Question: Ever since Sears announced plans to shut down its $3.3 billion catalog business in 1992 , Theresa Dunsmore had been swallowing more and more Pepto

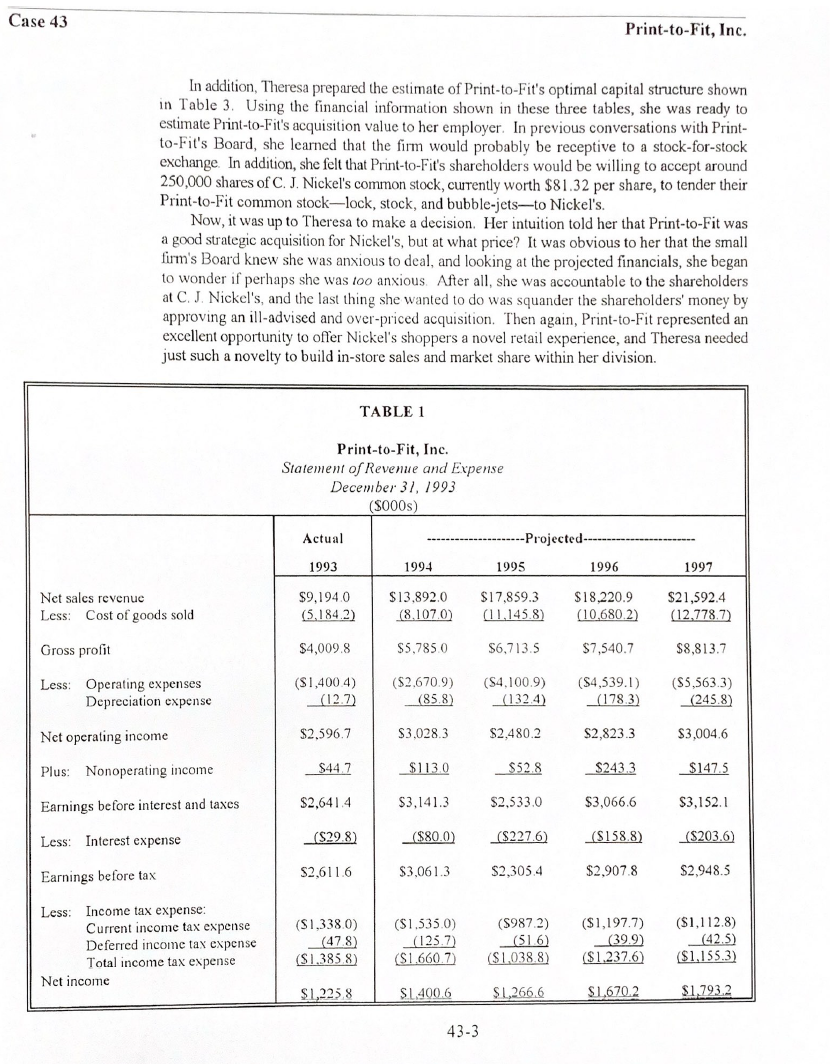

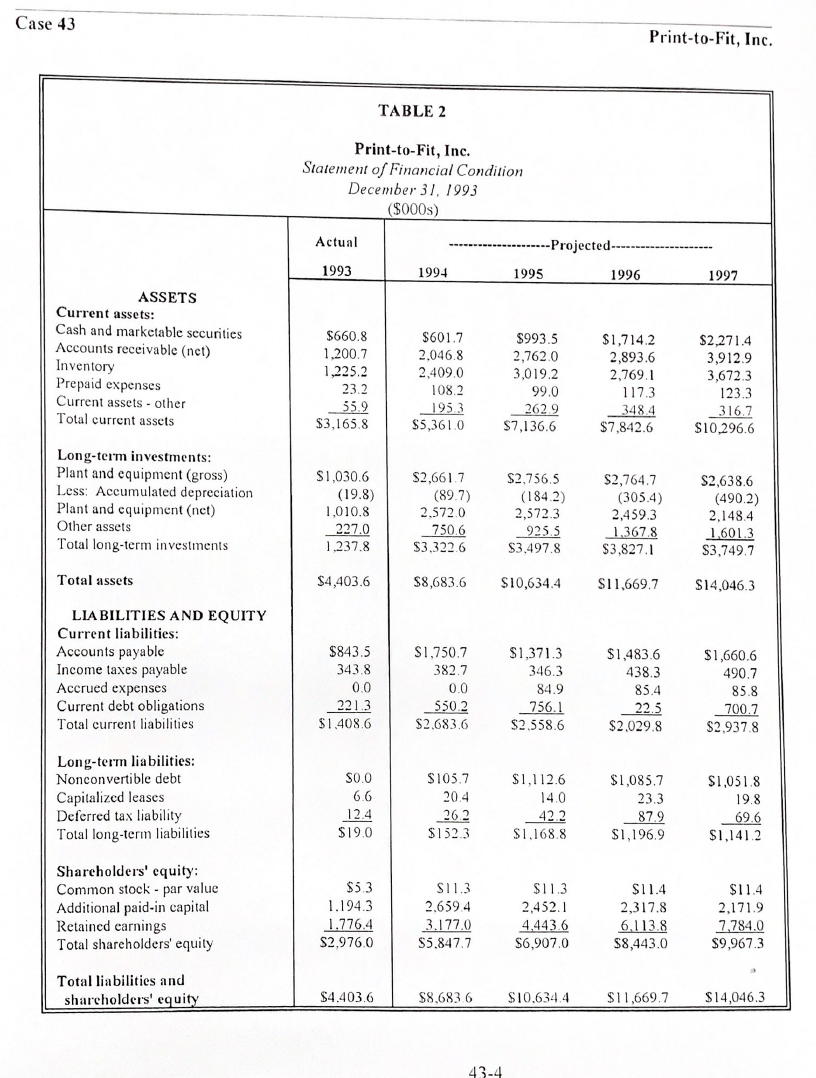

Ever since Sears announced plans to shut down its $3.3 billion catalog business in 1992 , Theresa Dunsmore had been swallowing more and more Pepto Bismol. It's not that she liked the taste of the pink stuff, but as senior vice president in charge of in-store merchandising at C. J. Nickel's - the nation's fourth-largest department store retailer-Theresa developed stomach problems when Sears retired the Big Book. At first glance, you'd think that Sears' abrupt exit from mail-order retailing would cause celebration in the hallways at C. J. Nickel's. But remember, Theresa was responsible for Nickel's in-store retail operations-not the mail order business While Nickel's catalog sales rose by almost $200 million in 1993 as thousands of former Sears' customers started ordering from Nickel's, the in-store division of the giant retailer faced some major troubles. During the 1980s, Theresa worked hard to differentiate Nickel's merchandise lines from those offered by Sears. She dumped hardware items, garden supplies, and auto parts, in favor of trendier fashions and more upscale apparel items. She expanded instore merchandise selection and incorporated pricier brand names into the product mix, and targeted the stores' merchandise mix toward affluent, sophisticated shoppers. Then the 1989-91 recession hit, and consumer confidence plummeted. Conspicuous consumption was replaced by value-conscious shopping, and Theresa was stuck with a huge inventory of upscale, high-fashion junk. Nickel's managed to move its merchandise only through a big end-of-season markdown sale, and in the process, the retailer's annual earnings fell 36 percent from the previous year. If that wasn't bad enough, soon after the end of 1992 the catalog division at Nickel's started reporting record-breaking sales increases as former Sears' customers shifted their business to the Nickel's catalog. Needless to say, the transparent "glass ceiling" that blocked Theresa's move into top management at Nickel's was rapidly turning into very visible concrete. Unless she improved the financial performance of the in-store retail division at the firm, her career in retailing would face an untimely and involuntary demise. Now, you might argue that Theresa was a victim of circumstance- in the wrong management job at the wrong time-but the handwriting she saw on the corporate wall was clear: Restore sales growth and profitability within Nickel's in-store division, or seek work elsewhere. After twenty years in retail management, Theresa was tough enough and smart enough to accept the challenge. She quickly revised her division's merchandising strategy to emphasize consumer value-focusing on a combination of lower retail prices and higher product quality - to restore sales and profit growth. She moved product emphasis away from the stuff covered with little alligators and started stocking moderately-priced, private-label brands to boost her stores' gross margins. Finally, she slashed in-store operating expenses to boost Nickel's net operating margin. 431 All these changes suited Theresa's superiors fine and dandy, but like most bosses, they pressured her to do more. Nickel's still faced intense competition from several national retailers, and Theresa needed to gain market share from these firms to earn the respect of Nickel's top brass. In order to gain market share, she knew Nickel's must broaden its merchandise mix and become more flexible in offering new shoppers a wide assortment of product choices. Unfortunately, expanded product selections meant an increased investment in floor inventory, and more inventory meant higher operating expenses and dwindling profit margins. After the dismal 1992 selling season, Theresa could scarcely risk the adverse financial consequences associated with expanding Nickel's product line. There had to be another way - and with a little creative thinking and a little luck, Theresa thought she'd found it. Scanning an industry trade publication late one evening after work, Theresa noticed a brief article about a small, unknown firm in the retailing industry, Print-to-Fit, Inc. Unknown in retailing because the small firm wasn't a retailer, Print-to-Fit was a All these changes suited Theresa's superiors fine and dandy, but like most bosses, they pressured her to do more. Nickel's still faced intense competition from several national retailers, and Theresa needed to gain market share from these firms to earn the respect of Nickel's top brass. In order to gain market share, she knew Nickel's must broaden its merchandise mix and become more flexible in offering new shoppers a wide assortment of product choices. Unfortunately, expanded product selections meant an increased investment in floor inventory, and more inventory meant higher operating expenses and dwindling profit margins. After the dismal 1992 selling season, Theresa could scarcely risk the adverse financial consequences associated with expanding Nickel's product line. There had to be another way - and with a little creative thinking and a little luck, Theresa thought she'd found it. Scanning an industry trade publication late one evening after work, Theresa noticed a brief article about a small, unknown firm in the retailing industry, Print-to-Fit, Inc. Unknown in retailing because the small firm wasn't a retailer, Print-to-Fit was a manufacturer of textile printers that modified Canon's color laser printing technology to print on fabric, rather than paper. Using its patented, bubble-jet transfer method, Print-to-Fit was able to squit microfine droplets of yellow, cyan, magenta, and black ink on a variety of textile surfaces, creating colorful designs and patterns on ordinary, ready-to-wear fabrics. While Print-to-Fit was a computer manufacturing company, Theresa immediately recognized that the firm's future was in retailing - not manufacturing. Using Print-to-Fit's printers connected to microcomputers in selected areas of Nickel's retail stores, customers could literally design their own clothing, preview various designs on the computer's screen, and print their favorite selections on blank apparel items stocked in Nickel's inventory. Theresa envisioned almost unlimited potential for the new technology: customers in the menswear department could design their own neckties; in womenswear, shoppers could instantly change the color and pattern of mix-and-match separates; and even better, in the children's department kids could dress up dull, white tee-shirts with full-color pictures of their favorite cartoon characters and other images. From the shopper's viewpoint, this would be a different and fun way to shop. From Theresa's perspective, it would be an efficient and inexpensive way to move merchandise. Nickel's could offer, quite literally, an infinite array of merchandise, yet the furm's inventory could be reduced to a small set of pattern masters waiting to be printed. After thinking quietly about the potential changes that Print-to-Fit might bring to Nickel's, Theresa had a finghtening thought: If Nickel's could purchase textile printers from Print-to-Fit, why couldn't other retailer's do the very same thing? Theresa answered her question almost as soon as it entered her mind-Print-to-Fit's technology was protected by patent, and if Nickel's bought the entire firm, rather than just its printers, she'd own the patents. Finally, Theresa had a new retail strategy, and the means to prevent her competitors from copying it. Over the course of the next several weeks, Theresa negotiated with Print-to-Fit's managers and Board of Directors for the purchase of the small firm by Nickel's. As the income statement shown in Table 1 reports, Print-to-Fit's 1993 sales volume was a modest $9 million, which was dwarfed by Nickel's $17 billion in 1993 sales. Clearly, Nickel's could afford this small acquisition. After extensive negotiation between Print-to-Fit's Board and her own finance people, Theresa was able to assemble the projected financial statements shown in Tables 1 and 2. These data conservatively estimated how Print-to-Fit would perform as a division of C. J. Nickel's over the 1994-97 period. While Theresa considered the projected statements reasonable, she made sure that they reflected the dramatic sales potential that Print-to-Fit's technology offered Nickel's retail stores. 43-2 In addition, Theresa prepared the estimate of Print-to-Fit's optimal capital structure shown in Table 3. Using the financial information shown in these three tables, she was ready to estimate Print-to-Fit's acquisition value to her employer. In previous conversations with Printto-Fit's Board, she learned that the firm would probably be receptive to a stock-for-stock exchange. In addition, she felt that Print-to-Fit's shareholders would be willing to accept around 250,000 shares of C. J. Nickel's common stock, currently worth $81.32 per share, to tender their Print-to-Fit common stock-lock, stock, and bubble-jets-to Nickel's. Now, it was up to Theresa to make a decision. Her intuition told her that Print-to-Fit was a good strategic acquisition for Nickel's, but at what price? It was obvious to her that the small firm's Board knew she was anxious to deal, and looking at the projected financials, she began to wonder if perhaps she was too anxious. After all, she was accountable to the shareholders at C. J. Nickel's, and the last thing she wanted to do was squander the shareholders' money by approving an ill-advised and over-priced acquisition. Then again, Print-to-Fit represented an excellent opportunity to offer Nickel's shoppers a novel retail experience, and Theresa needed just such a novelty to build in-store sales and market share within her division. Case 43 Print-to-Fit, Inc. [Questions 5 through 9 dea] with the retum to total capital model of corporate valuation] What are the total annual net cash flows that Print-to-Fit's debt and equity holders will receive from the firm over the 1994-97 period? 6. Based on the forecast book value of Print-to-Fit's total capitalization in 1997 (i.e., the total quantity of debt and equity funds invested in the firm), what is the projected terminal value of the firm in this year? Based on the perpetual value of Print-to-Fit's earnings stream available to the firm's debt and equity providers in 1997, what is the projected terminal value of the firm in that year? 7. Given your answers to Questions 5 and 6, what is the total acquisition value of Print-toFit? 8. Given your estimate of Print-to-Fit's aggregate acquisition value in Question 7, what is the value of this acquisition to the firm's stockholders? 9. Based on (a) the total capitalization of Print-to-Fit, Inc., and (b) the total income that providers of the fum's debt and equity capital will receive over the 1994-97 period, what is the total return on capital offered by the firm over the 1994-97 period? Ever since Sears announced plans to shut down its $3.3 billion catalog business in 1992 , Theresa Dunsmore had been swallowing more and more Pepto Bismol. It's not that she liked the taste of the pink stuff, but as senior vice president in charge of in-store merchandising at C. J. Nickel's - the nation's fourth-largest department store retailer-Theresa developed stomach problems when Sears retired the Big Book. At first glance, you'd think that Sears' abrupt exit from mail-order retailing would cause celebration in the hallways at C. J. Nickel's. But remember, Theresa was responsible for Nickel's in-store retail operations-not the mail order business While Nickel's catalog sales rose by almost $200 million in 1993 as thousands of former Sears' customers started ordering from Nickel's, the in-store division of the giant retailer faced some major troubles. During the 1980s, Theresa worked hard to differentiate Nickel's merchandise lines from those offered by Sears. She dumped hardware items, garden supplies, and auto parts, in favor of trendier fashions and more upscale apparel items. She expanded instore merchandise selection and incorporated pricier brand names into the product mix, and targeted the stores' merchandise mix toward affluent, sophisticated shoppers. Then the 1989-91 recession hit, and consumer confidence plummeted. Conspicuous consumption was replaced by value-conscious shopping, and Theresa was stuck with a huge inventory of upscale, high-fashion junk. Nickel's managed to move its merchandise only through a big end-of-season markdown sale, and in the process, the retailer's annual earnings fell 36 percent from the previous year. If that wasn't bad enough, soon after the end of 1992 the catalog division at Nickel's started reporting record-breaking sales increases as former Sears' customers shifted their business to the Nickel's catalog. Needless to say, the transparent "glass ceiling" that blocked Theresa's move into top management at Nickel's was rapidly turning into very visible concrete. Unless she improved the financial performance of the in-store retail division at the firm, her career in retailing would face an untimely and involuntary demise. Now, you might argue that Theresa was a victim of circumstance- in the wrong management job at the wrong time-but the handwriting she saw on the corporate wall was clear: Restore sales growth and profitability within Nickel's in-store division, or seek work elsewhere. After twenty years in retail management, Theresa was tough enough and smart enough to accept the challenge. She quickly revised her division's merchandising strategy to emphasize consumer value-focusing on a combination of lower retail prices and higher product quality - to restore sales and profit growth. She moved product emphasis away from the stuff covered with little alligators and started stocking moderately-priced, private-label brands to boost her stores' gross margins. Finally, she slashed in-store operating expenses to boost Nickel's net operating margin. 431 All these changes suited Theresa's superiors fine and dandy, but like most bosses, they pressured her to do more. Nickel's still faced intense competition from several national retailers, and Theresa needed to gain market share from these firms to earn the respect of Nickel's top brass. In order to gain market share, she knew Nickel's must broaden its merchandise mix and become more flexible in offering new shoppers a wide assortment of product choices. Unfortunately, expanded product selections meant an increased investment in floor inventory, and more inventory meant higher operating expenses and dwindling profit margins. After the dismal 1992 selling season, Theresa could scarcely risk the adverse financial consequences associated with expanding Nickel's product line. There had to be another way - and with a little creative thinking and a little luck, Theresa thought she'd found it. Scanning an industry trade publication late one evening after work, Theresa noticed a brief article about a small, unknown firm in the retailing industry, Print-to-Fit, Inc. Unknown in retailing because the small firm wasn't a retailer, Print-to-Fit was a All these changes suited Theresa's superiors fine and dandy, but like most bosses, they pressured her to do more. Nickel's still faced intense competition from several national retailers, and Theresa needed to gain market share from these firms to earn the respect of Nickel's top brass. In order to gain market share, she knew Nickel's must broaden its merchandise mix and become more flexible in offering new shoppers a wide assortment of product choices. Unfortunately, expanded product selections meant an increased investment in floor inventory, and more inventory meant higher operating expenses and dwindling profit margins. After the dismal 1992 selling season, Theresa could scarcely risk the adverse financial consequences associated with expanding Nickel's product line. There had to be another way - and with a little creative thinking and a little luck, Theresa thought she'd found it. Scanning an industry trade publication late one evening after work, Theresa noticed a brief article about a small, unknown firm in the retailing industry, Print-to-Fit, Inc. Unknown in retailing because the small firm wasn't a retailer, Print-to-Fit was a manufacturer of textile printers that modified Canon's color laser printing technology to print on fabric, rather than paper. Using its patented, bubble-jet transfer method, Print-to-Fit was able to squit microfine droplets of yellow, cyan, magenta, and black ink on a variety of textile surfaces, creating colorful designs and patterns on ordinary, ready-to-wear fabrics. While Print-to-Fit was a computer manufacturing company, Theresa immediately recognized that the firm's future was in retailing - not manufacturing. Using Print-to-Fit's printers connected to microcomputers in selected areas of Nickel's retail stores, customers could literally design their own clothing, preview various designs on the computer's screen, and print their favorite selections on blank apparel items stocked in Nickel's inventory. Theresa envisioned almost unlimited potential for the new technology: customers in the menswear department could design their own neckties; in womenswear, shoppers could instantly change the color and pattern of mix-and-match separates; and even better, in the children's department kids could dress up dull, white tee-shirts with full-color pictures of their favorite cartoon characters and other images. From the shopper's viewpoint, this would be a different and fun way to shop. From Theresa's perspective, it would be an efficient and inexpensive way to move merchandise. Nickel's could offer, quite literally, an infinite array of merchandise, yet the furm's inventory could be reduced to a small set of pattern masters waiting to be printed. After thinking quietly about the potential changes that Print-to-Fit might bring to Nickel's, Theresa had a finghtening thought: If Nickel's could purchase textile printers from Print-to-Fit, why couldn't other retailer's do the very same thing? Theresa answered her question almost as soon as it entered her mind-Print-to-Fit's technology was protected by patent, and if Nickel's bought the entire firm, rather than just its printers, she'd own the patents. Finally, Theresa had a new retail strategy, and the means to prevent her competitors from copying it. Over the course of the next several weeks, Theresa negotiated with Print-to-Fit's managers and Board of Directors for the purchase of the small firm by Nickel's. As the income statement shown in Table 1 reports, Print-to-Fit's 1993 sales volume was a modest $9 million, which was dwarfed by Nickel's $17 billion in 1993 sales. Clearly, Nickel's could afford this small acquisition. After extensive negotiation between Print-to-Fit's Board and her own finance people, Theresa was able to assemble the projected financial statements shown in Tables 1 and 2. These data conservatively estimated how Print-to-Fit would perform as a division of C. J. Nickel's over the 1994-97 period. While Theresa considered the projected statements reasonable, she made sure that they reflected the dramatic sales potential that Print-to-Fit's technology offered Nickel's retail stores. 43-2 In addition, Theresa prepared the estimate of Print-to-Fit's optimal capital structure shown in Table 3. Using the financial information shown in these three tables, she was ready to estimate Print-to-Fit's acquisition value to her employer. In previous conversations with Printto-Fit's Board, she learned that the firm would probably be receptive to a stock-for-stock exchange. In addition, she felt that Print-to-Fit's shareholders would be willing to accept around 250,000 shares of C. J. Nickel's common stock, currently worth $81.32 per share, to tender their Print-to-Fit common stock-lock, stock, and bubble-jets-to Nickel's. Now, it was up to Theresa to make a decision. Her intuition told her that Print-to-Fit was a good strategic acquisition for Nickel's, but at what price? It was obvious to her that the small firm's Board knew she was anxious to deal, and looking at the projected financials, she began to wonder if perhaps she was too anxious. After all, she was accountable to the shareholders at C. J. Nickel's, and the last thing she wanted to do was squander the shareholders' money by approving an ill-advised and over-priced acquisition. Then again, Print-to-Fit represented an excellent opportunity to offer Nickel's shoppers a novel retail experience, and Theresa needed just such a novelty to build in-store sales and market share within her division. Case 43 Print-to-Fit, Inc. [Questions 5 through 9 dea] with the retum to total capital model of corporate valuation] What are the total annual net cash flows that Print-to-Fit's debt and equity holders will receive from the firm over the 1994-97 period? 6. Based on the forecast book value of Print-to-Fit's total capitalization in 1997 (i.e., the total quantity of debt and equity funds invested in the firm), what is the projected terminal value of the firm in this year? Based on the perpetual value of Print-to-Fit's earnings stream available to the firm's debt and equity providers in 1997, what is the projected terminal value of the firm in that year? 7. Given your answers to Questions 5 and 6, what is the total acquisition value of Print-toFit? 8. Given your estimate of Print-to-Fit's aggregate acquisition value in Question 7, what is the value of this acquisition to the firm's stockholders? 9. Based on (a) the total capitalization of Print-to-Fit, Inc., and (b) the total income that providers of the fum's debt and equity capital will receive over the 1994-97 period, what is the total return on capital offered by the firm over the 1994-97 period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts