EX

The basis for recognizing patient care revenue is not always obvious In a particular month, Northwest Medical Clinic reported the following:

It provided direct care services to patients, billing them $ Of this amount it received $ in cash, but as a consequence of bad debts, it expects to collect a total of only $

It provided charity care for which it would have billed, at standard rates, $

It received capitation fees of $ from healthcare plans and provided services to members of those plans for which it would have billed, at standard rates, $

Prepare appropriate journal entries to recognize revenue.

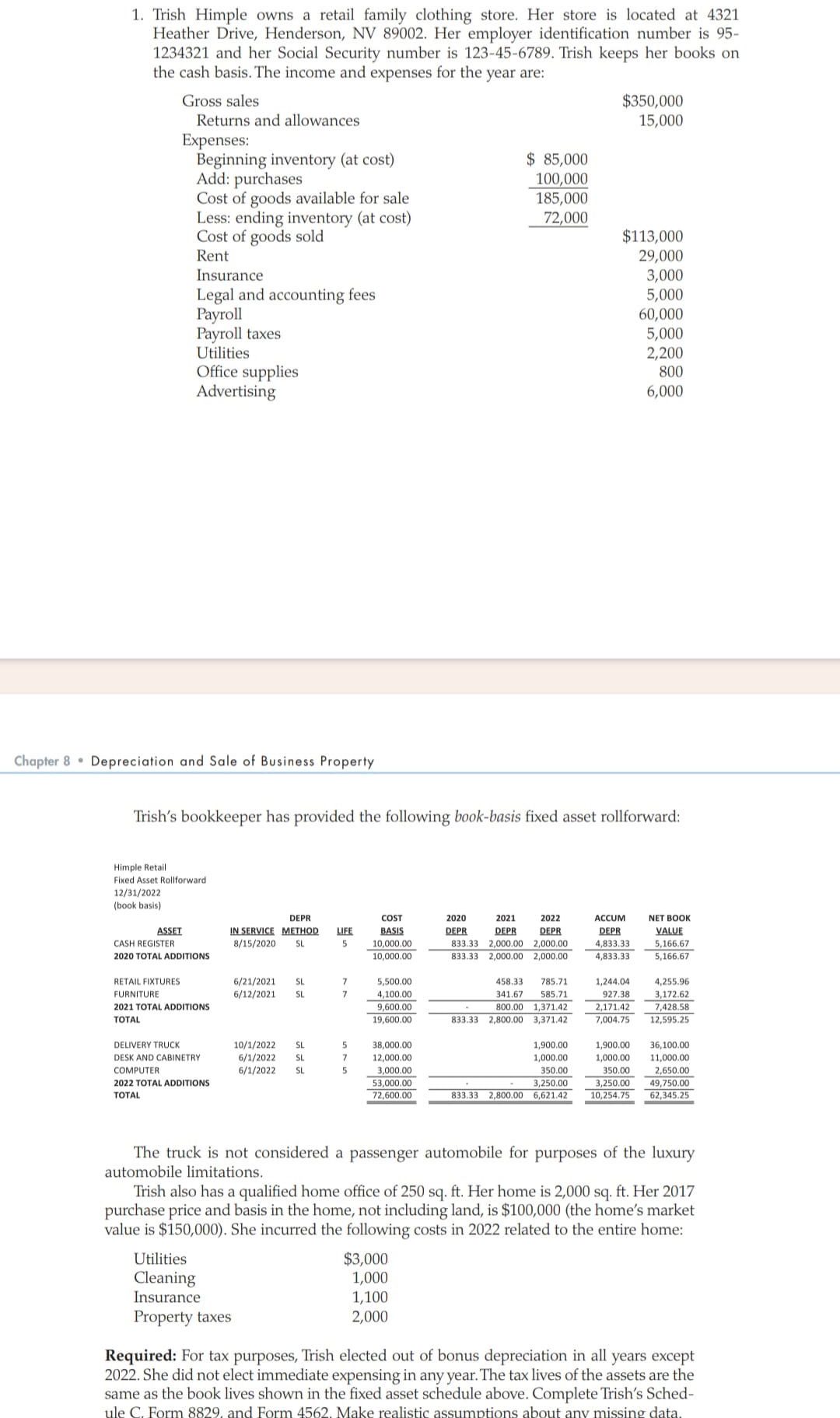

Trish Himple owns a retail family clothing store. Her store is located at Heather Drive, Henderson, NV Her employer identification number is and her Social Security number is Trish keeps her books on the cash basis. The income and expenses for the year are:

tableGross sales,,$