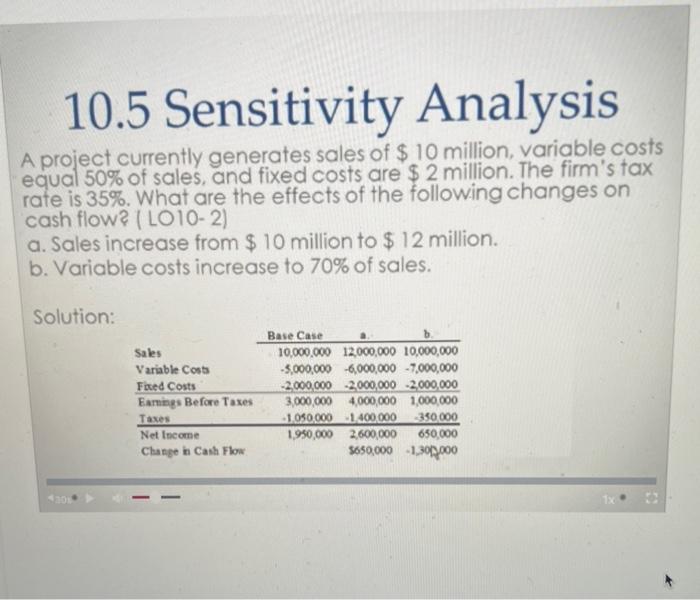

Question: everyone on chegg us wrong! please answer correctly . example is shown below practice problem example project currently generates sales of $10 million, variable costs

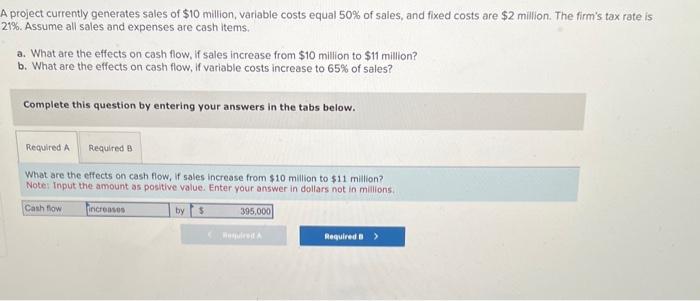

project currently generates sales of $10 million, variable costs equal 50% of sales, and fixed costs are $2 million. The firm's tax rate is 1\%. Assume all sales and expenses are cash items. a. What are the effects on cash flow, if sales increase from $10 million to $11 million? b. What are the effects on cash flow, if variable costs increase to 65% of sales? Complete this question by entering your answers in the tabs below. What are the effects on cash flow, if sales increase from $10 million to $11 million? Noter Input the amount as positive value. Enter your answer in dollars not in millions. 10.5 Sensitivity Analysis a. Sales increase from $10 million to $12 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts