIFO, which method results in the higher pretax income? Which method results in the higher EPS? 3. Between FIFO and LIFO, which method results in the lower income tax expense? Explain, assuming a 30 percent average tax rate. 4. Between FIFO and LIFO, which method produces the more favorable cash flow? Explain. ring and Internreting Income Maninulation under the LIFO Inventory Method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts