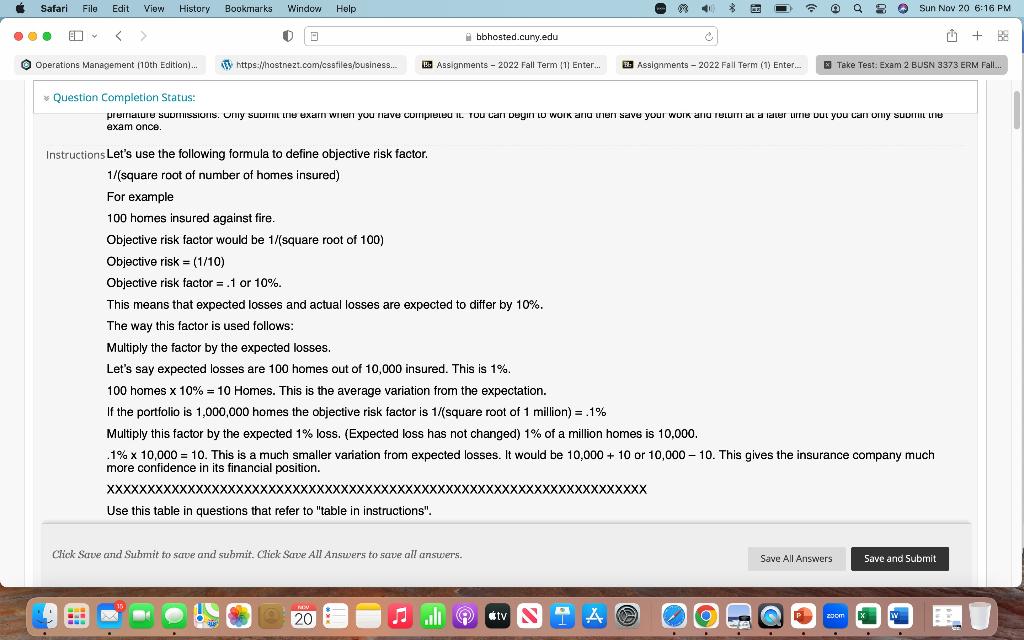

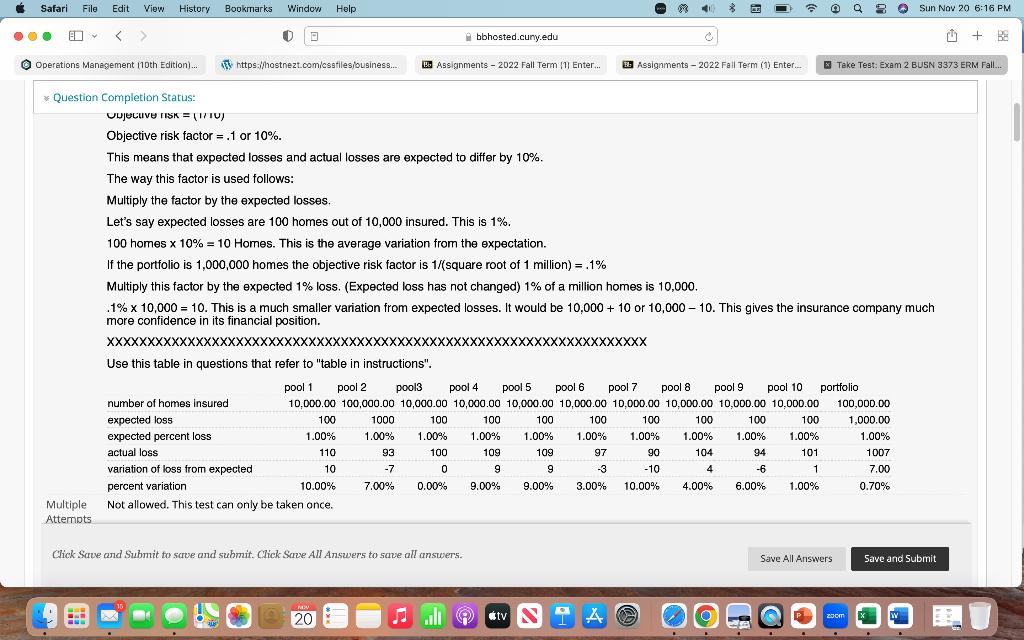

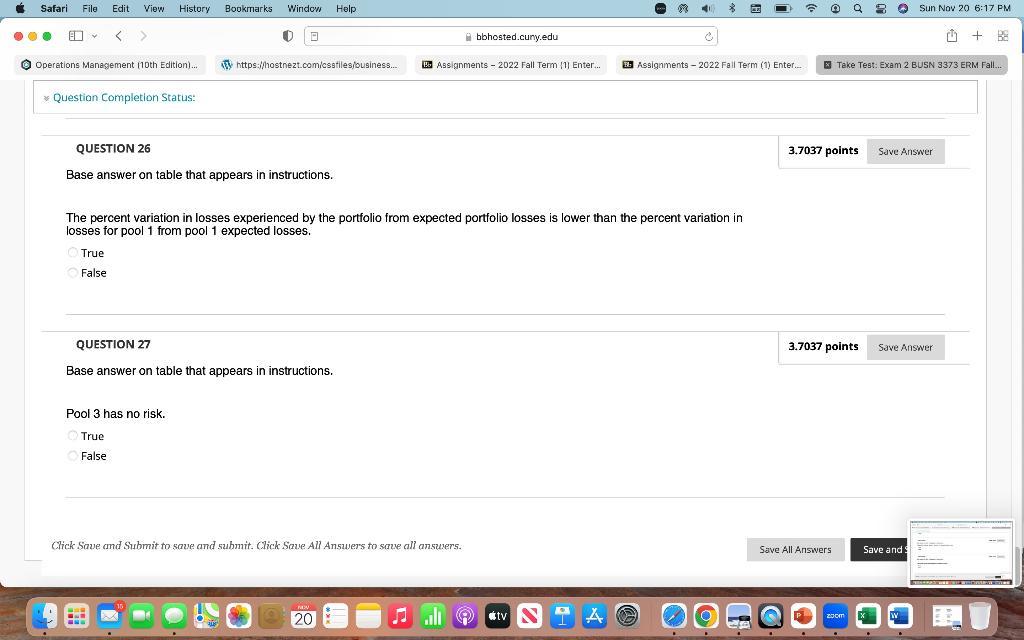

Question: exam once. Instructions Let's use the following formula to define objective risk factor. 1/( square root of number of homes insured) For example 100 homes

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock