Question: On March 1,2020, quinto mining inc, issued a 520,000, 10%, three year bond. interest payable semiannually beginning september 1,2020 Using the effective interest method, prepare

On March 1,2020, quinto mining inc, issued a 520,000, 10%, three year bond. interest payable semiannually beginning september 1,2020

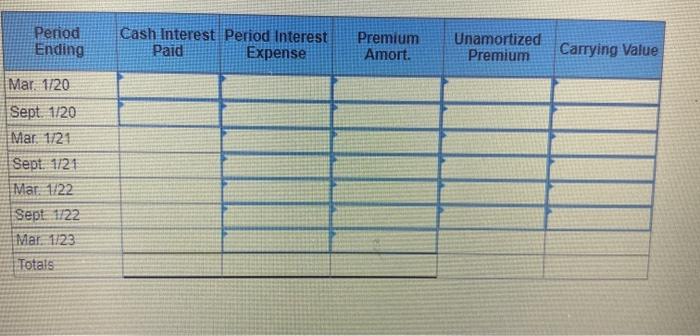

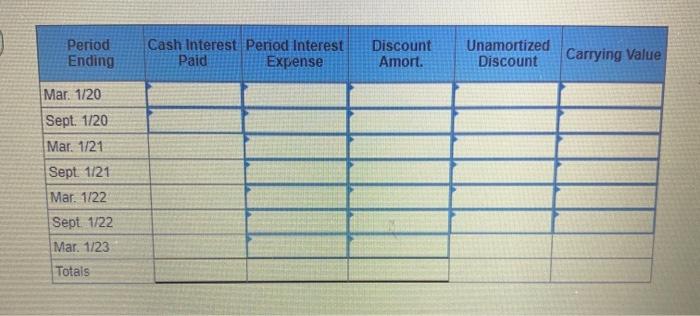

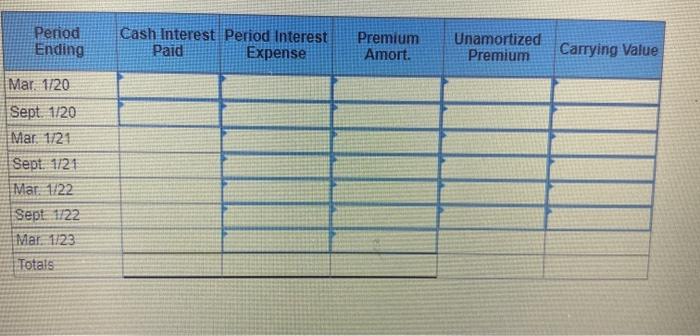

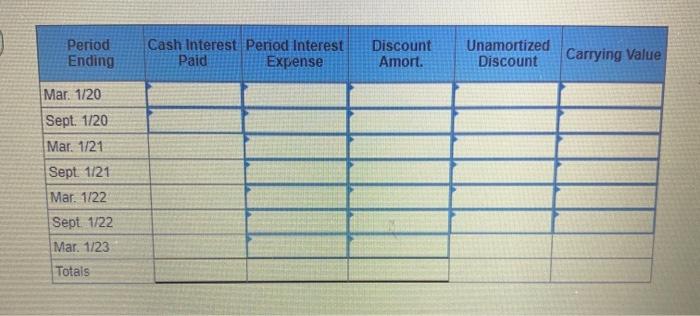

Using the effective interest method, prepare an amortization schedule

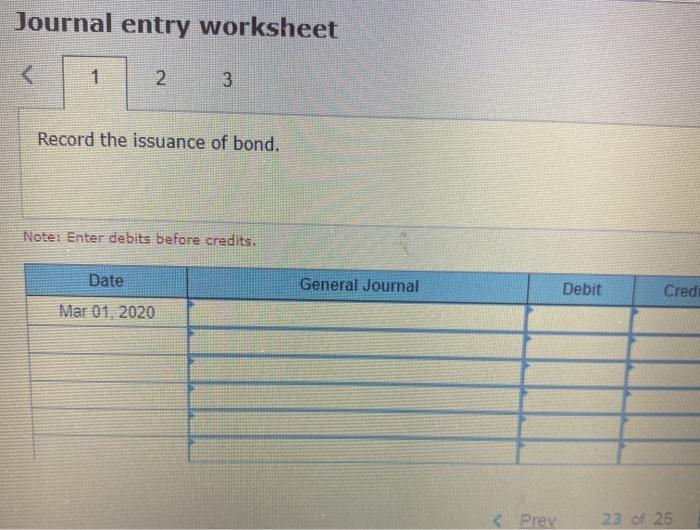

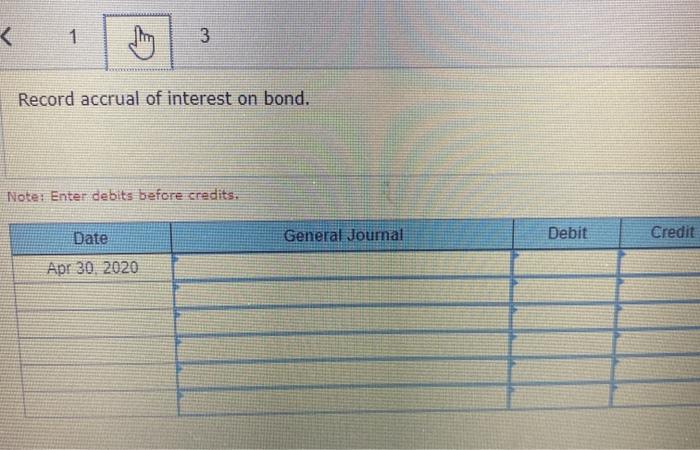

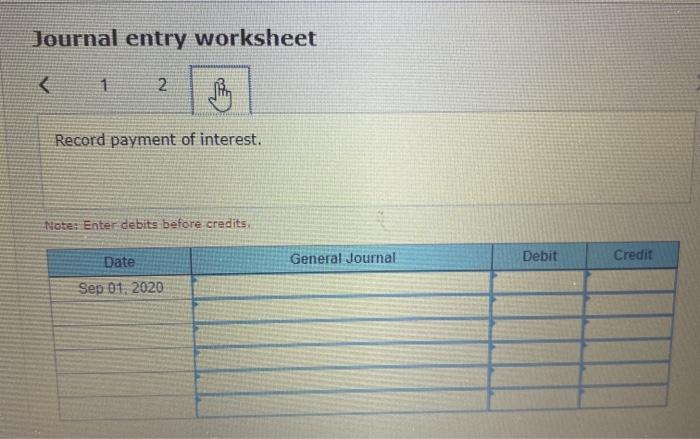

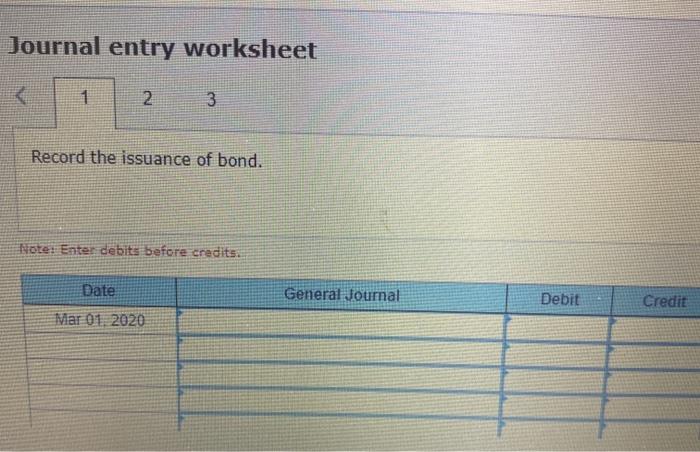

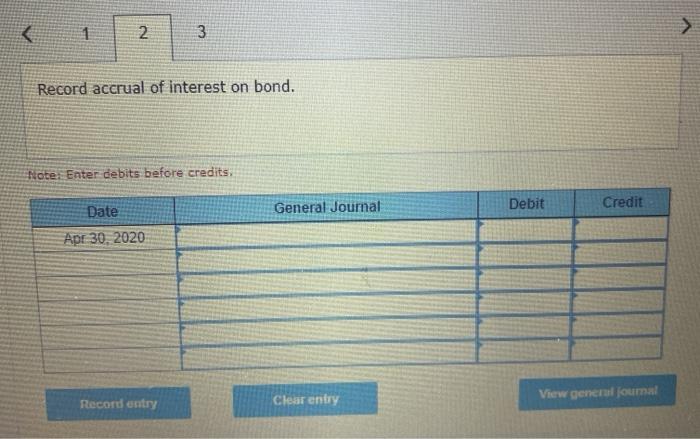

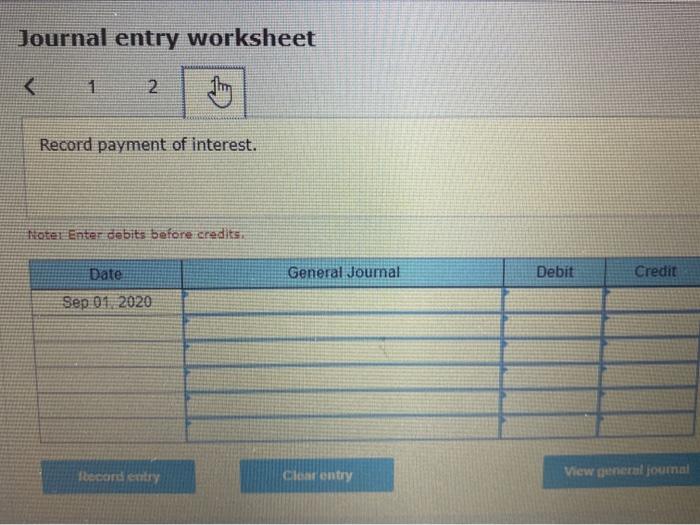

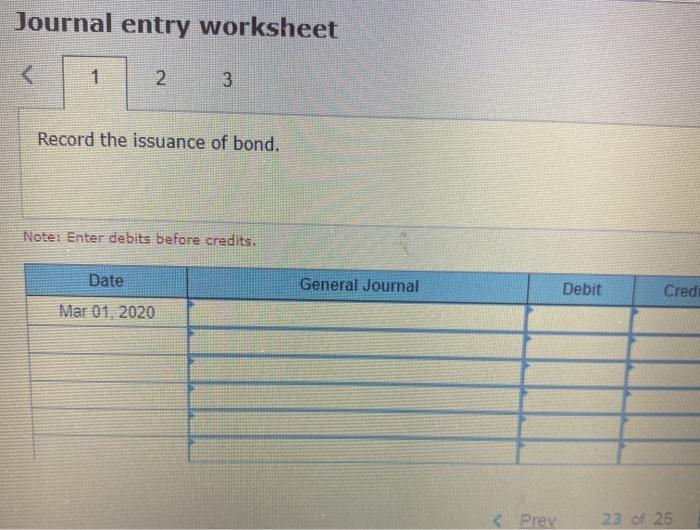

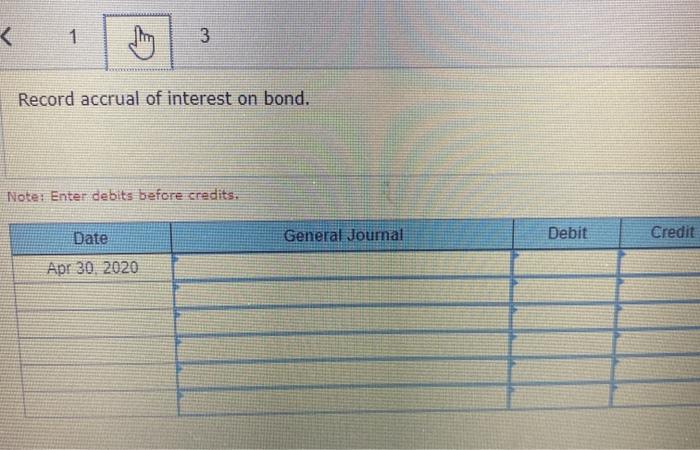

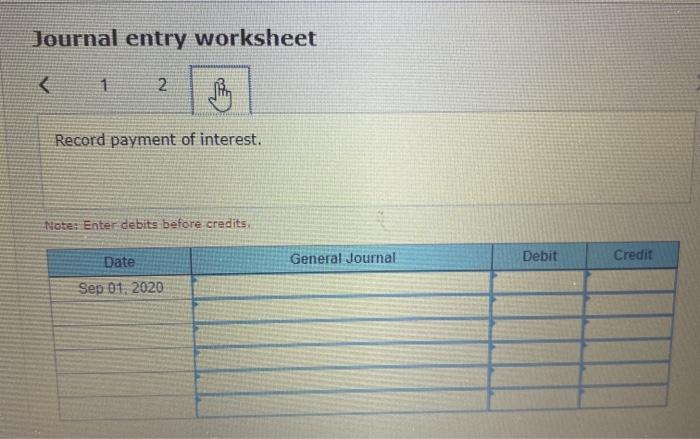

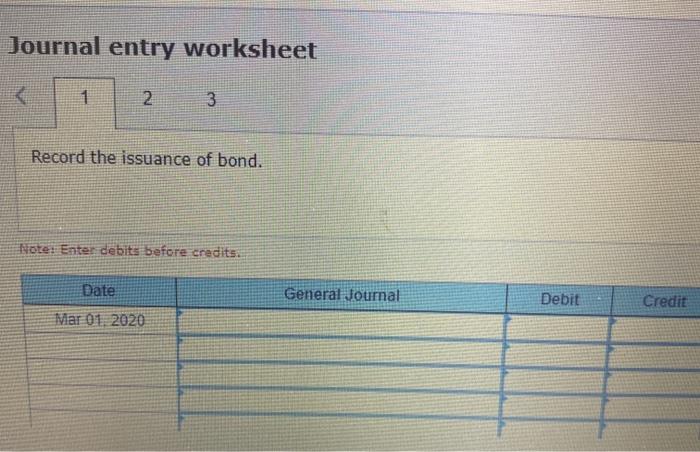

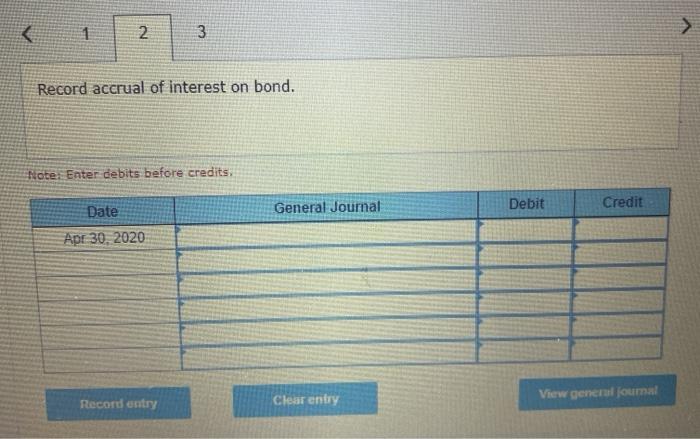

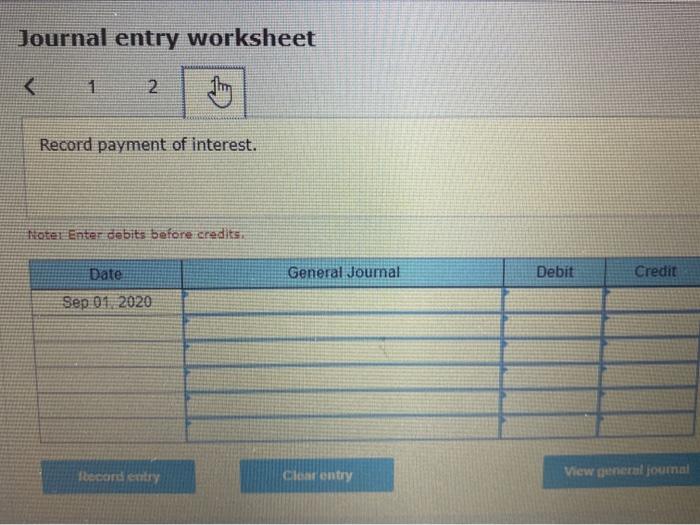

Record the entries for the issuance of the bond on march 1, the adjusting entry to accrue bond interest and related amortization on april 30,2020. Quintos year end, and the payment of interest on september 1,2020

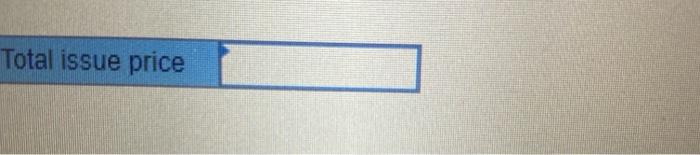

Calculate the bond issue price assuming a market interest rate of 11% on the date of issue

Using the effective interest method, prepare an amortization schedule

Record the entries for the issuance of the bond march 1; the adjusting entry to accrue bond interest and related amortizarion on april 30,2020. Quintod year-end and the payment of interest on september 1,2020

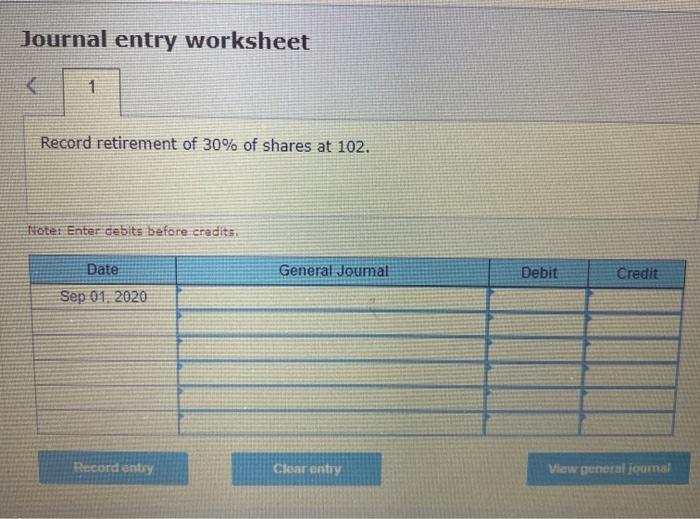

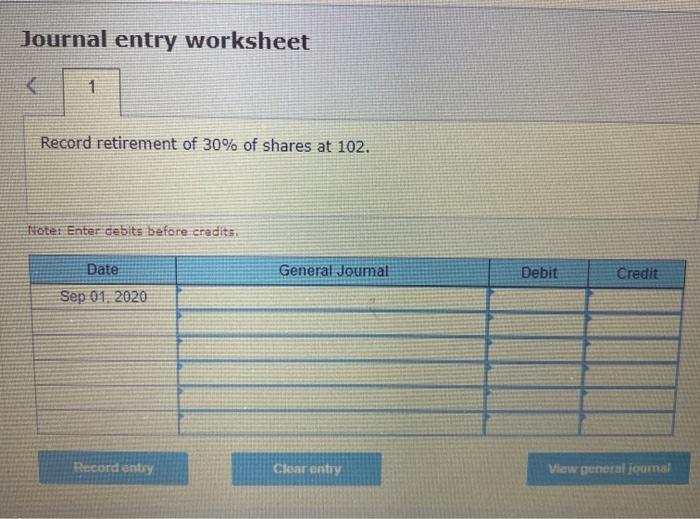

Record the entries for the retirement of 30% of the bonds at 102, on september 1,2020 after the interest payment

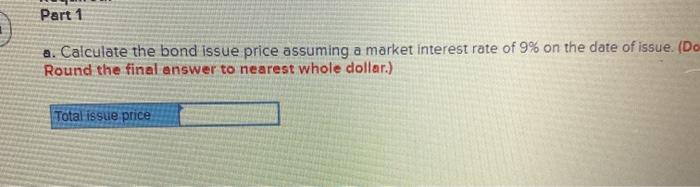

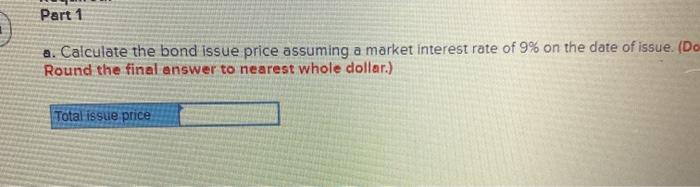

Part 1 a. Calculate the bond issue price assuming a market interest rate of 9% on the date of issue. (Do Round the final answer to nearest whole dollar.) Total issue price Period Ending Cash Interest Period Interest Paid Expense Premium Amort. Unamortized Premium Carrying Value Mar. 1/20 Sept. 1/20 Mar. 1/21 Sept. 1/21 Mar. 122 Sept. 1722 Mar. 1723 Totals Journal entry worksheet 1 2 3 Record the issuance of bond. Note: Enter debits before credits. Date General Journal Debit Credi Mar 01, 2020

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock