Question: Event Risk and Project Evaluation: Consider a foreign project in with the following expected free cash flows. [ begin{array}{lllll} text { Year } & frac{0}{text

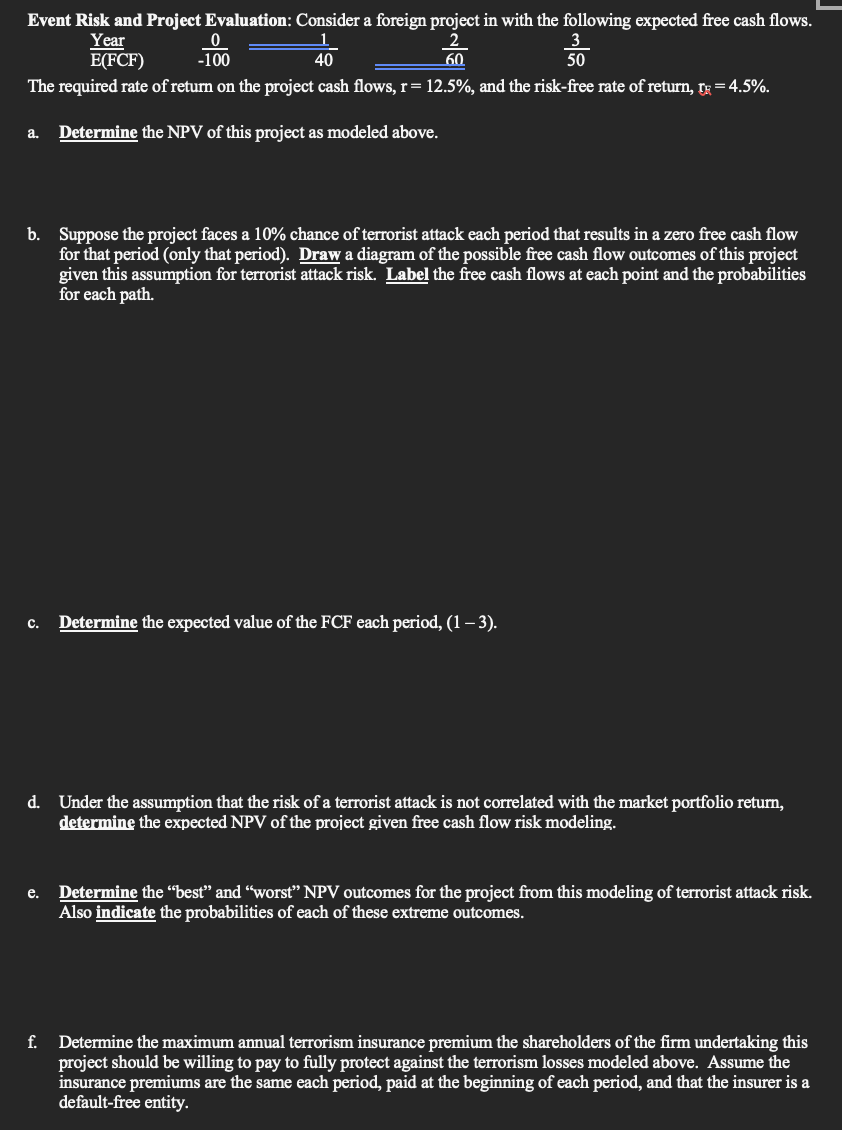

Event Risk and Project Evaluation: Consider a foreign project in with the following expected free cash flows. \\[ \\begin{array}{lllll} \\text { Year } & \\frac{0}{\\text { E(FCF) }} & -100 & \\frac{1}{2} & \\frac{3}{50} \\end{array} \\] The required rate of return on the project cash flows, =12.5, and the risk-free rate of return, \mathrmrmathrmE=4.5. a. Determine the NPV of this project as modeled above. b. Suppose the project faces a \10 chance of terrorist attack each period that results in a zero free cash flow for that period (only that period). Draw a diagram of the possible free cash flow outcomes of this project given this assumption for terrorist attack risk. Label the free cash flows at each point and the probabilities for each path. c. Determine the expected value of the FCF each period, \\( (1-3) \\). d. Under the assumption that the risk of a terrorist attack is not correlated with the market portfolio return, determine the expected NPV of the project given free cash flow risk modeling. e. Determine the \"best\" and \"worst\" NPV outcomes for the project from this modeling of terrorist attack risk. Also indicate the probabilities of each of these extreme outcomes. f. Determine the maximum annual terrorism insurance premium the shareholders of the firm undertaking this project should be willing to pay to fully protect against the terrorism losses modeled above. Assume the insurance premiums are the same each period, paid at the beginning of each period, and that the insurer is a default-free entity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts