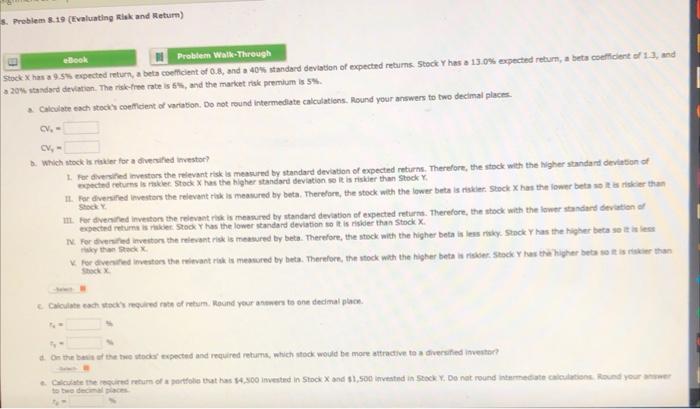

Question: . Problem 8.19 (Evaluating Risk and Return) ebook Problem Walk-Through Stock X has a 9. expected return, a beta coefficient of 0.8, and 40 standard

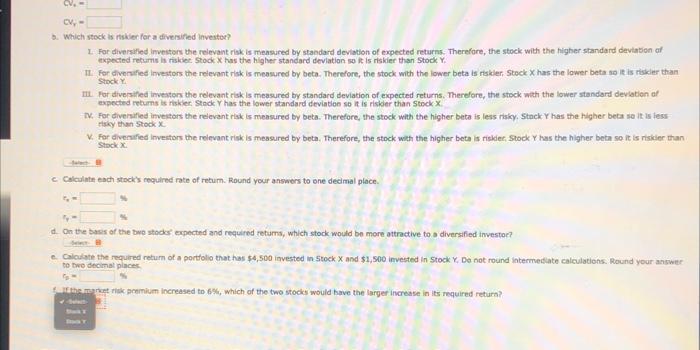

. Problem 8.19 (Evaluating Risk and Return) ebook Problem Walk-Through Stock X has a 9. expected return, a beta coefficient of 0.8, and 40 standard deviation of expected returns Stock has a 13.0% expected return, abesconto 1, and 20% dard deviation. The risk-free rates and the market risk premium is Calculate each stock confident of varon. Do not round Intermediate calculations. Round your answers to two decimal places CV. - CV- Which stock is for a diversified investor 1. Per diversited Investors the relevant risk is measured by standard deviation of expected returns. Therefore, the stock with the higher standard deviation of ected returns is met Stock X has the higher standard deviation so it is rider than Stock I ordered travestors the relevant rok is measured by beta. Therefore, the stock with the lower Detais riskler Stock X has the lower betaler than m. for diversified investon the relevant med by standard deviation of expected returna. Therefore, the stock with the lower standard deviation expected returnere Stock has the lower standard deviation so tissier than Stock x I for diverse investors the relevant risk is measured by bets. Therefore, the stock with the higher betalerky Stack has the higher bets seis y thank per diverted investors the event ke menuired by het. Therefore, the stock with the higher betalersker Shock Y as the higher bete soit le than Cuired rate of retum. Round your awers to one decimal phen On the other the stock expected and required returns, which took would be more attractive to a diversified investor Chequired return of portfolio tathas 14.300 invested in Stock and $1,500 invested in Stock Y. Do not round match consund your to the deca CV. CV- b. Which stock is riskler for a diversified Investor I for diversified Investors the relevant risk is measured by standard deviation of expected returns. Therefore, the stock with the higher standard deviation of expected returns is risicie Stock X has the higher standard deviation so it is niskier than Stock Y. TL for diversified Investors the relevant risk is measured by beto. Therefore, the stock with the lower beta is riskler, Stock X has the lower beta so it is iskier than Stock TIL. For diversified investors the relevant risk is measured by standard deviation of expected returns. Therefore, the stock with the lower standard deviation of expected returns is riskler Stack Y has the lower standard deviation so it is riskler than Stock X t. For diversified investors the relevant risk is measured by beta. Therefore, the stock with the higher beta is less risky Stock Y has the higher beta so it is less sky than stock For diversified investors the relevant risk is measured by beta. Therefore, the stock with the higher betalis riskier. Stok Y has the higher beta so it is nisikier than c Calculate each stock's required rate of retum. Round your answers to one decimal place. On the basis of the two stocks expected and required retums, which stock would be more attractive to a diversified investor? Calculate the required return of a portfolio that has $4,500 invested in Stock X and $1,500 invested in Stock Y. De not round intermediate calculations. Round your answer to two decimal places Berriak premium increased to 6%, which of the two stocks would have the larger increase in its required retur

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts