Evans Inc. had the following activities during 20X5: Direct materials used Indirect materials used Direct manufacturing...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

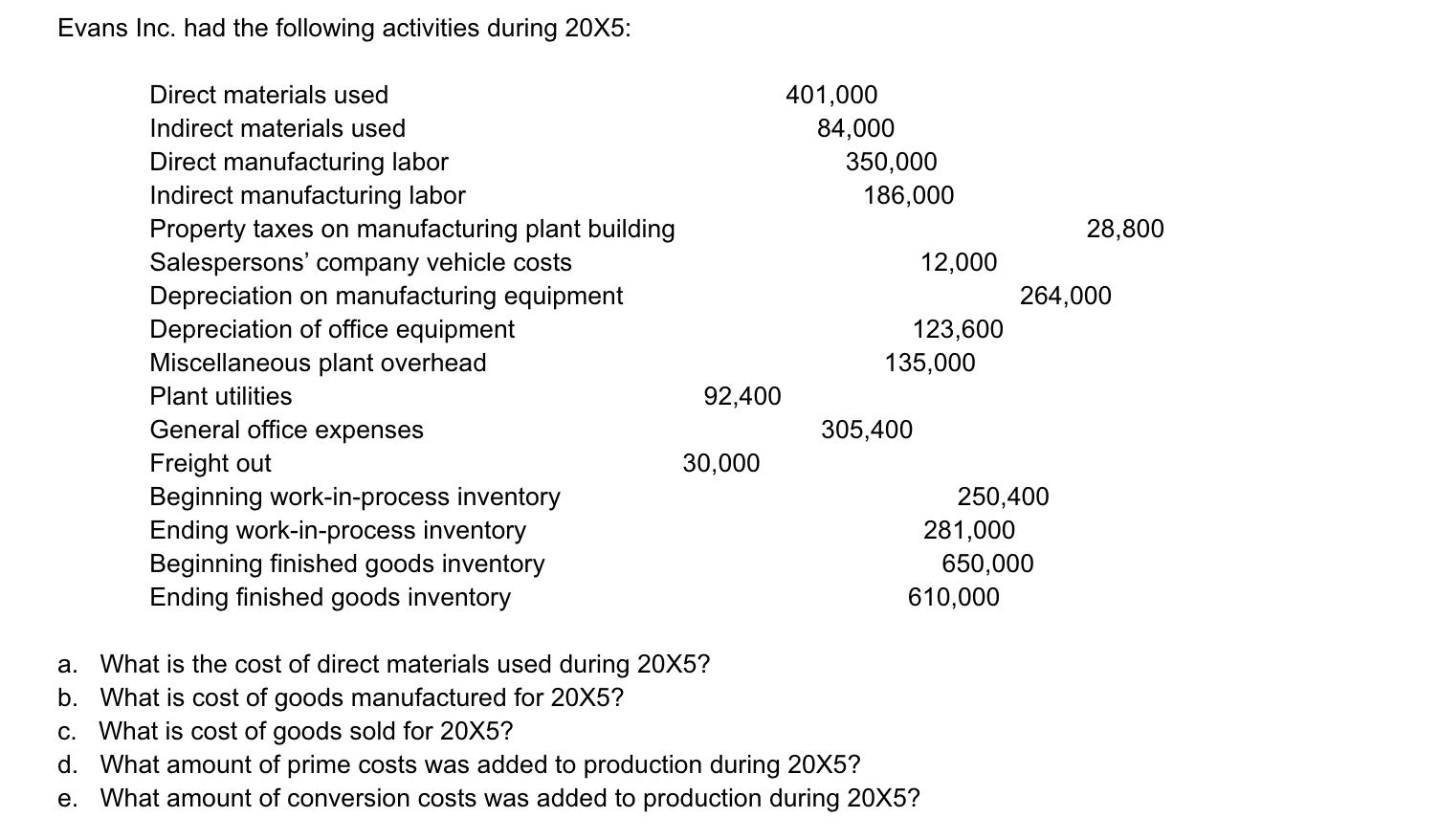

Evans Inc. had the following activities during 20X5: Direct materials used Indirect materials used Direct manufacturing labor Indirect manufacturing labor Property taxes on manufacturing plant building Salespersons' company vehicle costs Depreciation on manufacturing equipment Depreciation of office equipment Miscellaneous plant overhead Plant utilities General office expenses Freight out Beginning work-in-process inventory Ending work-in-process inventory Beginning finished goods inventory Ending finished goods inventory 92,400 30,000 401,000 84,000 350,000 186,000 123,600 12,000 135,000 305,400 a. What is the cost of direct materials used during 20X5? b. What is cost of goods manufactured for 20X5? c. What is cost of goods sold for 20X5? d. What amount of prime costs was added to production during 20X5? e. What amount of conversion costs was added to production during 20X5? 250,400 281,000 610,000 264,000 650,000 28,800 Evans Inc. had the following activities during 20X5: Direct materials used Indirect materials used Direct manufacturing labor Indirect manufacturing labor Property taxes on manufacturing plant building Salespersons' company vehicle costs Depreciation on manufacturing equipment Depreciation of office equipment Miscellaneous plant overhead Plant utilities General office expenses Freight out Beginning work-in-process inventory Ending work-in-process inventory Beginning finished goods inventory Ending finished goods inventory 92,400 30,000 401,000 84,000 350,000 186,000 123,600 12,000 135,000 305,400 a. What is the cost of direct materials used during 20X5? b. What is cost of goods manufactured for 20X5? c. What is cost of goods sold for 20X5? d. What amount of prime costs was added to production during 20X5? e. What amount of conversion costs was added to production during 20X5? 250,400 281,000 610,000 264,000 650,000 28,800

Expert Answer:

Answer rating: 100% (QA)

a The cost of direct materials used during 20X5 is 401000 b To calculate the cost of goods manufactured for 20X5 we need to add up the total manufactu... View the full answer

Related Book For

Financial and Managerial Accounting the basis for business decisions

ISBN: 978-0078111044

16th edition

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello

Posted Date:

Students also viewed these finance questions

-

Star Videos, Inc., produces short musical videos for sale to retail outlets. The company's balance sheet accounts as of January 1 are given below. Because the videos differ in length and in...

-

The Pacific Manufacturing Company operates a job-order costing system and applies overhead cost to jobs on the basis of direct labor cost. In computing an overhead rate for the year, the companys...

-

Brooks Corporation uses a job-order costing system to apply manufacturing costs to jobs. The company closes its under applied or over applied overhead to cost of goods sold. Its balance sheet on...

-

On November 1, 2021, Sadie's borrows $230,000 from a local bank and signs a note. The note requires interest to be paid annually beginning on August 1, 2022 at 12%. Principal and interest are due in...

-

List the errors you find in the following partial balancesheet: Kraftmaid Company Balance Sheet December 31, 2007 Assets Total current assets $597,500 Replacement Accumulated Book Cost Depreciation...

-

The reaction A + B 2C takes place in an unsteady CSTR. The feed is only A and B in equimolar proportions. Which of the following sets of equations gives the correct set of mole balances on A, B, and...

-

We consider automobile injury claims data using data from the Insurance Research Council (IRC), a division of the American Institute for Chartered Property Casualty Underwriters and the Insurance...

-

1. Why did the Iowa Supreme Court rule in favor of the criminal intruder, Katko? 2. What classes of people other than intruders are of concern to the courts in cases like Katko? 3. A businessman in...

-

A telephone manufacturer produced and sold 2 0 0 0 telephones and made a net income of $ 7 0 , 0 0 0 last year, with total revenues of $ 5 0 0 , 0 0 0 . The manufacturer s break - even volume is 1 2...

-

Sayaka Tar and Gravel Ltd. operates a road construction business. In its first year of operations, the company obtained a contract to construct a road for the municipality of Cochrane West, and it is...

-

XYZ Inc. invested $500,000 to help fund a company expansion project scheduled for five years from now. How much additional money will they have five years from now if they can earn 7% rather than 6%...

-

Table 1 shows the demand schedule for Lins Fortune Cookies. Calculate Lins marginal revenue for each quantity demanded. Compare Lins marginal revenue and price. In what type of market does Lins...

-

The affect of the earth plane is to slightly increase the capacitance, and as the line height increases, the effect of earth becomes negligible. (a) True (b) False

-

A circle with diameter \(D\) in. \(=1000 D\) mil \(=d\) mil has an area of \(c\) mil.

-

Considering lines with neutral conductors and earth return, the effect of earth plane is accounted for by the method of conducting earth plane. with a perfectly

-

For a completely transposed three-phase line that has balanced positivesequence voltages, the total reactive power supplied by the three-phase line, in var, is given by \(\mathrm{Q}_{\mathrm{C} 3}=\)...

-

The rectangular block is a solid with rectangular cutouts. Use composite shapes to determine the x, y, and z locations of the centroid. 1.5 in. 2 in. X Z 2.5 in. 2 in. The x location of the centroid...

-

White Bolder Investments (WBI) You are an intern working for WBI, a large investment advisory services in Sydney. Among other regular customers, WBI has been providing advisory services for Jumbo...

-

Distinguish between corporations and partnerships in terms of the following characteristics: a. Owners liability for debts of the business. b. Transferability of ownership interest. c. Continuity of...

-

The following items were taken from the accounting records of Minnesota Satellite Telephone Corporation (MinnSat) for the year ended December 31, 2011 (dollar amounts are in thousands): Accounts...

-

How do dividends affect owners equity? Are they treated as a business expense? Explain.

-

For the finite square well potential, prove the formula for the transmission coefficient (7.83), calculate \(R\), and prove that \(|R|^{2}+T=1\). Equation 7.83:- T = |S|2 K3 = 42 2(+)2 cos KL + (2 +...

-

The data in Table 1 represent the first exam score of 10 students enrolled in Introductory Statistics. Treat the 10 students as a population. (a) Compute the population mean. (b) Find a simple random...

-

Consider an asymmetric potential barrier, with Calculate the tunneling probability \(T\) for energy \(U_{1} U_{0}\). 0, x < 0 U(x) = U> U, 0 < x 0, x > L. (7.96)

Study smarter with the SolutionInn App