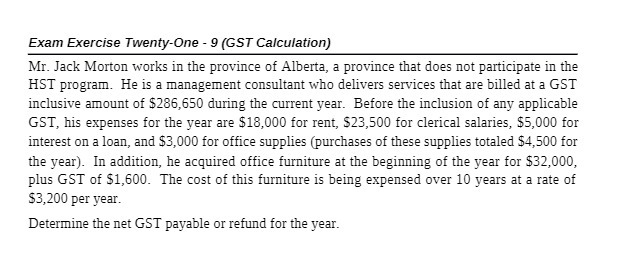

Question: Exam Exercise Twenty-Doe - 9 [GET Calculation} Mr. Jack Morton works in the province of Alberta, a province that does not participate in the HST

Exam Exercise Twenty-Doe - 9 [GET Calculation} Mr. Jack Morton works in the province of Alberta, a province that does not participate in the HST program. He is a management consultant Twho delivers services that are billed at a GST inclusive amount of $286,650 during the current year. Before the inclusion of an}:r applicable GET, bis expenses for the year are $18,!l for rent, $23,5l} for clerical salaries, $5,0D for interest on a loan, and $3,000 for ofce supplies [purchases of these supplies totaled $4,50 for the year}. In addition, he acquired ofce furniture at the beginning of the year for $32,!llll, plus GET of SLEDI}- The cost of this furniture is being espensed over ll] years at a rate of $3,310 per year- Determine the net EST payable or refimd for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts