Question: Exam 2 Chapter 10 and Chapter 13 9) Dilty Corp, owned a subsidiary in France. Didty concluded that the subsidiary's functional currency was the US

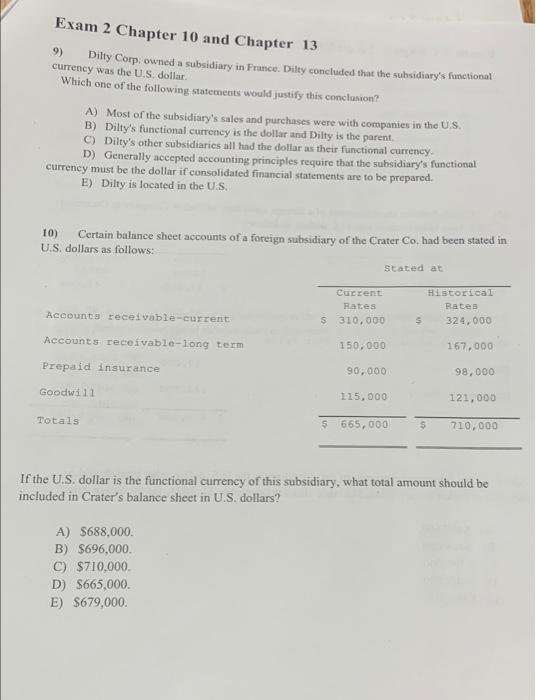

Exam 2 Chapter 10 and Chapter 13 9) Dilty Corp, owned a subsidiary in France. Didty concluded that the subsidiary's functional currency was the US dollar. Which one of the following statements would justify this conclusion? A) Most of the subsidiary's sales and purchases were with companies in the US. B) Dilty's functional currency is the dollar and Dilty is the parent. C) Dilty's other subsidiaries all had the dollar as their functional currency D) Generally accepted accounting principles require that the subsidiary's functional currency must be the dollar if consolidated financial statements are to be prepared. E) Dilty is located in the U.S. 10) Certain balance sheet accounts of a foreign subsidiary of the Crater Co. had been stated in U.S. dollars as follows: Stated at Current Rates S 310,000 Historical Rates $ 324,000 Accounts receivable-current Accounts receivable-long term 150,000 167.000 Prepaid insurance 90,000 98,000 Goodwill 115,000 121,000 Totals $ 665,000 $ 710,000 If the U.S. dollar is the functional currency of this subsidiary, what total amount should be included in Crater's balance sheet in U.S. dollars? A) $688,000 B) $696,000. C) $710,000 D) $665,000 E) $679,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts