Question: Exam. Help now. Do all. Give me the answer. No need explanation. Fail or pass is on your hands. Thank you 11) Which statement is

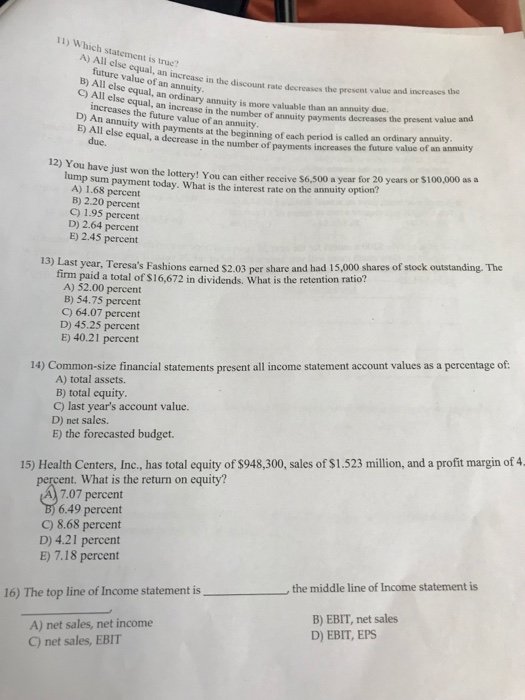

11) Which statement is true? A) All else equal, ire value of an anuisy in the discount rate docreases the present value and increaues the else equal, an ordinary annuity is more valuable than an anuity aues the present value and else equal, an increase in the number of annuity payments B) All C) All due. increases the future value of an annuity D) An annuity payment E All else equal, a decrease in the number of payments increases th payments at the beginning of each period is called an ordinary anmuity due. the future value of an annuity 12) You have just won the lottery! You can either reseive $6,500 a year for 20 years or $100,000 aa lump sum payment today. What is the interest rate on the annuity option? A) 1.68 percent B) 2.20 percent C) 1.95 percent D) 2.64 percent E) 2.45 percent 13) Last year, Teresa's Fashions earned s2.03 per share and had 15,000 shares of stock outstanding. The firm paid a total of $16,672 in dividends. What is the retention ratio? A) 52.00 percent B) 54.75 percent C) 64.07 percent D) 45.25 percent E) 40.21 percent 14) Common-size financial statements present all ncome statement account values as a percemntage of: A) total assets. B) total equity C) last year's account value D) net sales. E) the forecasted budget. 15) Health Centers, Inc., has total equity of $948,300, sales of $1.523 million, and a profit margin of 4. ent. What is the return on equity? 7.07 percent 6.49 percent C) 8.68 percent D) 4.21 percent E) 7.18 percent , the middle line of Income statement is 16) The top line of Income statement is A) net sales, net income C) net sales, EBIT B) EBIT, net sales D) EBIT, EPS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts