Question: EVO, Inc. is evaluating a project that will have a life of four years. The operating cash flow each year is expected to be $48,000.

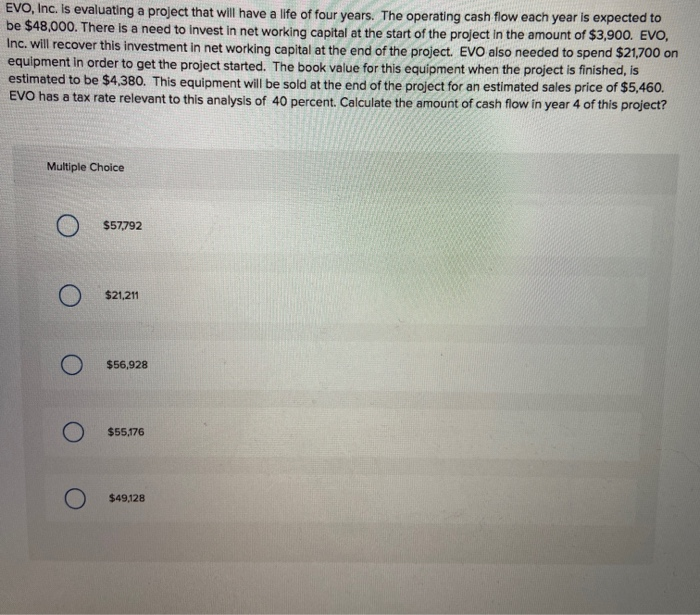

EVO, Inc. is evaluating a project that will have a life of four years. The operating cash flow each year is expected to be $48,000. There is a need to invest in net working capital at the start of the project in the amount of $3,900. EVO, Inc. will recover this investment in net working capital at the end of the project. EVO also needed to spend $21,700 on equipment in order to get the project started. The book value for this equipment when the project is finished, is estimated to be $4,380. This equipment will be sold at the end of the project for an estimated sales price of $5,460. EVO has a tax rate relevant to this analysis of 40 percent. Calculate the amount of cash flow in year 4 of this project? | o $57,792 o $21,21 o $56,928 o S5576 o $49128

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts