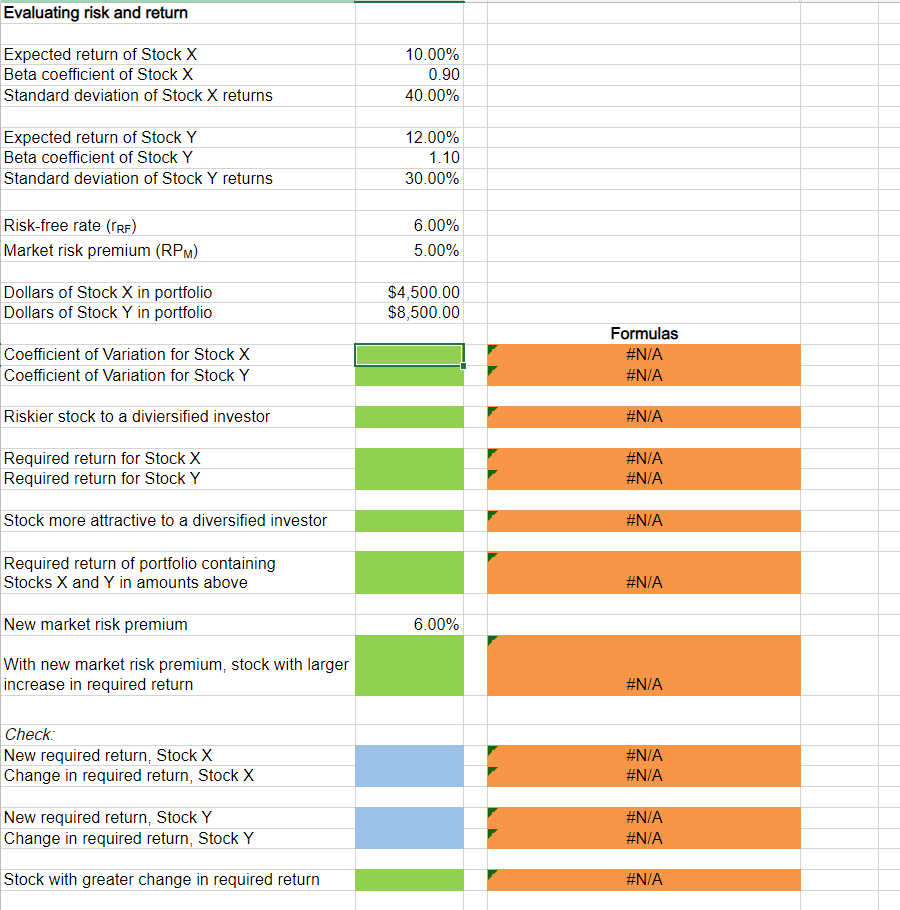

Question: Evaluating risk and return Expected return of Stock X Beta coefficient of Stock X Standard deviation of Stock X returns 10.00% 0.90 40.00% Expected return

Evaluating risk and return Expected return of Stock X Beta coefficient of Stock X Standard deviation of Stock X returns 10.00% 0.90 40.00% Expected return of Stock Y Beta coefficient of Stock Y Standard deviation of Stock Y returns 12.00% 1.10 30.00% Risk-free rate (RF) Market risk premium (RPM) 6.00% 5.00% Dollars of Stock X in portfolio Dollars of Stock Y in portfolio $4,500.00 $8,500.00 Coefficient of Variation for Stock X Coefficient of Variation for Stock Y Formulas #N/A #N/A Riskier stock to a diviersified investor #N/A Required return for Stock X Required return for Stock Y #N/A #N/A Stock more attractive to a diversified investor #N/A Required return of portfolio containing Stocks X and Y in amounts above #N/A New market risk premium 6.00% With new market risk premium, stock with larger increase in required return #N/A Check: New required return, Stock X Change in required return, Stock X #N/A #N/A New required return, Stock Y Change in required return, Stock Y #N/A #N/A Stock with greater change in required return #N/A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts