Question: Ex. 01: Spreads There were three sell orders placed for a stock during a day. The following are the quoted bid and ask quotes at

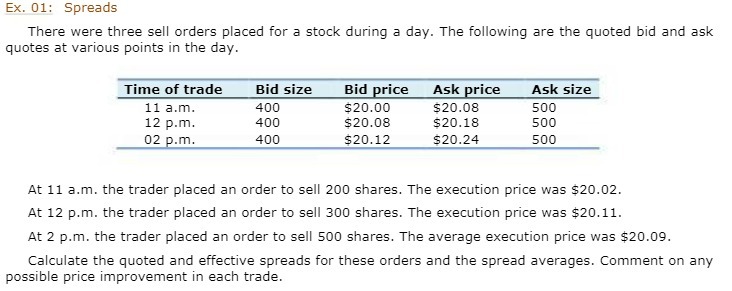

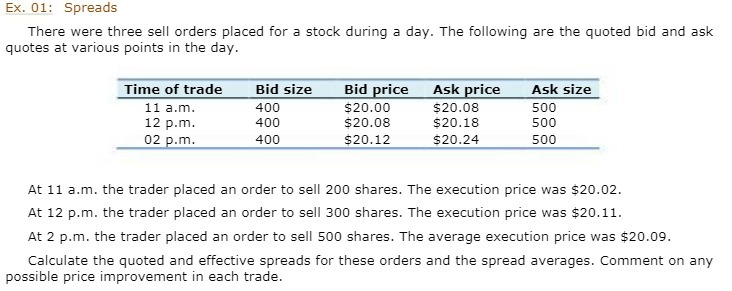

Ex. 01: Spreads There were three sell orders placed for a stock during a day. The following are the quoted bid and ask quotes at various points in the day. Time of trade Bid size Bid price Ask price Ask size 11 a.m. 400 $20.00 $20.08 500 12 p.m. 400 $20.08 $20.18 500 02 p.m. 400 $20.12 $20.24 500 At 11 a.m. the trader placed an order to sell 200 shares. The execution price was $20.02. At 12 p.m. the trader placed an order to sell 300 shares. The execution price was $20.11. At 2 p.m. the trader placed an order to sell 500 shares. The average execution price was $20.09. Calculate the quoted and effective spreads for these orders and the spread averages. Comment on any possible price improvement in each trade

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts